BANK SYARIAH DAN KONVENSIONAL SAMA AJA??? - Dr. M. Syafii Antonio, M.Ec.

Summary

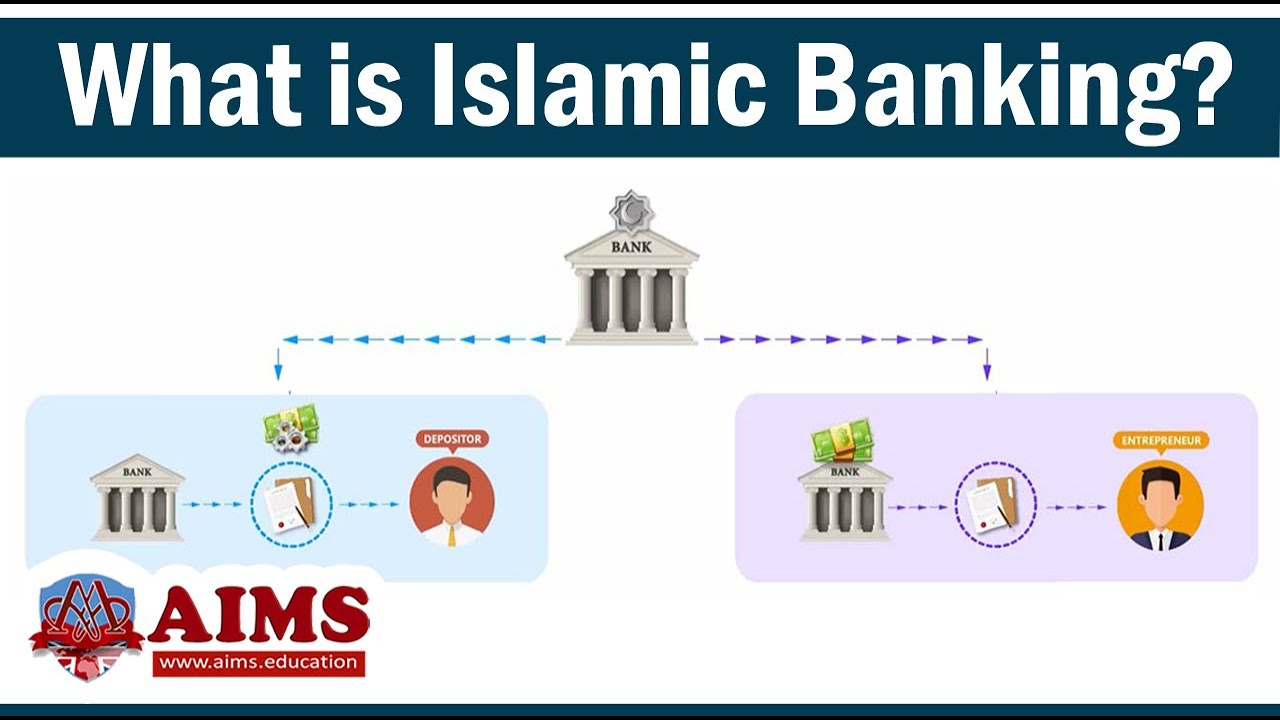

TLDRThe transcript explores the distinctions and similarities between conventional and Islamic banking, focusing on financial products, the foundational contracts governing transactions, and the ethical obligations of banks and customers. It highlights the significance of ensuring that projects financed align with Islamic principles, distinguishing between halal and haram investments. Additionally, the discussion addresses the role of banks in facilitating charitable contributions like zakat and the implications of delays in financing, emphasizing the complexities and ethical considerations unique to Islamic finance compared to traditional banking.

Takeaways

- 🏦 Banking processes, including savings, deposits, and financing, appear similar but differ significantly in their underlying principles and contracts.

- 📜 The fundamental differences in transactions stem from the type of contracts that govern them, which are crucial in Islamic banking.

- 🤝 Responsibilities of customers (nasabah) towards the bank and the bank's obligations towards customers vary between conventional and Islamic banking.

- 🏛️ The corporate culture and values within conventional banks differ from those in Islamic banks, particularly regarding the ethical sourcing of funds.

- 🌱 In Islamic banking, projects are evaluated for their permissibility, determining if they are halal (permissible), mubah (neutral), syubhat (doubtful), or haram (forbidden).

- ⏳ Issues of delays in financing raise questions about the application of compounded interest, which is not permissible in Islamic finance.

- 💰 Wealth accumulation in banks should also be linked to charitable obligations, such as zakat, infaq, and shodaqoh.

- 🔍 The financing process in Islamic banking is closely examined, including whether instruments used are compliant with Sharia principles.

- 🛡️ The role of Sharia-compliant insurance in financing and investment processes is an important consideration in Islamic banking.

- 📊 Investment strategies in Islamic finance must ensure that funds are allocated to halal instruments rather than traditional or potentially non-compliant markets.

Q & A

What are the main banking processes mentioned in the transcript?

-The main banking processes discussed include savings deposits, giro processes, financing for working capital, investment financing, letters of credit, and fund transfers.

How does the concept of akad (contract) differentiate transactions in Islamic banking?

-In Islamic banking, the akad or contract underlying the transaction is crucial as it defines the terms and conditions, which must comply with Sharia law.

What distinguishes the obligations of customers and banks in conventional versus Islamic banking?

-The obligations of customers and banks are based on the contracts governing the transactions. In Islamic banking, these contracts must align with ethical and religious guidelines, unlike conventional banking where such restrictions may not apply.

What considerations are made regarding the halal status of projects funded by Islamic banks?

-Islamic banks assess whether projects are halal (permissible), mubah (neutral), syubhat (questionable), or haram (forbidden) to ensure compliance with Islamic law.

What happens in Islamic banking when a borrower delays payment?

-In Islamic banking, if a borrower delays payment, there are no compounded interests applied, as charging interest is against Sharia principles.

How does Islamic banking support charitable giving?

-Islamic banking institutions often assist customers with their zakat (almsgiving), infaq (donations), and shodaqoh (charitable acts), ensuring that funds are used in accordance with Islamic principles.

What instruments are used in Islamic financing?

-Islamic financing instruments may include sharia-compliant insurance and other financial products that adhere to Islamic law.

What is the role of corporate culture in Islamic banking?

-Corporate culture in Islamic banking influences how funds are allocated and managed, ensuring that all activities comply with Islamic values and ethical standards.

How do Islamic banks approach investment in financial markets?

-Islamic banks prioritize investment in halal instruments and avoid traditional money markets or any investments that do not comply with Sharia law.

What complexities arise in the operational processes of Islamic banking?

-While Islamic banking may appear similar to conventional banking, there are complexities related to Sharia compliance, ethical considerations, and the specific structures of financial products.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级5.0 / 5 (0 votes)