Public Goods and Externalities

Summary

TLDRIn a free market economy, public goods, like bridges and education, are essential for society's functioning. These goods are funded through taxes, as they can't be efficiently provided by the private sector. Public goods are non-excludable and non-rivalrous, meaning they benefit everyone without reducing availability. However, debates arise over what should be classified as a public good. A common issue is the 'free-rider problem,' where individuals benefit without paying. Additionally, public goods often generate externalities—both positive and negative impacts on third parties. Understanding these dynamics is crucial for macroeconomic policy and societal welfare.

Takeaways

- 😀 A free market economy is driven by supply and demand, but there are cases where government intervention is necessary to provide goods and services that the market cannot.

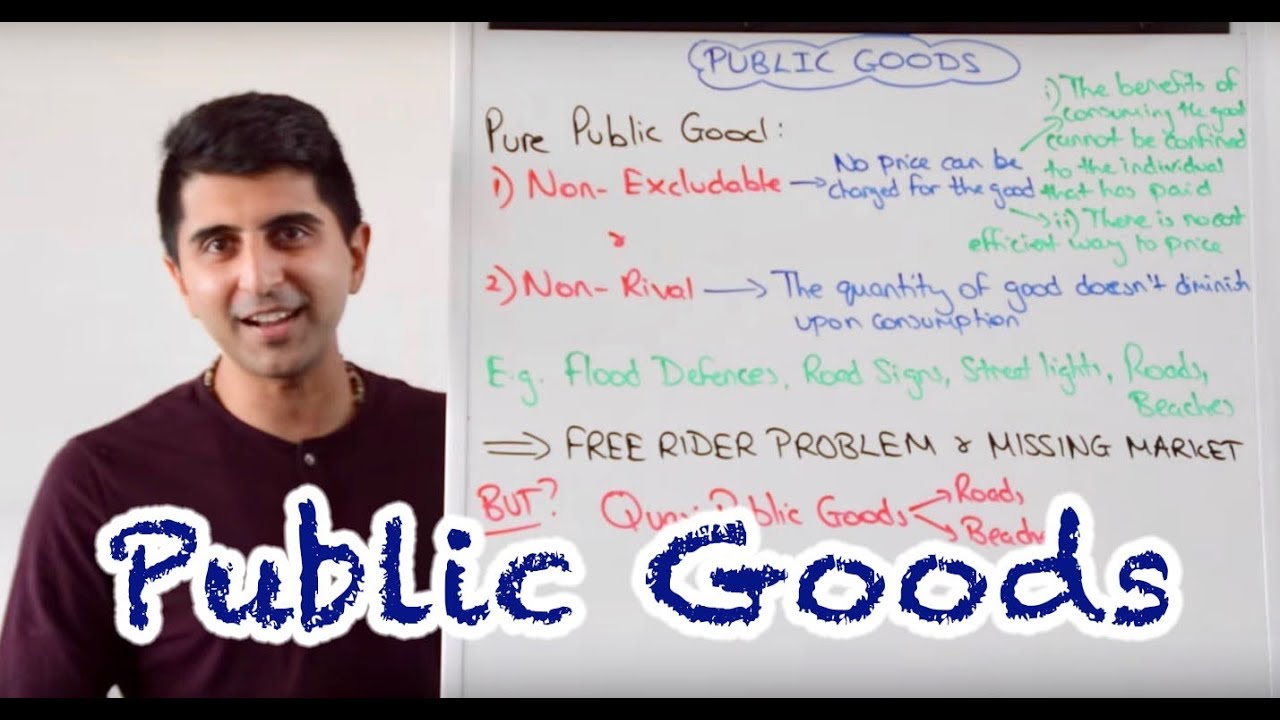

- 😀 Public goods, such as bridges, are shared resources that do not make sense to charge users individually for or exclude non-payers from using.

- 😀 Public goods are funded through taxes collected by the government, which uses this money to build and maintain infrastructure for the collective benefit.

- 😀 The cost of public goods like bridges is not significantly impacted by the number of users, making them non-rivalrous in nature.

- 😀 The public sector funds public goods, while the private sector is responsible for most other economic activities.

- 😀 Infrastructure and other public goods are critical for the functioning and growth of society and the economy.

- 😀 The debate over whether something should be a public good often revolves around questions of efficiency, fairness, and societal benefit.

- 😀 Education is a prime example of a public good; while private education could be more efficient for individuals, public education benefits society by ensuring a well-educated populace.

- 😀 The free-rider problem occurs when people benefit from public goods without contributing to their cost, leading to potential underfunding or unavailability of these services.

- 😀 Externalities are side effects (positive or negative) that affect third parties; public goods can generate positive externalities like increased tourism, job creation, and local economic growth.

- 😀 Negative externalities can arise from public goods as well, such as environmental damage or disruptions to local businesses, highlighting the complexities of funding and managing public goods.

Q & A

What defines a free market economy?

-A free market economy is one in which the allocation of resources is determined by supply and demand, with minimal government intervention or control.

Why does the government provide certain goods and services in a free market economy?

-The government provides goods and services that the marketplace cannot efficiently supply, such as public goods, which benefit all individuals in society.

What is a public good?

-A public good is a good or service that is non-excludable (people cannot be prevented from using it) and non-rivalrous (one person's use does not reduce its availability for others). Examples include bridges and highways.

How are public goods typically funded?

-Public goods are funded by taxes collected from citizens, which the government uses to build and maintain infrastructure and other services in the public interest.

What is the free-rider problem?

-The free-rider problem occurs when individuals benefit from public goods without contributing to their cost, potentially leading to underfunding and unavailability of these goods.

Can you give an example of the free-rider problem?

-An example of the free-rider problem is when individuals use public highways without paying for their construction or maintenance, but still enjoy the benefits, like easier travel and reduced transportation costs.

What are externalities in economics?

-Externalities are unintended side effects of an economic activity that affect third parties, either positively or negatively. These can arise from the production or consumption of goods and services.

What are positive externalities associated with public goods like bridges?

-Positive externalities of public goods such as bridges include increased tourism, local business growth, job creation, and improved transportation for the community.

What are negative externalities, and how might they relate to a bridge project?

-Negative externalities are unintended harmful effects caused by an economic activity. For a bridge, this could include increased traffic congestion, pollution, or ecological damage to the surrounding environment.

How do public goods and externalities impact political debates?

-The classification of a good as a public good often sparks political debate, especially when tax dollars are involved. Citizens want to ensure that public goods align with their values and that funds are used efficiently, balancing individual and societal benefits.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)