Kurva LM, Keseimbangan Pasar Uang

Summary

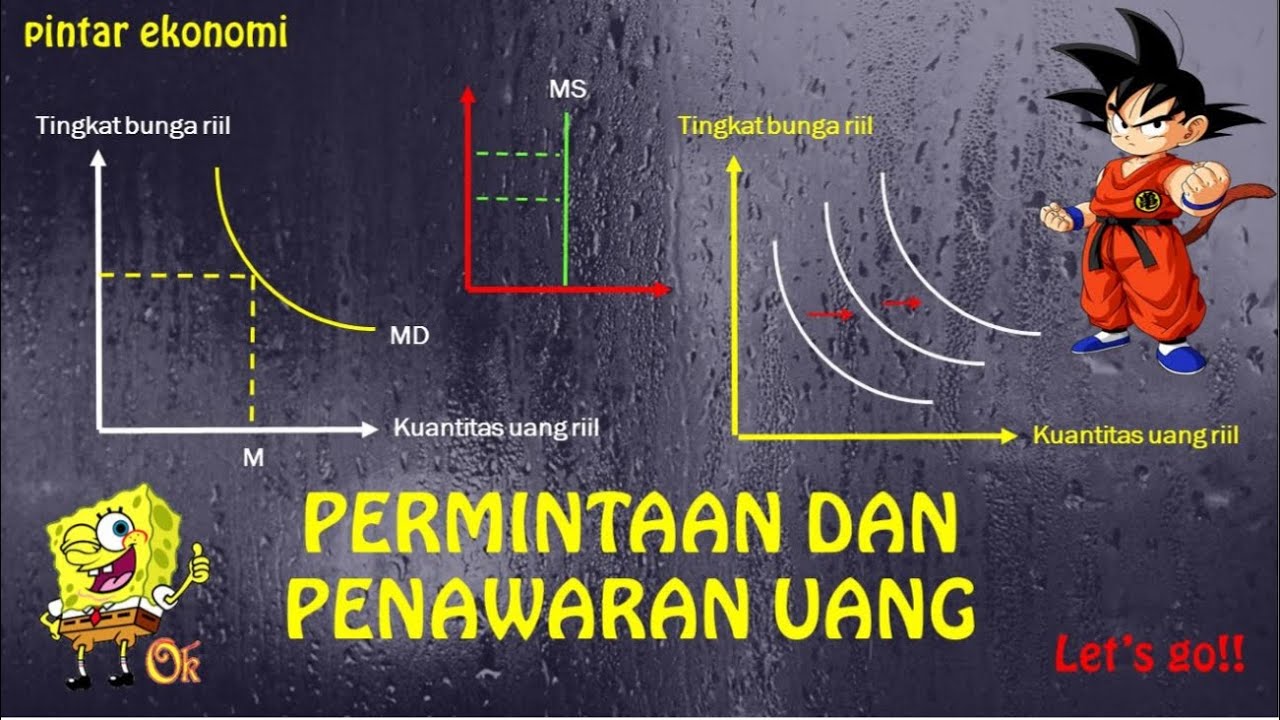

TLDRThis video lesson covers the LM curve in macroeconomics, explaining its relationship with the money supply, interest rates, and national income. It introduces key concepts such as liquidity preference and money supply, along with their impact on the economy. The lesson highlights how changes in income or the money supply can shift the LM curve, affecting interest rates and economic equilibrium. The video also touches on the role of monetary policy and the interaction between the LM curve and the IS curve, providing a comprehensive understanding of these foundational economic concepts.

Takeaways

- 😀 The LM curve is an essential concept in macroeconomics, closely related to the IS curve. Both curves interact to form the IS-LM model, which demonstrates the equilibrium between the goods and money markets.

- 😀 LM stands for 'Liquidity Preference - Money Supply,' highlighting the relationship between money supply and interest rates.

- 😀 The LM curve represents the equilibrium in the money market, where money demand equals money supply. It links the interest rate (i) and national income (Y).

- 😀 The money supply (M) is determined by the central bank, such as Bank Indonesia, and is not affected by the interest rate, which makes the LM curve vertical.

- 😀 Money demand (L) depends on three main motives: transaction, precautionary, and speculative. The transaction and precautionary motives increase with higher income, while the speculative motive decreases with higher interest rates.

- 😀 The LM curve has a positive correlation between the interest rate and national income, meaning higher income leads to higher demand for money and potentially higher interest rates.

- 😀 Changes in national income (Y) lead to shifts in the LM curve. For example, if national income increases, money demand rises, causing the LM curve to shift to the right, resulting in higher interest rates.

- 😀 A contractionary monetary policy (reducing the money supply) shifts the LM curve leftward, resulting in higher interest rates, while an expansionary policy (increasing the money supply) shifts it rightward.

- 😀 The LM curve is not affected by fiscal policy changes directly, but it can be influenced by monetary policy decisions made by the central bank.

- 😀 The script concludes by stating that the LM curve interacts with the IS curve to show the equilibrium in both the goods and money markets, and the IS-LM model is a fundamental tool in macroeconomic analysis.

Q & A

What is the LM curve in macroeconomics?

-The LM curve represents the equilibrium in the money market, where the demand for money equals the supply of money. It shows the relationship between the interest rate (r) and national income (Y) in the economy.

What are the factors that influence the demand for money in the LM model?

-The demand for money is influenced by three factors: transaction motive (based on income), precautionary motive (based on income), and speculative motive (based on interest rates).

How does income affect the LM curve?

-An increase in income raises the demand for money, both for transactions and precautionary purposes. This leads to a rightward shift in the LM curve, indicating that higher income leads to higher interest rates in equilibrium.

What is the relationship between interest rates and the demand for money for speculative motives?

-The demand for money for speculative purposes is inversely related to the interest rate. When interest rates rise, the demand for money for speculative purposes decreases.

How does monetary policy affect the LM curve?

-Monetary policy affects the LM curve through changes in the money supply. A contractionary monetary policy (reducing the money supply) shifts the LM curve to the left, raising interest rates. An expansionary monetary policy (increasing the money supply) shifts the LM curve to the right, lowering interest rates.

What happens to the LM curve when the money supply is reduced?

-When the money supply is reduced, the LM curve shifts to the left. This results in a higher interest rate at any given level of income.

What is the shape of the LM curve, and why is it like that?

-The LM curve is typically upward sloping because there is a positive relationship between income and interest rates in the money market. As income increases, the demand for money increases, which drives up interest rates.

What does it mean for the LM curve to shift rightward?

-A rightward shift of the LM curve indicates an increase in the demand for money due to higher income. This results in lower interest rates for any given level of income.

Can the LM curve shift in response to changes in income?

-Yes, the LM curve can shift in response to changes in income. An increase in income causes the LM curve to shift to the right, reflecting higher money demand, while a decrease in income can cause it to shift leftward.

What does the LM curve equilibrium represent?

-The equilibrium on the LM curve represents the point where the supply of money equals the demand for money in the economy, balancing the money market. It reflects the relationship between interest rates and national income at equilibrium.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)