What are the real problems in public sector stocks? |Vinod Srinivasan|

Summary

TLDRIn this video, the speaker critically examines the decline of public sector undertakings (PSUs) in India, highlighting a staggering drop in market capitalization of up to 55% since August 2024. He attributes this downturn to bureaucratic inefficiencies, political influence, and unrealistic valuations, urging caution for potential investors. The speaker emphasizes that PSUs struggle with poor management and lack of accountability, making them risky investments. He advises viewers to consult financial advisors before making decisions about PSU stocks, rather than relying solely on his commentary.

Takeaways

- 📉 Many public sector companies (PSUs) have experienced significant declines, losing over 8 lakh crores in market capitalization since August 2024.

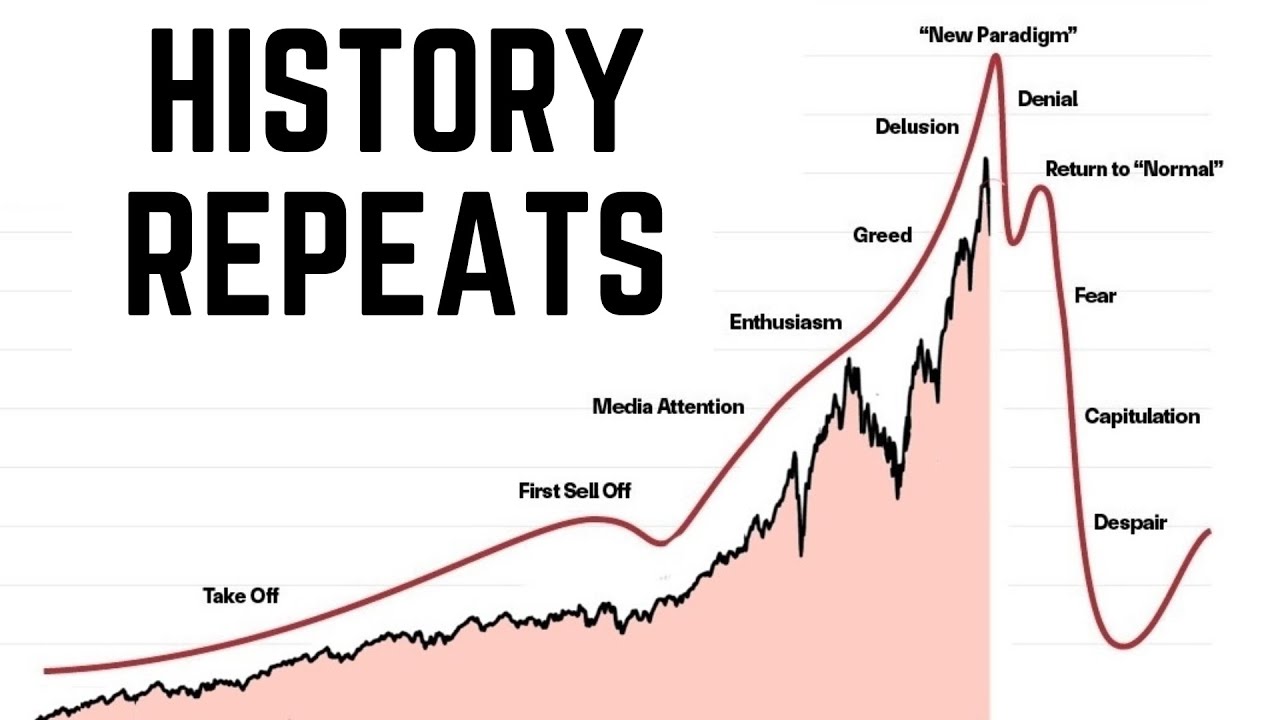

- 📊 Unrealistic valuations of PSUs often lead to speculative price movements not grounded in actual earnings.

- 🏢 Government ownership introduces bureaucratic inefficiencies that slow decision-making and hinder growth in PSUs.

- ⚖️ Political influence plays a major role in the operations of PSUs, impacting their stability and profitability.

- 🔄 Frequent leadership changes in PSUs disrupt long-term strategies and execution, limiting effective management.

- 💰 PSUs heavily depend on government funding and aid, which reduces accountability and focus on shareholder interests.

- ⚠️ The slow adoption of technology in PSUs contrasts sharply with the agility of private sector companies.

- 📉 Analysts note that valuations in the broader market, including PSUs, are increasingly overvalued compared to historical averages.

- 💡 New investors should approach PSU stocks with caution and consider the fundamental issues that persist regardless of price corrections.

- 📈 Investors are advised to seek alternatives and consult financial advisors to better understand the risks involved with PSU investments.

Q & A

Why does the speaker avoid discussing public sector companies (PSUs)?

-The speaker believes that PSUs suffer from fundamental issues such as bureaucratic inefficiency, political influence, and unrealistic valuations, which lead to poor investment outcomes.

What recent trends in PSU stock performance are highlighted in the video?

-The video mentions a significant decline in PSU market capitalization, with 19 companies dropping by 40-55% and an overall loss exceeding 8 lakh crores since August 2024.

How does government ownership impact PSU performance?

-Government ownership leads to inefficiencies and lack of accountability due to bureaucratic processes, frequent leadership changes, and a focus on government interests over shareholder returns.

What role do unrealistic valuations play in PSU stock fluctuations?

-Unrealistic valuations create speculative price movements that do not align with true earnings, making it difficult for investors to predict the stock's value accurately.

What sectors are mentioned as being particularly affected among PSUs?

-The sectors notably impacted include defense, capital goods, and shipping, with companies like Cochin Shipyard and Shipping Corporation of India highlighted.

Why does the speaker compare Indian PSUs to private sector companies?

-The comparison emphasizes the agility and technological adoption in private companies versus the slow, bureaucratic processes of PSUs, illustrating the performance gap.

What advice does the speaker offer to investors currently holding PSU stocks?

-The speaker suggests that if investors are suffering losses in PSU stocks, they should consider exiting their positions to preserve capital, as the underlying issues are unlikely to improve.

What broader economic factors does the speaker mention in relation to PSUs?

-The speaker refers to government spending and economic policies that directly influence PSU performance and growth expectations, highlighting their dependency on government aid.

How does the speaker address the common misconception about investing in PSUs during market corrections?

-The speaker argues that even during corrections, fundamental problems persist, making PSUs a risky investment choice despite their lower prices.

What personal experience does the speaker share regarding PSU investments?

-The speaker recounts advice from a mentor to avoid PSU stocks, reinforcing the view that the risks associated with these companies outweigh potential rewards.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Ekonomi Inggris Terpukul Tarif AS, Kontraksi Terdalam Sejak 2023

Wall Streets Hidden Trades Uncovered…

We are at the Precipice of a Major Turning Point for US Stocks…

India’s First Sovereign Wealth Fund With ₹50 Lakh Crore Corpus: All You Need To Know

Trump TARIFF Fear? Post Market Report 06-Aug-25

Public, Private and Global enterprises | Chapter 3 | Business Studies | Class 11 | Part 1

5.0 / 5 (0 votes)