STOP Doing These 20 Things and Become RICH

Summary

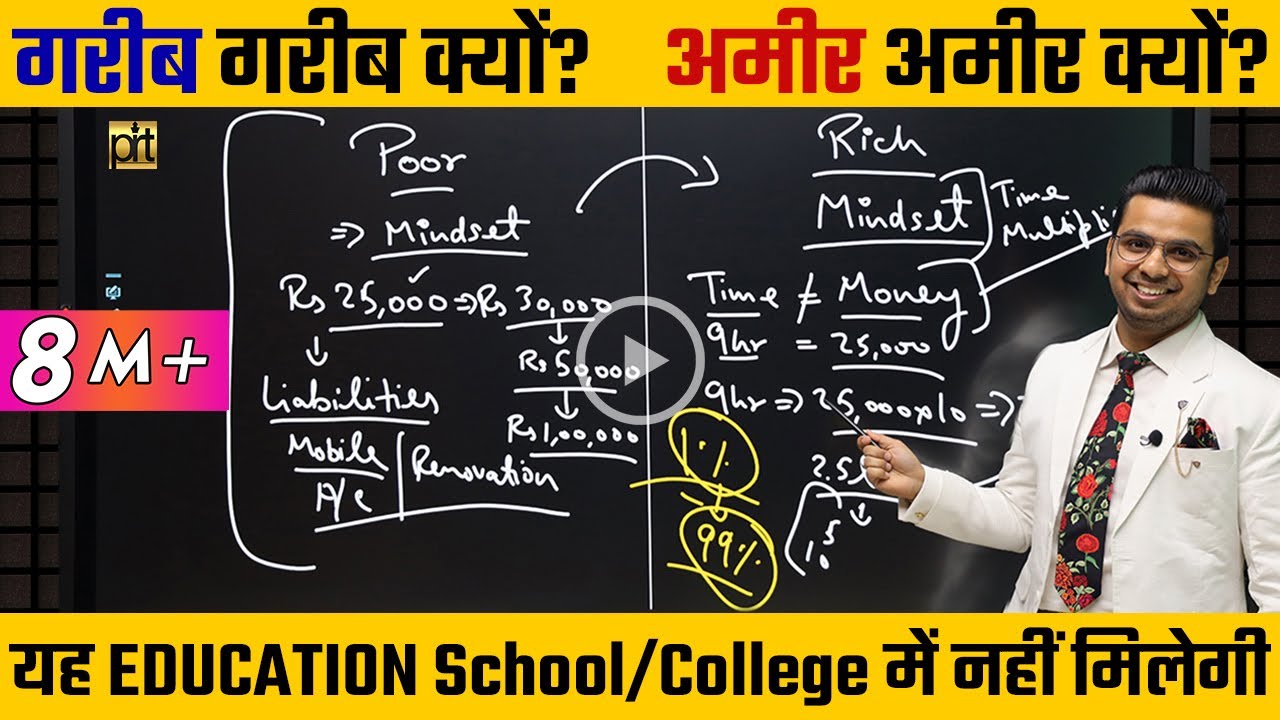

TLDRThe video explores the key differences between the habits of the rich and the poor, emphasizing the importance of financial education, delayed gratification, budgeting, and investing over saving. It highlights how wealthy individuals focus on long-term wealth building, take calculated risks, and prioritize health, personal development, and multiple income streams. In contrast, the video identifies common pitfalls among the poor, such as living beyond their means, avoiding risk, and neglecting financial planning. The video encourages viewers to adopt a wealth-building mindset and offers practical tips for improving financial habits.

Takeaways

- 💸 Living below your means is essential to financial success; overspending pokes holes in your financial bucket.

- 🌳 Wealth is about what you keep and grow, not just about high income. Focus on building wealth over simply making more money.

- 📚 Financial education is key. Ignoring financial literacy can cost you in the long run.

- 🎲 The rich understand the importance of taking calculated risks to grow wealth, unlike the risk-averse mindset of the poor.

- ⏳ Delayed gratification is a principle that rich people follow, investing today for long-term rewards rather than seeking instant satisfaction.

- 📝 Budgeting gives control over finances, allowing rich people to plan while poor people often face financial chaos due to lack of budgeting.

- 💼 Having multiple income streams is crucial; relying on just one source is risky for financial stability.

- 🚗 Rich people take control of their financial future by focusing on what they can control, while the poor may blame external circumstances.

- ⏱️ Time is invested wisely by the rich in personal development and growth, while poor people often waste time on non-productive activities.

- 🎯 Setting clear, measurable financial goals is a practice of the rich, helping them work toward success, unlike those living paycheck to paycheck without direction.

Q & A

What is the main difference between how rich and poor people manage their finances?

-The main difference is that rich people live below their means, saving and investing before spending on luxuries, while poor people tend to live beyond their means, spending more than they earn.

Why is focusing on wealth accumulation more important than focusing on income?

-Focusing on wealth accumulation is key because wealth is what you keep and grow over time, not what you earn. High income doesn't necessarily lead to wealth if it's all spent; it's more important to invest and build assets.

How do rich people approach risk compared to poor people?

-Rich people take calculated risks, such as investing or starting a business, to grow wealth, while poor people often avoid risk altogether, which limits their financial growth.

What is the role of financial education in achieving wealth?

-Financial education is essential for wealth building. Rich people prioritize learning about investing, taxes, and managing money, whereas poor people often neglect financial education, thinking it's too complicated or unnecessary.

Why is having multiple income streams important?

-Having multiple income streams is crucial because relying on a single source of income is risky. If that source dries up, financial stability is threatened. Rich people diversify their income through investments, businesses, or real estate.

How does delayed gratification contribute to financial success?

-Delayed gratification allows people to invest in long-term wealth-building opportunities rather than spending on immediate pleasures. Rich people focus on future benefits, while poor people often seek instant satisfaction, which doesn't help in the long run.

Why is having a budget compared to building a house with a blueprint?

-A budget is like a financial blueprint because it helps you plan and track where your money is going. Without it, financial chaos can ensue, just like a house would be unstable without a construction plan.

What mindset difference exists between rich and poor people regarding external circumstances?

-Poor people tend to blame external factors for their financial struggles, while rich people take responsibility and focus on what they can control, steering their own financial future.

How does the rich people's view on failure differ from that of poor people?

-Rich people see failure as a necessary part of success and learning, while poor people often fear failure so much that they avoid taking any action, which limits their progress.

Why do rich people prioritize investing over just saving money?

-Rich people prioritize investing because it grows wealth, while simply saving doesn't generate significant financial growth. Investing allows money to multiply, creating long-term value.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Complete Financial Education जो आपका दिमाग हिला देगी | Rich Vs Poor Mindset

7 Major Differences Between Rich and Poor People

what school didn't teach you about money

My updated LOOKSMAXING regime (ADVICE)

10 Crucial Personal Finance Lessons That Transformed My Life

Kenapa Menunda Kepuasan Bisa Bikin Hidup Lebih Sukses?

5.0 / 5 (0 votes)