7 Major Differences Between Rich and Poor People

Summary

TLDRThis video explores the key habits that differentiate wealthy individuals from those who struggle financially. It emphasizes 'stealth wealth,' where true wealth is understated and focused on freedom rather than flashy displays. Wealthy people prioritize saving and investing, practice delayed gratification, and invest in appreciating assets. Effective money management and maintaining excellent credit are crucial for wealth accumulation. Finally, a commitment to lifelong learning helps the rich identify opportunities and make informed financial decisions. By adopting these mindsets, viewers can improve their financial trajectories and work towards building lasting wealth.

Takeaways

- 😀 Wealthy individuals often practice 'stealth wealth,' avoiding flashy displays of their riches.

- 😀 Rich people prioritize investments over immediate spending to grow their wealth.

- 😀 Delayed gratification is crucial; resisting short-term rewards can lead to significant long-term benefits.

- 😀 Rich individuals actively invest in assets that appreciate and generate income, unlike poorer individuals who may keep money in savings.

- 😀 Effective money management is essential; understanding income, spending, and savings can set you up for financial success.

- 😀 Having excellent credit is vital; it allows for better loan rates and financial opportunities.

- 😀 Continuous education and self-improvement are key traits among wealthy individuals.

- 😀 Social media can distort perceptions of wealth; influencers may not be financially successful despite appearances.

- 😀 Wealth accumulates through compounding; the earlier one starts investing, the more significant the potential growth.

- 😀 The financial behaviors of the rich contrast sharply with those of the poor, highlighting the importance of mindset and long-term planning.

Q & A

What is 'stealth wealth' and how does it differ from the behavior of flashy individuals?

-Stealth wealth refers to the mindset of wealthy individuals who avoid showing off their wealth through extravagant purchases or displays. Unlike flashy individuals, the truly wealthy prioritize freedom and autonomy over status symbols.

Why do rich people tend to save and invest rather than spend their money immediately?

-Rich people understand that it takes money to make money. They prioritize saving and investing to leverage their capital, leading to significantly higher returns over time compared to immediate spending.

What role does delayed gratification play in wealth accumulation?

-Delayed gratification is crucial for building wealth, as it allows individuals to forgo immediate rewards in favor of greater long-term benefits. This mindset can significantly increase future financial returns.

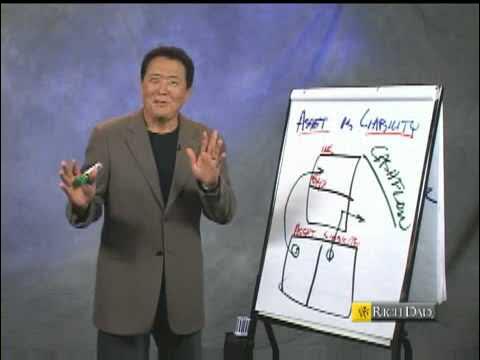

How do rich individuals typically view assets compared to poorer individuals?

-Rich individuals invest in assets that appreciate or generate income, such as stocks, real estate, and business interests. In contrast, poorer individuals might keep money in savings accounts without leveraging the full potential of financial assets.

What is the importance of money management for wealthy individuals?

-Wealthy individuals are generally aware of their income, spending habits, and savings, which helps them avoid overspending and stay on track financially. Effective money management is essential for sustaining and growing wealth.

Why is having good credit essential for wealth accumulation?

-Good credit allows individuals to secure lower interest rates on loans, which can save significant amounts of money over time. Wealthy individuals leverage their good credit to maximize their financial opportunities.

How does the concept of 'time horizon' affect financial decision-making?

-By extending their time horizon to 10, 20, or even 30 years, individuals can make clearer and more informed financial decisions, often leading to better long-term outcomes.

What is the '60310 rule' for budgeting?

-The '60310 rule' suggests that individuals allocate 60% of their budget for needs, 30% for wants, and 10% for savings and investments. This framework helps maintain a balanced financial life and supports wealth building.

How can continuous education impact a person's financial growth?

-Continuous education fosters a thirst for knowledge, which can open doors to new opportunities and enhance understanding of financial concepts, ultimately contributing to greater wealth accumulation.

What is the significance of compounding in wealth building?

-Compounding allows money to earn returns on previous returns, significantly increasing wealth over time. For example, a $1 investment at a young age can grow to a much larger sum due to the power of compounding.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)