UK Deficit Surges to $85.4 Billion Amid Economic Challenges | Latest News | WION

Summary

TLDRThe UK faces a significant budget deficit with borrowing surpassing expectations, leading to a national debt at 100% of GDP. Chancellor Rachel Reeves is under pressure to consider tax increases. The deficit rose to £85.4 billion between April and August, with public sector pay rises contributing to the strain. Consumer confidence is declining, and demographic shifts are expected to increase health and pension costs. The Chancellor must make tough fiscal decisions, but improving productivity could reduce the debt to GDP ratio.

Takeaways

- 📉 The UK government is facing a significant budget deficit, with borrowing surpassing expectations.

- 💷 The UK's deficit for April to August was £85.4 billion, which is £8 billion higher than forecasts.

- 📈 In August alone, the deficit was £18 billion, exceeding economist predictions by £1 billion.

- 💼 A £13 billion pay rise for public sector workers has added to the strain on public finances.

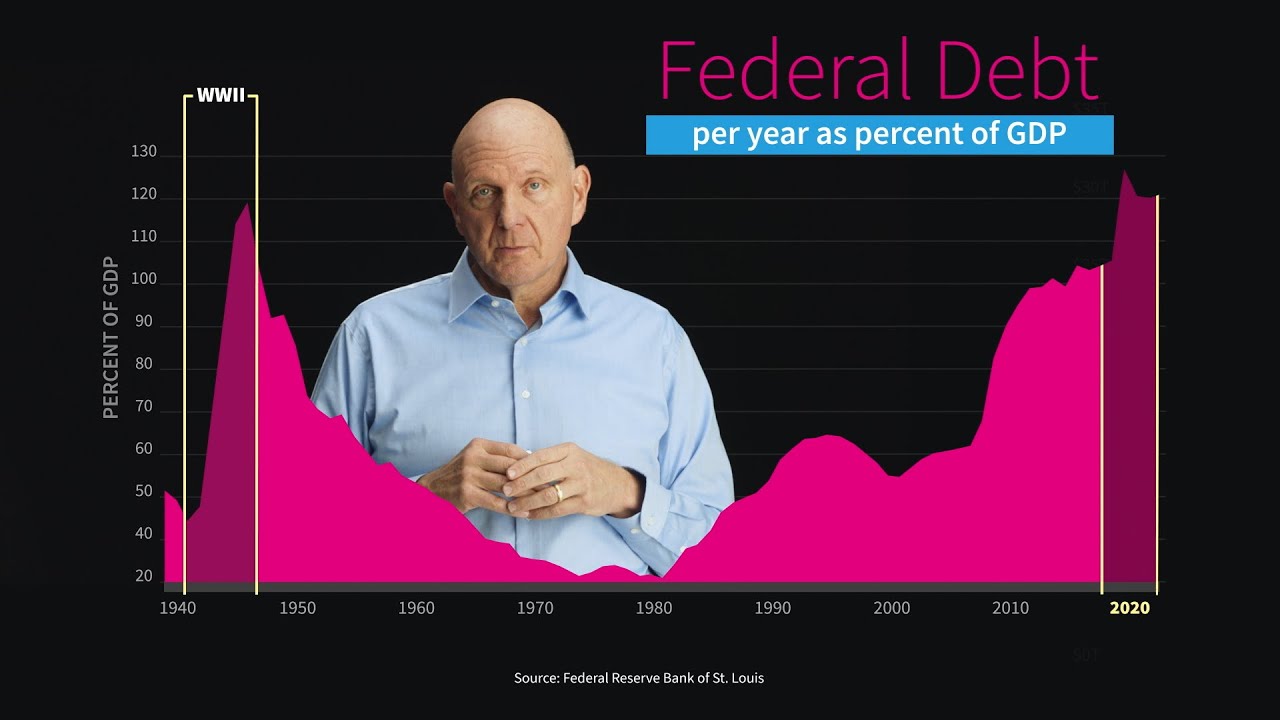

- 🚨 The national debt has reached 100% of GDP, a level not seen since 1961.

- 📈 If current trends continue, the national debt could rise to 274% by the mid-2070s.

- 👥 Consumer confidence is dropping, with a recent survey indicating the sharpest decline in sentiment in 2.5 years.

- 👴 The UK population is expected to increase by over 13 million by 2070, with a significant rise in those aged 65 and older.

- 💊 The demographic shift will lead to increased health and pension costs, with public health spending projected to double.

- 💼 Chancellor Rachel Reeves faces tough decisions as she prepares her budget for October 30th, considering tax increases and welfare cuts.

- 🔝 Improving productivity could significantly lower the debt to GDP ratio, potentially reducing national debt to 65% by the mid-2070s.

Q & A

What is the current UK budget deficit situation?

-The UK is grappling with a significant budget deficit, with new data revealing that borrowing has surpassed expectations. The deficit reached £85.4 billion between April and August, which is £8 billion higher than forecasts by the Office for Budget Responsibility.

How does the UK's budget deficit compare to its GDP?

-The national debt now stands at 100% of the GDP, a level not seen since 1961. If current trends continue, the Office for Budget Responsibility estimates it could rise to an astonishing 274% by the mid-2070s.

What recent financial event has added to the UK's public finances strain?

-A £13 billion pay rise for public sector workers has highlighted the ongoing strain on public finances, contributing to the budget deficit.

How has consumer confidence been affected by the UK's economic situation?

-Consumer confidence has taken a hit, with a recent survey showing the sharpest decline in sentiment in 2 and a half years. Many are worried about potential tax increases and cuts to welfare that could impact their everyday lives.

What demographic changes are expected in the UK by 2070?

-The UK population is expected to increase by over 13 million by 2070, predominantly among those aged 65 and older. This demographic shift will lead to skyrocketing health and pension costs.

What is the projected increase in Public Health spending as a percentage of the GDP by the mid-2070s?

-Public Health spending alone is projected to nearly double to 14.5% of the GDP by the mid-2070s.

What challenges does Chancellor Rachel Reeves face as she prepares her budget?

-Chancellor Rachel Reeves faces tough choices as she prepares her budget for October 30th, with an economy that has been struggling since the 2008 financial crisis. She may need to raise taxes and cut welfare to adhere to fiscal rules.

What could be a potential solution to lower the UK's debt to GDP ratio?

-Improving productivity could dramatically lower the debt to GDP ratio. If productivity growth averages 2.5% instead of the 1.5%, the national debt could fall to just 65% of the GDP by the mid-2070s.

What is the current sentiment regarding the future of public services in the UK?

-Many are left wondering how the economic changes will impact their finances and the future of public services, as the economic outlook is challenging and difficult decisions lie ahead.

What steps can individuals take to stay updated on the latest economic news from the UK?

-Individuals can download the Weon app and subscribe to their YouTube channel for all the latest news on the UK's economic situation and its implications.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Understanding the cycle of U.S. deficit spending and rising debt amid Trump budget push

Is the UK government bankrupt?

Defisit APBN Melebar Per-Agustus 2024 - [Metro Siang]

Just the Facts About the US Federal Budget: Steve Ballmer Talks Through the Numbers

Increase in Public Debt

Why Hungary's Ballooning Deficit is Bad News for Orban

5.0 / 5 (0 votes)