99% Traders LOSE MONEY While SEBI Does Nothing to Help?!

Summary

TLDRThe video discusses a new SEBI report on stock market trading losses, revealing that 93% of retail traders lose money, with the bottom 3.5% losing an average of 28 lakh rupees each. It highlights the high taxes and charges, such as ST and brokerage fees, that contribute to the losses. The speaker criticizes the lack of regulation on advisory services and questions the government's high taxes without adequate awareness programs. The conversation also touches on the geographical spread of traders, the impact of algo trading, and the need for a level playing field in the market.

Takeaways

- 📉 The SEBI report indicates that a significant majority, 93%, of retail traders incur losses in the stock market.

- 💹 Only 1% of retail traders make substantial profits, exceeding one lakh rupees, highlighting the difficulty of making significant money.

- 💸 The bottom 3.5% of traders reportedly lose an average of 28 lakh rupees each, underscoring the severity of losses for some.

- 📊 The report's findings are consistent over the last three years, suggesting a persistent trend rather than an anomaly.

- 🚫 The report focuses on individual traders, excluding large entities like ultra-high net worth individuals who trade through companies to minimize tax liabilities.

- 📈 Increasing taxes on stock trading, such as the Securities Transaction Tax (STT), have risen dramatically in the past decade, with little evidence of the revenue being used for public awareness campaigns.

- 💼 The report does not account for advisory fees, a significant cost for many retail traders who seek tips and advice, potentially exacerbating their losses.

- 🏦 SEBI's licensing of advisory services is questioned, given the low success rate of traders, with concerns about the criteria and effectiveness of such services.

- 🌐 Geographical data from the report shows a higher concentration of active traders in North Indian states, possibly indicating economic motivations for trading.

- 📊 The report emphasizes the use of algorithms by large players, which can create market volatility and may be perceived as market manipulation by retail traders.

Q & A

What is the main topic of the discussion in the transcript?

-The main topic of the discussion is the new report by SEBI on the losses incurred by retail traders in the Indian stock market, specifically focusing on the financial year 2024 and the last three years.

According to the transcript, what percentage of retail traders lose money in the stock market?

-The transcript states that 93% of people lose money in the stock market.

What does the report reveal about the profits of the remaining 6% of traders?

-The report reveals that among the remaining 6% who make money, less than 1 lakh rupees profit is made by most, and only 1% of retail traders make more than one lakh rupees.

How much money do the bottom 3.5% of traders lose on average, as per the report?

-The bottom 3.5% of traders are losing an average of 28 lakh rupees each.

Why does the transcript suggest that the report's findings are not applicable to all traders?

-The report's findings are not applicable to all traders because it only considers individual traders and not those trading through companies, which often includes big clients or ultra-high net worth individuals.

What is the transcript's opinion on the government's increasing taxes on stock trading?

-The transcript suggests that while taxes are increasing, there is a lack of awareness programs for retail traders, and the taxes do not seem to be used effectively to educate people about the risks of trading.

What is the role of advisory services in the losses mentioned in the transcript?

-Advisory services are mentioned as a contributing factor to the losses as many inexperienced traders rely on them for tips, often leading to additional costs and losses.

What does the transcript suggest about the criteria for obtaining an advisory license from SEBI?

-The transcript implies that the criteria for obtaining an advisory license from SEBI may not be stringent enough, as it does not necessarily require proof of successful trading history or profit.

How much money has been lost by retail traders in the last three years according to the SEBI report mentioned in the transcript?

-According to the transcript, retail traders have lost approximately 1.8 lakh crores in the last three years.

What is the transcript's view on the geographical spread of traders in India?

-The transcript suggests that there is a higher concentration of traders from North Indian states, possibly due to economic conditions, and that South Indian states are less represented.

What does the transcript suggest as a potential solution to reduce losses in the stock market?

-The transcript suggests that SEBI could consider banning advisory services for cash market trading and implementing stricter regulations to level the playing field for retail traders.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

STOCK MARKET BASICS

😡SEBI New Rules|SEBI New Rules For F&o Trading|SEBI Consultation Paper|SEBI News|New SEBI Rules|😭

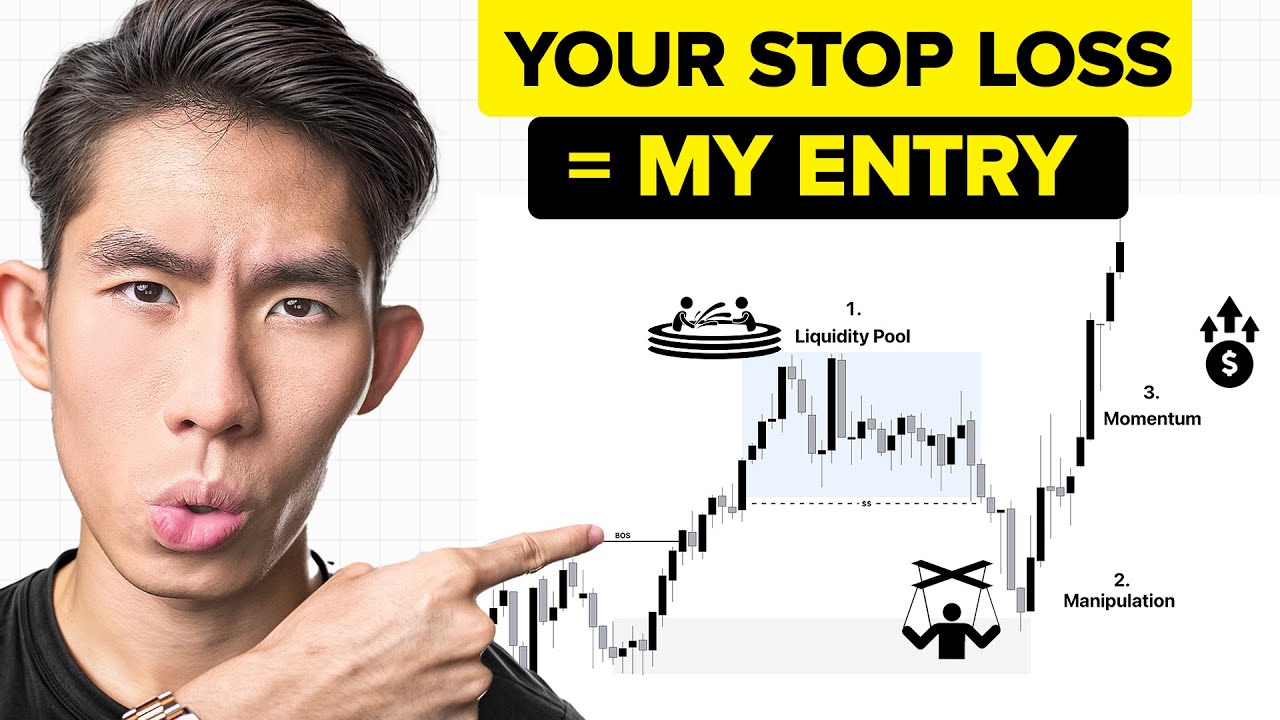

How Smart Money Manipulate YOUR Trades….(leaked video)

What is Insider Trading? [Explained]

| MCA trading | made simple - Episode 3: Stop & DM Positions Interaction

How To Identify Liquidity in Trading (SMC Trading)

5.0 / 5 (0 votes)