247. Can Interest Rates Fall to Zero on the Free Market

Summary

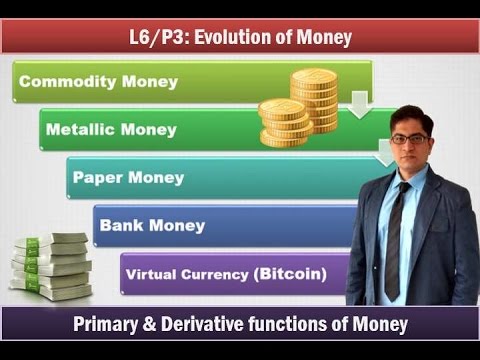

TLDRThis video explores the implications of using a hard money system, such as Bitcoin or gold, instead of fiat currencies, focusing on the relationship between interest rates, time preference, and capital accumulation. It delves into how societies with low time preference and abundant capital might see interest rates approach zero, as individuals prefer saving and investing over consuming. The discussion also highlights the role of trust in lending, the limitations of central banks, and the cultural implications of usury laws. Overall, the video highlights how a shift to hard money could reshape economic dynamics and interest rates.

Takeaways

- 😀 Capital accumulation leads to a decline in time preference, which is the tendency to favor present over future consumption.

- 😀 As civilization advances, originary interest (the rate of time preference) declines, making capital more abundant and future-oriented.

- 😀 Storing money has inherent costs, including monetary costs and risks like theft or damage, which are part of holding money in any form.

- 😀 When the originary interest rate falls below the cost of holding money, lending becomes preferable to simply holding money, even at a 0% nominal interest rate.

- 😀 A low nominal interest rate, even at 0%, can still result in a positive real interest rate due to the scarcity of money appreciating in value over time.

- 😀 In a society with abundant capital and low time preference, lending would likely shift towards equity investment and 0% nominal loans for personal needs.

- 😀 The creation of credit does not create capital, but reallocates existing capital, so an abundant capital supply does not necessarily lead to more credit creation.

- 😀 Religions have historically tried to reduce time preference by emphasizing long-term consequences, which could explain their opposition to usury (charging interest).

- 😀 Prohibiting usury could discourage saving and capital accumulation, potentially counteracting the natural reduction in interest rates driven by low time preference.

- 😀 If central banks were absent, the market would likely see declining interest rates over time, with hard money encouraging lower time preference and less inflation.

- 😀 Trust plays an important role in lending decisions, especially in 0% interest loans, where time preference and the relationship between means and ends can influence the willingness to lend.

Q & A

What is the primary argument for the potential elimination of interest rates?

-The primary argument is that as capital accumulates over time, society's time preference declines, meaning people are more willing to save and invest for the future. Eventually, the cost of holding money exceeds the interest rate, making 0% interest rates acceptable as holding money no longer offers a net benefit.

How does the concept of 'time preference' impact interest rates?

-Time preference refers to the degree of impatience people have regarding the future, influencing their willingness to lend or save. As time preference declines, individuals prefer to save more and consume less in the present, leading to a decrease in interest rates. This aligns with the idea that a lower time preference leads to a preference for capital accumulation and long-term investment.

What role does the cost of holding money play in the decline of interest rates?

-The cost of holding money involves both the direct costs of storage (such as fees) and the risk of loss or theft. As time preference declines, the nominal interest rate can approach the cost of holding money, and at a certain point, lending at 0% becomes preferable to holding money due to these associated costs.

How might a 0% interest rate be acceptable for lenders in a low time preference society?

-In a society with low time preference, the value of money increases over time due to its scarcity. Lending money at 0% interest means that the lender benefits from the appreciation of the money's value over time without having to incur storage costs or risks, making it a preferable option.

What is the distinction between capital accumulation and credit creation in economic terms?

-Capital accumulation refers to the process of saving and investing resources, leading to an increase in productive capital. Credit creation, however, merely reallocates existing capital by lending or borrowing money. Credit creation does not generate new capital but can facilitate the distribution of existing capital.

Why might banning usury be counterproductive in a low time preference society?

-Banning usury, or charging interest, could discourage the accumulation of capital. In a low time preference society, the absence of usury might reduce the incentives for people to save and invest, as they would not be compensated for lending money. This could ultimately hinder the natural decline of interest rates and capital accumulation.

What is the relationship between trust and the willingness to lend money at 0% interest?

-Trust plays a critical role in the decision to lend money at 0% interest, especially for personal loans between friends and family. In a society with low time preference, individuals are more likely to trust each other to repay loans, leading to a willingness to lend without requiring interest.

How does the concept of marginal utility of money relate to lending?

-The marginal utility of money decreases as one accumulates more wealth. This diminishing utility means that after a certain point, individuals may prefer to lend their money to others, rather than holding it. By lending, they can diversify their assets, reduce risks, and still benefit from the appreciation of money.

What role does religion play in reducing time preference, according to the script?

-Religion can be seen as a societal tool to lower time preference by encouraging individuals to consider the long-term consequences of their actions. This promotes more patience and self-discipline, which leads to lower time preference and a greater willingness to save and invest for the future.

How might the absence of central banks affect the behavior of market interest rates?

-Without central banks, interest rates would likely be determined by market forces based on the availability of hard money. In such a system, interest rates would likely decline over time as capital accumulates and time preference falls. The absence of inflationary fiat money would foster a more stable financial environment where savings and capital accumulation are rewarded.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)