Introduction to Investments || Business Finance || Quarter 2/4 Week 1

Summary

TLDRIn this business finance class, Tutor Meao introduces students to various types of investments, explaining their advantages and risks. The session covers traditional investment options such as stocks, bonds, mutual funds, and real estate, as well as alternative options like commodities and insurance. Through interactive activities and questions, the tutor highlights key concepts such as risk vs. return and the impact of inflation. Emphasizing the importance of making informed investment choices, the lesson encourages students to understand how different investments can help them grow their wealth over time.

Takeaways

- 😀 Introduction to Business Finance: The tutor introduces the subject, emphasizing the importance of learning about investment and finance in everyday life.

- 😀 Concept of Inflation: The tutor explains how inflation has impacted the value of money over time, using the example of how a peso used to buy more in the past.

- 😀 Importance of Investment: It is crucial for everyone, regardless of profession, to invest because everyone handles money and needs to make it grow.

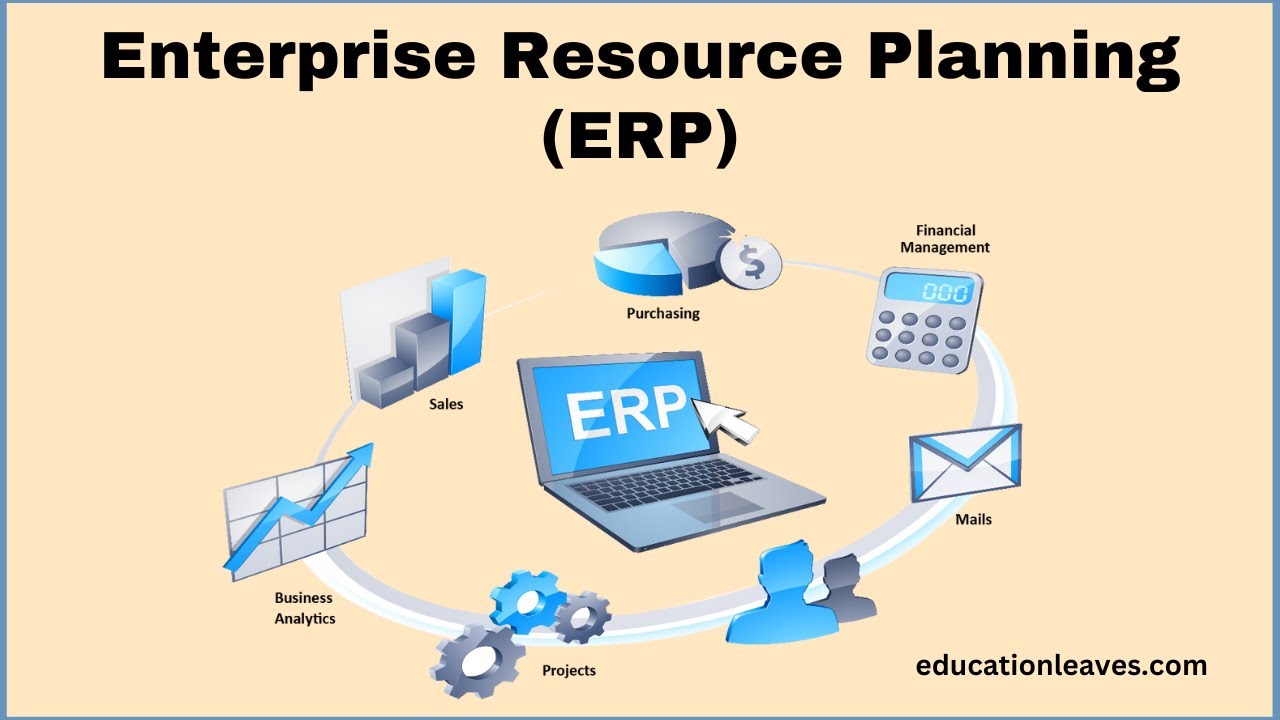

- 😀 Traditional Investment Options: The focus of the lesson is on traditional investments such as stocks, bonds, mutual funds, and real estate.

- 😀 Difference Between Investing and Saving: Saving is putting aside money, while investing involves making that money work for you to earn profit.

- 😀 Types of Investments: The tutor outlines various investment types including stocks, bonds, bank deposits, mutual funds, and real estate.

- 😀 Stocks: When you buy stocks, you own a share of the company, and you can earn dividends, but there is also a risk that the stock value may fall.

- 😀 Bonds: Bonds are debt instruments with a fixed interest rate and a longer term. They are relatively safer but less flexible than other investment types.

- 😀 Real Estate: Real estate investments involve buying property, which can be profitable through appreciation or rental income, though it may be hard to sell quickly due to high value.

- 😀 Insurance as an Investment: Insurance can serve as an investment with long-term benefits, although it takes a while to see returns and can be subject to contract conditions.

- 😀 Risk in Investments: All investments have associated risks, such as the possibility of losing capital or not reaching the expected returns, which needs to be considered before investing.

Q & A

What is the primary focus of this online tutorial?

-The primary focus of the tutorial is to introduce students to various types of investments, including stocks, bonds, mutual funds, and real estate, and to explain the advantages and disadvantages of each investment type.

How does the tutor engage students with the concept of investment?

-The tutor engages students by asking them what they would do if they had one million pesos, prompting them to think about different investment options and how they would manage money.

What is the difference between investing and saving?

-Saving involves putting money aside for future use without expecting it to grow, whereas investing involves committing money with the expectation of obtaining additional income or profit over time.

What are the potential advantages of investing in stocks?

-Investing in stocks allows individuals to own part of a company and earn dividends. It has the potential for high returns, especially if the company performs well.

What is the main risk associated with stock investments?

-The main risk associated with stocks is the possibility of the stock value dropping, which can result in a loss of money for the investor.

What makes bonds a more stable investment compared to stocks?

-Bonds are a debt instrument where investors lend money to a corporation or government, and in return, they receive fixed interest payments. This makes bonds a more stable investment compared to stocks, which can be volatile.

How do mutual funds work and what is their advantage?

-Mutual funds pool money from multiple investors and invest it in various assets, such as stocks and bonds. The advantage is that it allows for diversification, spreading the investment risk across different asset classes.

What is real estate investment, and why is it considered a good long-term option?

-Real estate investment involves purchasing land or property with the expectation that its value will increase over time. It is considered a good long-term investment because real estate tends to appreciate in value, and properties can also generate rental income.

What are the disadvantages of investing in real estate?

-The main disadvantage of investing in real estate is that it can be difficult to sell quickly, as properties typically have high values. Additionally, real estate investments can require substantial initial capital and maintenance costs.

Why do some people invest in currencies, and what is the risk involved?

-People invest in currencies to take advantage of fluctuations in exchange rates. The risk involved is that currency values can change rapidly, which can lead to losses if the investor does not time the market correctly.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)