[MEET 9] AKUNTANSI SEKTOR PUBLIK - AKUNTANSI PEMBIAYAAN

Summary

TLDRIn this online lecture on public sector accounting, Nilam Kemala discusses financial accounting principles, focusing on the differences between financing receipts and expenditures. Key topics include classifications of financing, recognition, and measurement processes. The lecture details various transactions, such as forming reserve funds, lending to local government units, and managing long-term debts and investments. Understanding these concepts is crucial for effective budget management, surplus utilization, and deficit closure in government financial practices.

Takeaways

- 😀 Financing accounting in public sector involves managing receipts and expenditures that need to be repaid.

- 😀 The main difference between financing receipts and expenditures is that receipts are cash inflows, while expenditures are outflows that require future payment.

- 😀 Financing receipts include loans, bond sales, and returns from previous investments, whereas expenditures cover loans given and capital contributions.

- 😀 The classification of financing receipts consists of various sources, such as prior year surplus and internal loans.

- 😀 Recognition of financing transactions is based on cash basis, meaning receipts are recorded when cash is received and expenditures when cash is paid.

- 😀 Financing transactions are measured in local currency or foreign currency, depending on the nature of the transaction.

- 😀 Net financing is the difference between financing receipts and expenditures within a specific fiscal period.

- 😀 Practical examples of financing transactions illustrate how to record cash inflows and outflows using journal entries.

- 😀 The process of classifying financing expenditures includes identifying future recoverable amounts like loan repayments.

- 😀 Understanding public sector financing is crucial for managing government budget surpluses and deficits effectively.

Q & A

What is the primary focus of the lecture presented by Nilam Kemala?

-The primary focus of the lecture is public sector accounting, specifically the concept of financing within government financial transactions.

What are the key components discussed regarding financing in public sector accounting?

-The key components include the differences between financing receipts and expenditures, their classifications, recognition, measurement, and the transactions involved.

Why is financing specifically addressed by the PPKD and not the SKPD?

-PPKD serves as the central office responsible for transferring funds to branches (SKPD), making financing a core function of the PPKD.

What constitutes financing receipts?

-Financing receipts consist of all cash inflows that need to be repaid in the future, including loans, bond sales, and returns on previous investments.

What is the difference between financing receipts and expenditures?

-Financing receipts involve cash inflows that add to funds, while financing expenditures are cash outflows that require repayment, indicating a net financing effect.

How are financing receipts classified?

-Financing receipts are classified into categories such as the use of previous year surplus, fund disbursement, asset sales, domestic loans, and foreign loans.

What is the process for recognizing financing receipts?

-Recognition of financing receipts occurs when cash is received in the government’s general cash account.

What does net financing refer to?

-Net financing refers to the difference between financing receipts and financing expenditures over a specified fiscal year.

What types of transactions are involved in financing expenditures?

-Financing expenditures include forming reserve funds, lending to local enterprises, repaying bank loans, providing additional capital to companies, and managing long-term deposits.

How is the measurement of financing receipts and expenditures conducted?

-Financing receipts and expenditures can be measured in Indonesian Rupiah or foreign currency, with necessary conversions based on the central bank's exchange rate at the transaction date.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

[MEET 7] AKUNTANSI SEKTOR PUBLIK - AKUNTANSI UNTUK BELANJA & BEBAN

[MEET 10-1] AKUNTANSI SEKTOR PUBLIK - AKUNTANSI ASET & KEWAJIBAN

[MEET 2] AKUNTANSI EKUITAS & PELAPORAN KEUANGAN - AKUNTANSI DIVIDEN & LABA DITAHAN

Akuntansi Pemerintah SMK Kelas XI - Jenis Pembukuan Tunggal dan Berpasangan Akuntansi Daerah

[MEET 8-1] - AKUNTANSI SEKTOR PUBLIK - TRANSAKSI BELANJA & BEBAN SKPD

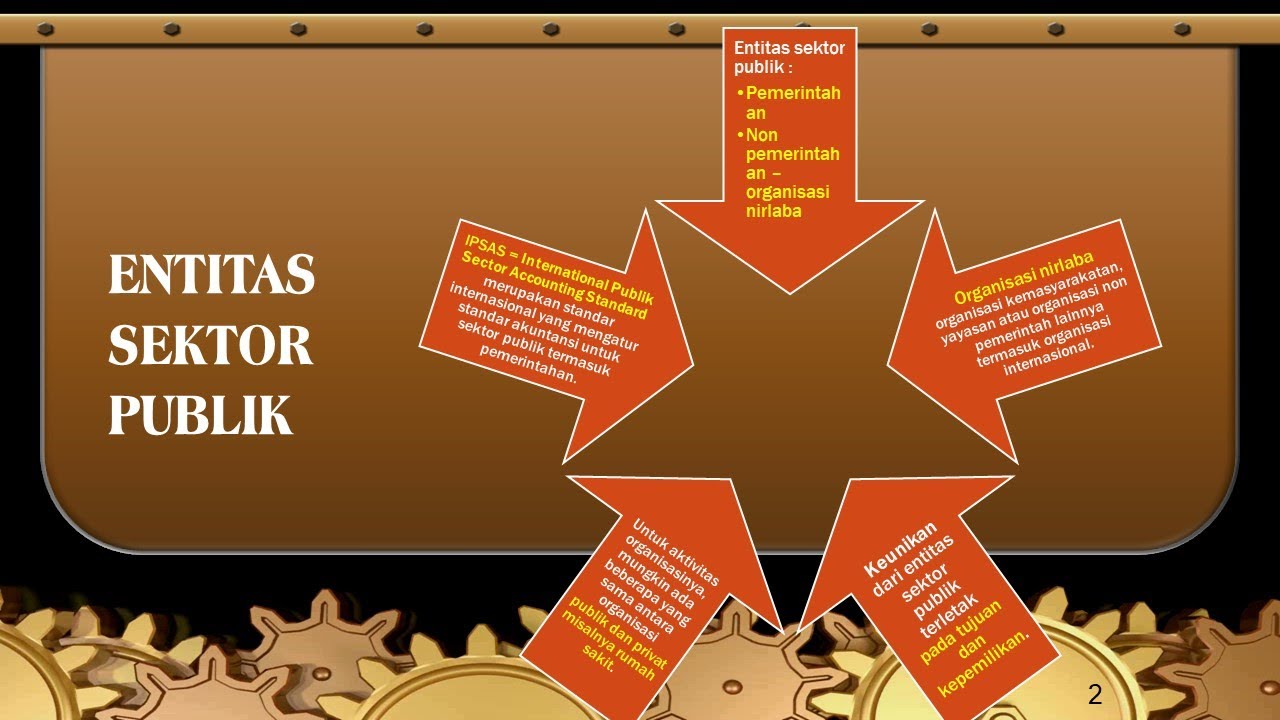

PENGANTAR AKUNTANSI SEKTOR PUBLIK

5.0 / 5 (0 votes)