Financial Education: Risk & Return

Summary

TLDRThis video explores the fundamental relationship between risk and return in investments, explaining how different financial products yield varying returns based on their risk levels. It highlights that fixed deposits are the safest but offer the lowest returns, while shares, being riskier, have the potential for higher returns. The concept of expected versus actual returns is introduced, emphasizing the significance of volatility and standard deviation as measures of risk. Additionally, it discusses assessing personal risk appetite and the importance of staying invested through market fluctuations, ultimately advocating for a balanced approach to investing.

Takeaways

- 😀 Higher returns typically come with higher risks in investment.

- 📉 Fixed deposits offer the lowest returns due to their safety.

- 📈 Shares have the highest expected returns but are considered the most risky.

- 💼 Bonds provide expected returns lower than shares, as they are less risky.

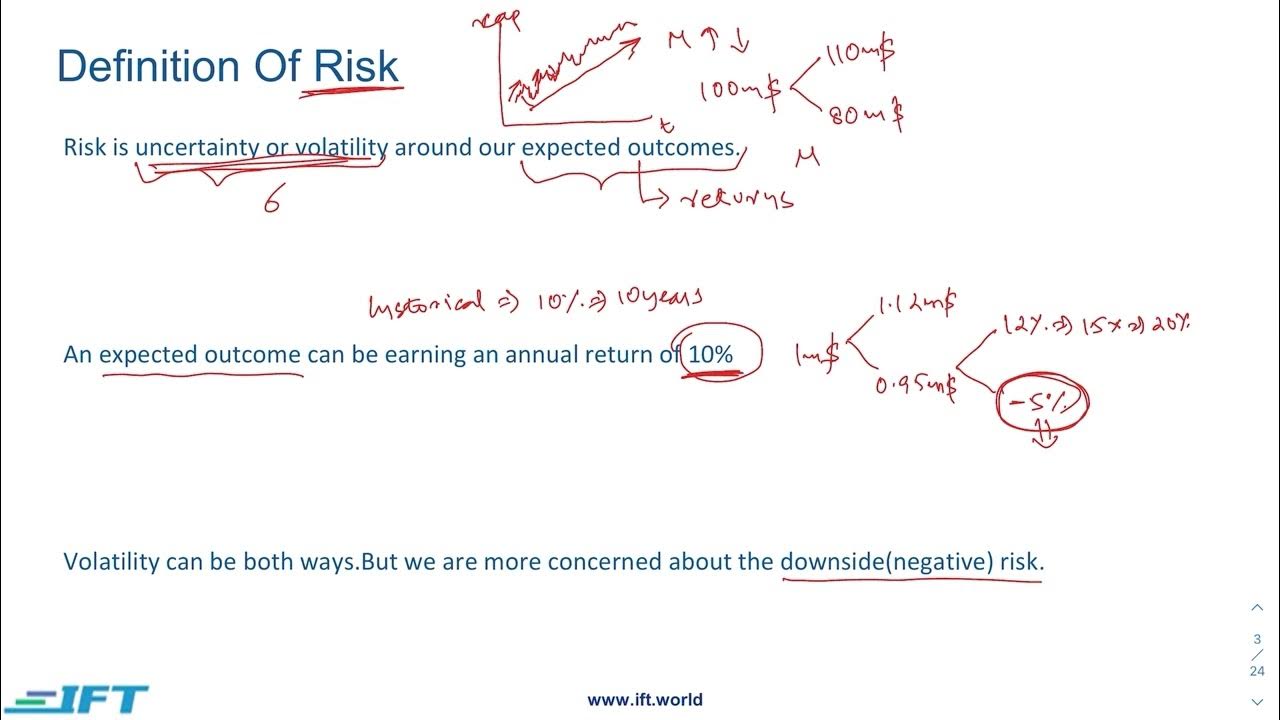

- 🔄 Risk or volatility affects the difference between actual and expected returns.

- 📊 Standard deviation is a simple measure of investment risk: larger values indicate greater risk.

- 💡 The Sharpe ratio helps investors maximize return for the same level of risk.

- 🧭 Understanding your risk appetite is crucial for successful investing.

- 🛑 Risk appetite can be assessed based on needs, ability, and willingness to take risks.

- 🎢 Staying invested is key to weathering market volatility and avoiding premature losses.

Q & A

What is the relationship between risk and return in investments?

-Higher returns typically come with higher risks. Investments with low risk, like fixed deposits, earn lower returns, while riskier investments, such as shares, have higher expected returns.

Why do different financial products yield different returns?

-Different financial products, like fixed deposits, bonds, and shares, have varying risk profiles. Fixed deposits are the safest, hence they offer the lowest returns, while shares are the riskiest and generally offer the highest expected returns.

What does actual return refer to in the context of investments?

-Actual return is the return that an investment achieves, which can vary from the expected return based on the investment's performance.

How is risk quantified in investments?

-Risk can be quantified using standard deviation; a larger standard deviation indicates greater overall risk associated with an investment.

What is the Sharpe Ratio, and why is it important?

-The Sharpe Ratio measures the return of an investment relative to its risk. It helps investors maximize return for the same level of risk or minimize risk for the same return.

What factors should be considered when assessing risk appetite?

-Risk appetite should be assessed based on three dimensions: needs, ability, and willingness to take risks.

How does dependence affect an individual's ability to take risks?

-Individuals with dependents generally have a lower ability to take risks compared to those without dependents, as their financial obligations may require more conservative investment strategies.

What analogy is used to describe the experience of investing?

-Investing is likened to choosing a roller coaster ride; if an investor chooses a ride that is too wild for their comfort level, they may want to exit prematurely, similar to how investors may panic and sell during market downturns.

What is the key to successful investing, according to the script?

-The key to successful investing is the ability to stay invested through market volatility and business cycles, rather than panicking and exiting investments at inopportune times.

What will be covered in the next video mentioned in the transcript?

-The next video will discuss portfolio diversification, which is an essential strategy for managing risk in investments.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Risk Return & Portfolio Management | CA Final SFM (New Syllabus) Classes & Video Lectures

TPAI Materi Pembelajaran 3: Konsep Return dan Risiko Investasi

Common Stocks vs Preferred Stocks | Similarities and Differences

FRM Part 1 Book 1 Chapter 1 – Lecture 1

Dr. Jiang Investment: Risk and Return

COMO ENSINEI MEU AMIGO A DOBRAR SUA RESERVA DE FORMA SIMPLES E NA PRÁTICA! COMPARTILHEI COM VOCÊ !!

5.0 / 5 (0 votes)