Accounting Cycle Step 1: Analyze Transactions

Summary

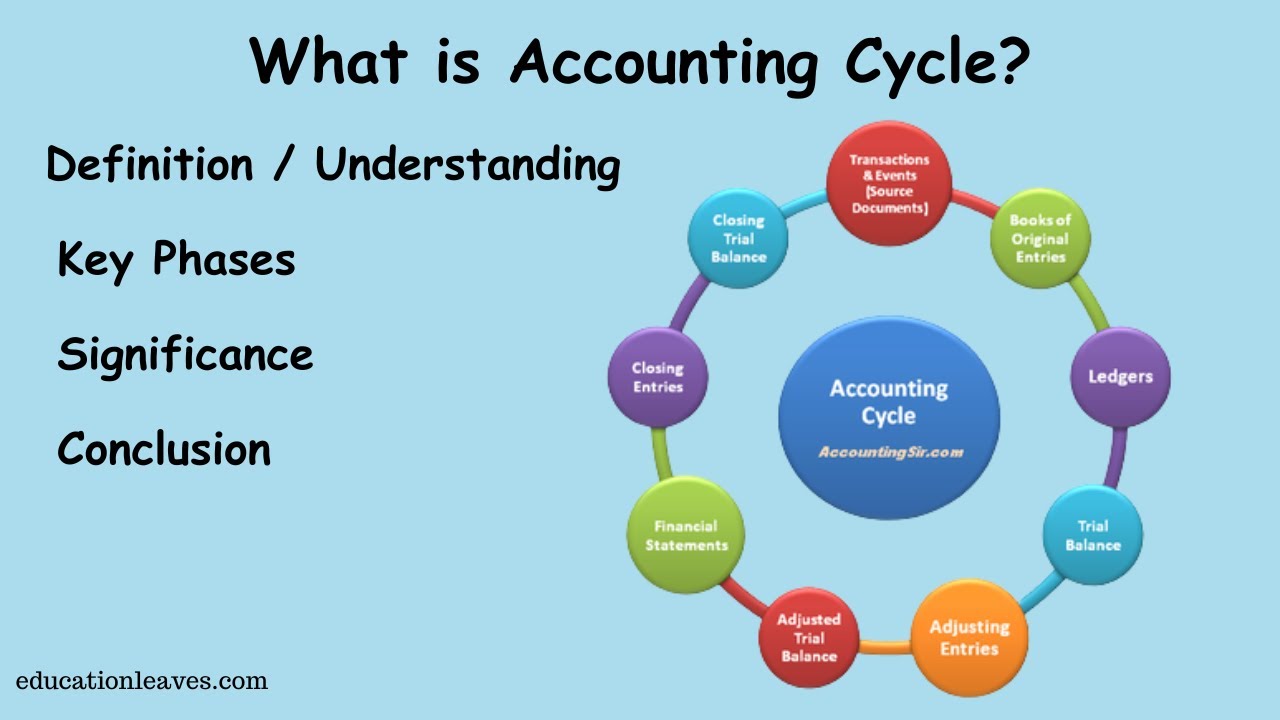

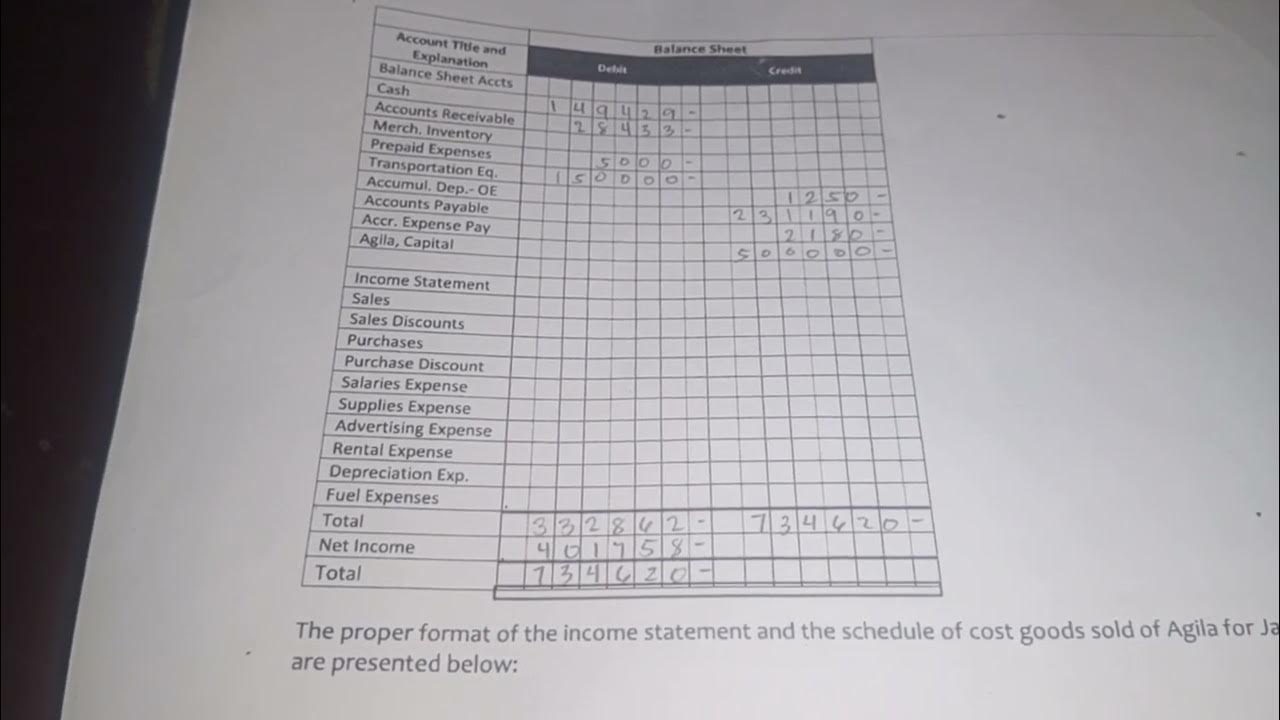

TLDRThe video script outlines the accounting cycle, a cornerstone of financial accounting, detailing its nine steps: analyzing transactions, journalizing, posting to the ledger, preparing trial balances, adjusting entries, financial statements, closing entries, and an optional post-closing trial balance. It emphasizes the three-part process of analyzing transactions: identifying affected accounts, determining increases or decreases, and applying debit and credit rules. Examples illustrate these steps, highlighting the foundational role of the accounting cycle in understanding financial transactions.

Takeaways

- 🔑 The Accounting Cycle is fundamental to all types of accounting and includes a series of steps that form the basis of financial accounting.

- 📚 The steps of the accounting cycle are: analyzing transactions, journalizing, posting to the ledger, preparing an unadjusted trial balance, adjusting entries, preparing the adjusted trial balance, preparing financial statements, closing entries, and optionally, a post-closing trial balance.

- 🔍 Analyzing transactions is the first step and involves a three-part process: identifying affected accounts, determining increases or decreases, and applying debit and credit rules.

- 🏢 Example 1: When a company buys supplies on account, the Supplies (asset) account increases with a debit, and the Accounts Payable (liability) account increases with a credit.

- 💼 Example 2: When a company performs a service on account, the Accounts Receivable (asset) account increases with a debit, and the Service Revenue (revenue) account increases with a credit.

- 💡 Example 3: When a company pays a utility bill, the Cash (asset) account decreases with a credit, and the Utilities Expense (expense) account increases with a debit.

- 📈 The rules of debits and credits are crucial for correctly analyzing transactions, with assets increasing with debits and expenses increasing with debits, while liabilities and revenues increase with credits.

- 📋 It's important to memorize the debit and credit rules for different types of accounts to accurately journalize and analyze transactions.

- 📈 The process of analyzing transactions is foundational for subsequent steps in the accounting cycle, such as journalizing and posting transactions.

- 👨🏫 The video lectures are designed to help viewers master each step of the accounting cycle, starting with transaction analysis.

Q & A

What is the Accounting Cycle?

-The Accounting Cycle is the foundation of Financial Accounting and almost all accounting. It consists of a series of steps that start with analyzing transactions and end with preparing a post-closing trial balance.

What are the steps involved in the Accounting Cycle?

-The steps in the Accounting Cycle are: analyze transactions, journalize transactions, post transactions to the ledger, prepare an unadjusted trial balance, journalize and post adjusting entries, prepare the adjusted trial balance, prepare financial statements, journalize and post closing entries, and optionally, prepare a post-closing trial balance.

How is the first step of the Accounting Cycle described in the script?

-The first step of the Accounting Cycle, analyzing transactions, is described as a three-part process involving identifying the accounts affected, determining which accounts are increasing or decreasing, and applying the rules of debits and credits.

What are the two accounts affected when a company buys supplies on account?

-When a company buys supplies on account, the two accounts affected are Supplies (an asset account) and Accounts Payable (a liability account).

How do you determine if accounts are increasing or decreasing in a transaction?

-In a transaction, you determine if accounts are increasing or decreasing by comparing the account's balance after the transaction to its balance before the transaction.

What is the rule for increasing an asset account in terms of debits and credits?

-Assets are increased with debits according to the rules of debits and credits.

What are the accounts affected when a company performs a service on account?

-When a company performs a service on account, the accounts affected are Accounts Receivable (an asset account) and Service Revenue (a revenue account).

How does paying a utility bill affect the accounts in the general ledger?

-Paying a utility bill affects the Cash (an asset account, which decreases) and Utilities Expense (an expense account, which increases).

What is the rule for decreasing an asset account using debits and credits?

-An asset account is decreased with a credit, as per the rules of debits and credits.

Why is it important to memorize the rules of debits and credits?

-It is important to memorize the rules of debits and credits because they are fundamental to correctly applying the accounting equation and ensuring accurate financial record-keeping.

What is the purpose of analyzing transactions in the Accounting Cycle?

-The purpose of analyzing transactions in the Accounting Cycle is to ensure that financial data is recorded accurately and in accordance with accounting principles, which is crucial for the preparation of financial statements and decision-making.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

What is Accounting cycle? | Key phase, Significance of Accounting cycle

Accounting Cycle - Definition, Example, 9 Steps of Accounting Cycle

November 15, 2024

CLOSING ENTRIES: Everything You Need To Know

Financial Analysis in Arabic - 04 1080p

Jurnal Penutup, Buku besar setelah penutupan, Neraca saldo setelah penutupan | PART 3

5.0 / 5 (0 votes)