Materialitas dan Resiko Audit

Summary

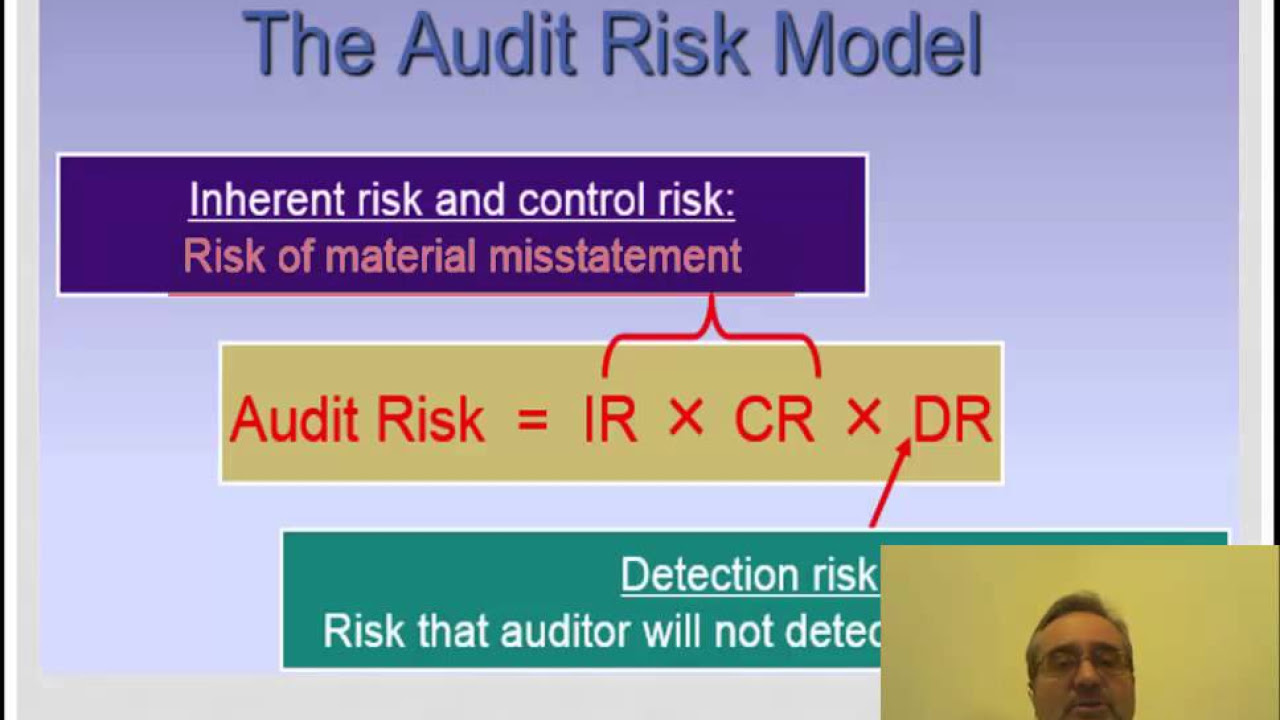

TLDRThis lecture on auditing covers the key concepts of materiality and audit risk. Materiality refers to the significance of errors in financial statements that could influence decision-making. It is determined through quantitative and qualitative factors. The lecture explains how auditors assess materiality, allocate it across financial accounts, and adjust based on system controls. Audit risk is discussed, emphasizing the possibility of an auditor failing to detect material misstatements, influenced by the effectiveness of internal controls and detection risk. The lecture also explores how auditors manage risk in the audit process to ensure accurate financial reporting.

Takeaways

- 😀 Materiality in auditing refers to the significance of accounting errors or misstatements that could impact the decision-making of financial report users.

- 😀 Materiality is a relative concept, meaning it varies across companies depending on their size and financial status, and is determined by the professional judgment of auditors.

- 😀 Materiality can be assessed through two main perspectives: quantitative (related to key financial numbers) and qualitative (focused on the reasons behind the misstatements).

- 😀 There are four levels of materiality assessment: overall financial statement materiality, account-level materiality, transaction-level materiality, and the comparison of estimated misstatements.

- 😀 Example: If a company's pre-audit profit is 100 million, and an error of 10 million is found, it may be deemed material if it affects decision-making, such as an investor's choice.

- 😀 Factors influencing materiality assessments include company size, previous year's materiality levels, and qualitative factors like fraud risks or legal violations.

- 😀 Audit materiality allocation depends on the potential for misstatements and the cost of auditing, with greater potential errors typically leading to tighter materiality limits.

- 😀 The quality of a company’s internal control system influences the level of audit materiality and the extent of audit evidence needed. Strong controls mean less risk and more tolerance for misstatements.

- 😀 Audit risk occurs when an auditor fails to modify their opinion despite material misstatements. This can result from either a failure to detect or properly assess errors in financial reports.

- 😀 Risk of engagement relates to potential loss or legal consequences for auditors if a company's business fails, even if the audit was conducted accurately and the report was correct.

Q & A

What is the main topic discussed in the video?

-The main topic of the video is about audit risk and engagement risk, focusing on the potential challenges auditors may face even when their audits are conducted correctly.

What does 'engagement risk' refer to in auditing?

-'Engagement risk' refers to the risk faced by auditors in the course of their work, particularly the potential for legal consequences if a business fails after an audit, despite the audit being done correctly.

Can an auditor be held accountable if a business fails after an audit?

-No, an auditor generally cannot be sued for the failure of a business, as the failure is not directly related to the execution of the audit itself.

What is the connection between audit risk and business risk?

-Audit risk is related to the possibility of audit errors, while business risk involves the financial health and potential failure of the company being audited. Business risk can lead to engagement risk for the auditor if the business fails post-audit.

What does the speaker mean by 'engagement risk' in relation to the auditor-client relationship?

-'Engagement risk' involves the relationship between the auditor and the client. If the audited company fails after the audit, it could affect this relationship, even if the auditor performed their duties correctly.

What impact can business failure have on the auditor's engagement with the client?

-Business failure can lead to legal disputes or claims against the auditor, affecting the auditor's professional reputation and relationship with the client, even though the audit itself was performed correctly.

Why is it important for auditors to understand engagement risk?

-Understanding engagement risk is crucial for auditors to prepare for the potential legal and professional consequences of a business failure after an audit, allowing them to manage their client relationships effectively.

What is the difference between audit risk and engagement risk?

-Audit risk is the risk of errors in the audit itself, while engagement risk is the risk to the auditor's relationship with the client and potential legal consequences arising from the failure of the business being audited.

Does engagement risk arise from poor auditing practices?

-No, engagement risk is not necessarily caused by poor auditing practices. It arises due to factors like business failure, which is outside the auditor's control, despite a correct and thorough audit being conducted.

How does the speaker conclude the discussion in the video?

-The speaker concludes the discussion by expressing hope that the explanation of audit and engagement risk is clear, and thanks the audience with a polite greeting.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Risk of Material Misstatement

Auditing 101 | Part 2: Risk Assessment, Assertions, and Materiality | Maxwell CPA Review

2.3 Overview of the Audit Process Audit Planning Risk Assessment

2.2 Overview of the Audit Process Auditing Planning Knowledge, Analytics, Materiality

Audit dalam Kerangka Islam - Audit Lembaga Keuangan Syariah

Mengupas Konsep Audit! Apa itu Audit? | Buku Wajib Mahasiswa Akuntansi Series

5.0 / 5 (0 votes)