How to Use ChatGPT4o as Your Stock Analyst ($NVDA, $GOOG)

Summary

TLDRThis video tutorial demonstrates how to use the new Omni model of cat GPT for stock analysis, taking Nvidia Corporation as an example. It guides viewers through quantitative and financial analysis, a task typically performed by entry to mid-level financial analysts. The video showcases how to analyze a stock's valuation using a 15% discount rate, and compares Nvidia's growth assumptions with those of Google (Alphabet), highlighting the market's expectations for each company's future growth.

Takeaways

- 📈 The video demonstrates how to use ChatGPT for stock analysis, specifically focusing on Nvidia Corporation.

- 💼 Entry-level financial analysts in the U.S. can earn between $60,000 and $110,000 annually.

- 🔍 ChatGPT provides valuable quantitative and financial analysis, comparable to traditional analyst methods.

- 📊 The analysis includes various financial metrics like trailing PE, forward PE, PEG ratio, and price-to-sales ratios.

- 💡 A 15% discount rate is used to ensure a margin of safety in investment decisions.

- 💵 The discounted cash flow analysis is emphasized as a crucial method for valuing a company.

- 📉 Nvidia's current market cap is approximately $2.27 trillion, but it may be overvalued based on the analysis.

- 🔄 The video suggests using screenshots of financial data for quick analysis with ChatGPT.

- 🚀 Implicit growth rates for Nvidia and Google are calculated, showing Nvidia's expected growth at 42.7% annually.

- 📺 The channel offers more content on financial matters and disruptive innovations, encouraging viewers to stay informed.

Q & A

What is the main topic of the video?

-The video is about using an AI model to analyze stocks, specifically Nvidia Corporation, for quantitative and financial analysis.

What is the salary range for an entry-level or mid-level financial analyst position in the United States?

-The salary range for such a position is between $60,000 and $110,000 annually.

What is the significance of the Nvidia Corporation being analyzed in the video?

-Nvidia Corporation is analyzed because it has experienced a significant Bull Run and is a relevant company in the context of AI training and compute.

What is the role of the AI model in the stock analysis process described in the video?

-The AI model is used to quickly analyze financial data, provide a unique perspective on whether the stock is overvalued or undervalued, and perform discounted cash flow analysis.

What is the discount rate used in the analysis and why is it chosen?

-A 15% discount rate is used in the analysis to provide a margin of safety and to account for the time value of money.

What financial metrics does the AI model analyze for Nvidia Corporation?

-The AI model analyzes metrics such as trailing PE ratio, forward PE ratio, PEG ratio, price/sales ratio, and price/book ratio for Nvidia Corporation.

What is the estimated intrinsic value of Nvidia Corporation according to the AI model's analysis?

-The AI model estimates the intrinsic value of Nvidia Corporation to be around $21 billion based on a discounted cash flow analysis with a 15% discount rate.

How does the AI model determine the growth assumptions implicit in the market cap of Nvidia Corporation?

-The AI model uses a discounted cash flow analysis repeatedly with different growth rates until it finds the growth rate that aligns with the current market cap of Nvidia.

What is the implicit growth rate of Nvidia Corporation according to the market?

-The implicit growth rate of Nvidia Corporation, as assumed by the market, is approximately 42.7% annually based on the AI model's analysis.

How does the AI model's analysis compare Nvidia Corporation to Alphabet (Google)?

-The AI model also performs a similar analysis on Alphabet (Google) and finds that the market assumes a growth rate of approximately 26.4% annually for Alphabet, which is lower than the growth rate assumed for Nvidia.

What is the importance of the growth rate assumptions in the stock valuation process?

-The growth rate assumptions are crucial in stock valuation as they directly impact the present value of future cash flows and can significantly influence the stock's price if the actual growth rates differ from expectations.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Midjourney's NEW Omni-Reference: Create CONSISTENT Characters, Objects, Scenes | V7 --oref Guide

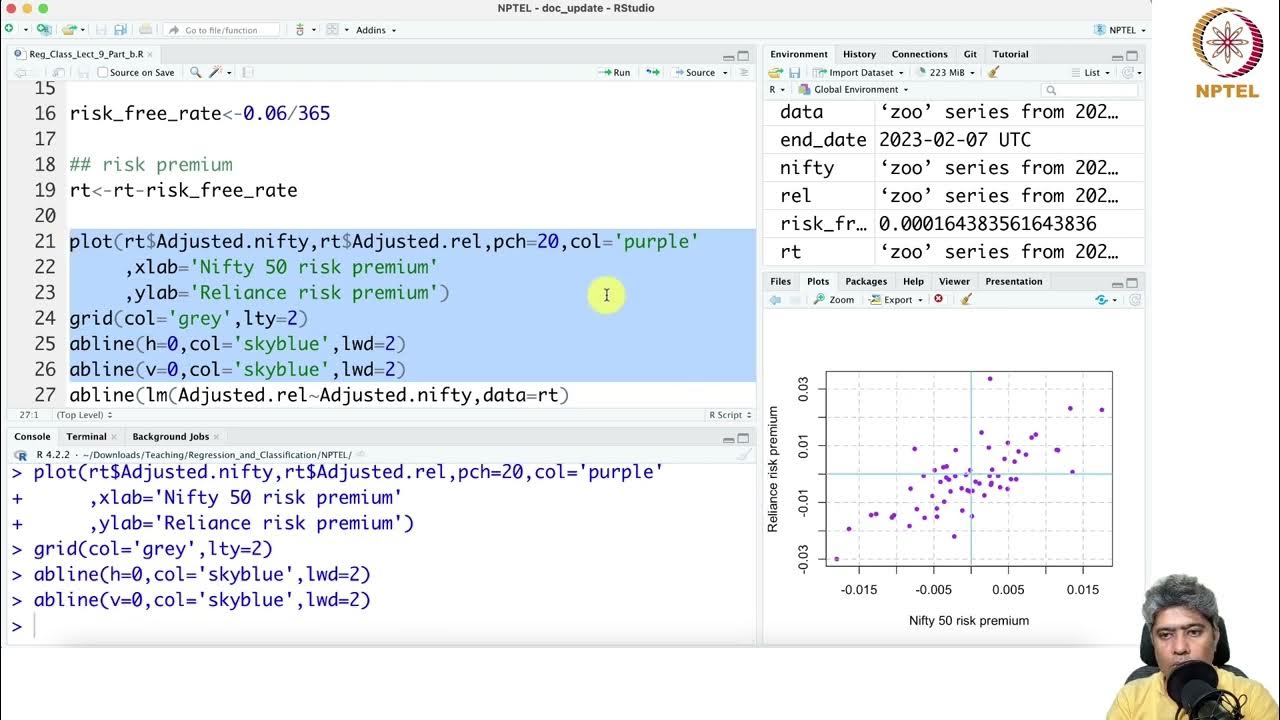

Using a Python DCF Calculation to find the Intrinsic Fair Value of a Stock

3 Must-Know GPT-4o Use Cases for Finance

OpenAI o1 + Sonnet 3.5 + Omni Engineer: Generate FULL-STACK Apps With No-Code!

Hands on with R for CAPM

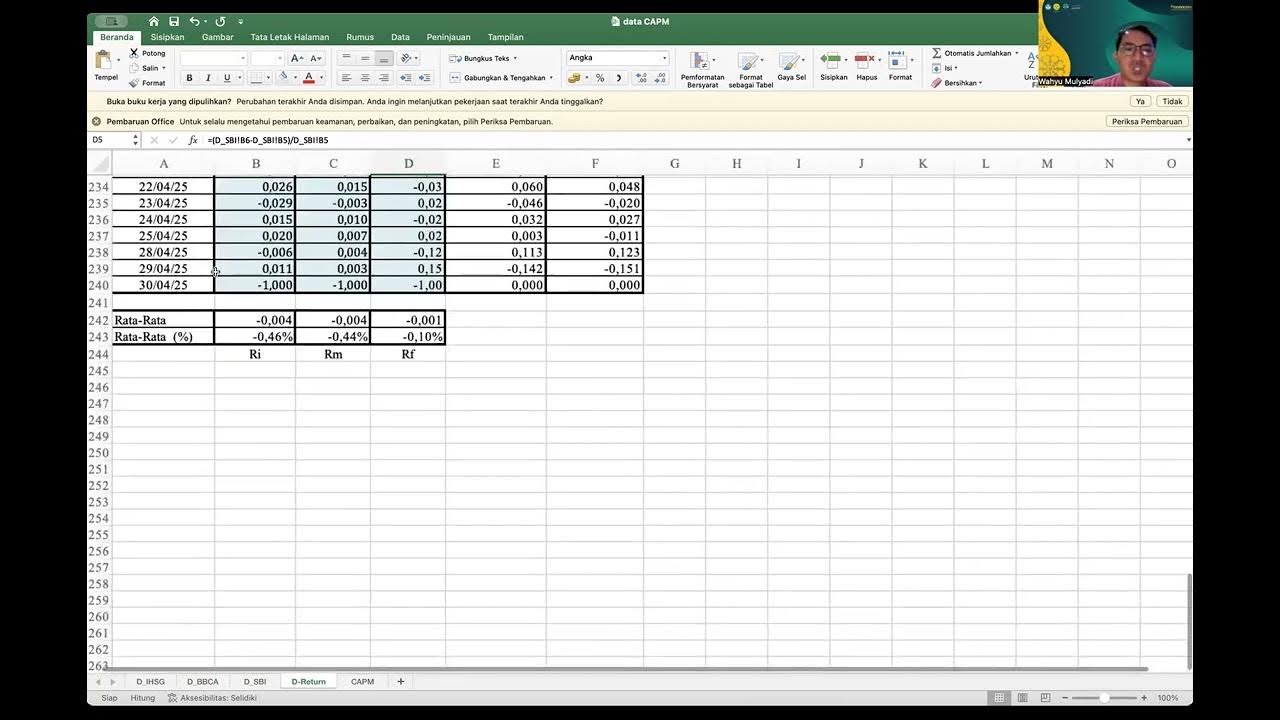

Teori Portofolio dan Analisis Investasi sesi 12 ( Menghitung Capital Aset Pricing Model)

5.0 / 5 (0 votes)