Estate Tax in the Philippines (TRAIN Law)

Summary

TLDRThis tutorial video explores estate taxes in the Philippines, defining the concept and detailing the impact of TRAIN law on tax rates and allowable deductions. It explains that estate tax is levied on the privilege of property transfer upon death, not on the property itself. The video outlines the updated standard deduction, clarifies deductions for resident and non-resident estates, and provides a step-by-step calculation of estate tax using illustrative problems. It concludes with instructions on filing requirements and forms, encouraging viewers to subscribe for more taxation insights.

Takeaways

- 📚 Estate tax is a tax on the right of a deceased person to transmit their estate to lawful heirs or beneficiaries.

- 🏛 Succession is the mode of acquisition by which property rights and obligations are transmitted after a person's death.

- 💼 The estate tax is not a tax on property itself but on the privilege of transmitting property upon the owner's death.

- 📉 The Tax Reform for Acceleration and Inclusion (TRAIN) law updated estate tax rates and deductions effective January 1, 2018.

- 🏡 The standard deduction for estate tax purposes has been increased from 1 million to 5 million pesos under TRAIN law.

- 🌍 For non-resident decedents who were not citizens of the Philippines, only properties situated in the Philippines are included in the taxable estate.

- 💼 If the gross estate is over five million pesos, a certification from a certified public accountant is required for the estate tax return.

- 🏠 The family home is considered as an allowable deduction for estate tax purposes.

- 💡 Actual funeral, medical, and judicial expenses related to testamentary and intestate proceedings are no longer deductible under TRAIN law.

- 💼 For Philippine resident citizens who died after January 1, 2018, estate tax computation follows the TRAIN law rates and regulations.

- 📊 The estate tax is computed by multiplying the net estate (after allowable deductions) by the flat rate of six percent.

Q & A

What is the main topic of the tutorial video?

-The main topic of the tutorial video is estate taxes in the Philippines, specifically discussing the definition, updated tax rates, allowable deductions, and an illustrative problem related to estate tax.

What is the difference between succession and estate tax as per the video?

-Succession is the mode of acquisition by which the property rights and obligations of a deceased person are transmitted to another or others, either by will or by operation of law. Estate tax, on the other hand, is a tax on the right of the deceased person to transmit their estate to lawful heirs and beneficiaries at the time of death.

When does the video state that the old tax laws are applicable?

-The old tax laws are applicable if the decedent died prior to January 1, 2018.

What is the general format for computing estate tax as mentioned in the video?

-The general format for computing estate tax is to deduct allowable deductions from the gross estate to arrive at the net estate, and then multiply the net estate by six percent to compute the estate tax due.

What is the updated standard deduction for estate tax purposes after TRAIN law?

-The updated standard deduction for estate tax purposes after TRAIN law has been increased from 1 million to 5 million.

What is the requirement for estate tax returns if the gross estate is more than five million, according to the video?

-If the gross estate is more than five million, the estate tax return shall require a certification from a certified public accountant.

What are the allowable deductions for estate tax purposes that have been updated due to TRAIN law?

-The allowable deductions updated due to TRAIN law include an increased standard deduction, claims against the estate, unpaid mortgages, properties previously taxed, the family home, and amounts received by heirs under Republic Act No. 4917.

What deductions are allowed to non-resident estates for estate tax purposes?

-Deductions allowed to non-resident estates include a standard deduction of 500,000, property previously taxed, transfers for public use, share in the conjugal property, and tax credit for estate taxes paid to a foreign country.

What has changed regarding actual funeral expenses, medical expenses, and judicial expenses under TRAIN law?

-Under TRAIN law, deductions for actual funeral expenses, medical expenses, and judicial expenses in relation to testamentary and intestate proceedings have been repealed.

Can you provide an example of how estate tax is computed based on the video?

-For a Philippine resident citizen who died on January 2018 with a net taxable estate of 10 million, the estate tax due would be computed by multiplying the net estate (10 million) by the estate tax rate of 6%, resulting in an estate tax due of 600,000.

What is the process for filing estate tax and which form should be used according to the video?

-Estate tax should be filed within one year from the death of the decedent, and the BIR Form 1801 should be used for filing.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

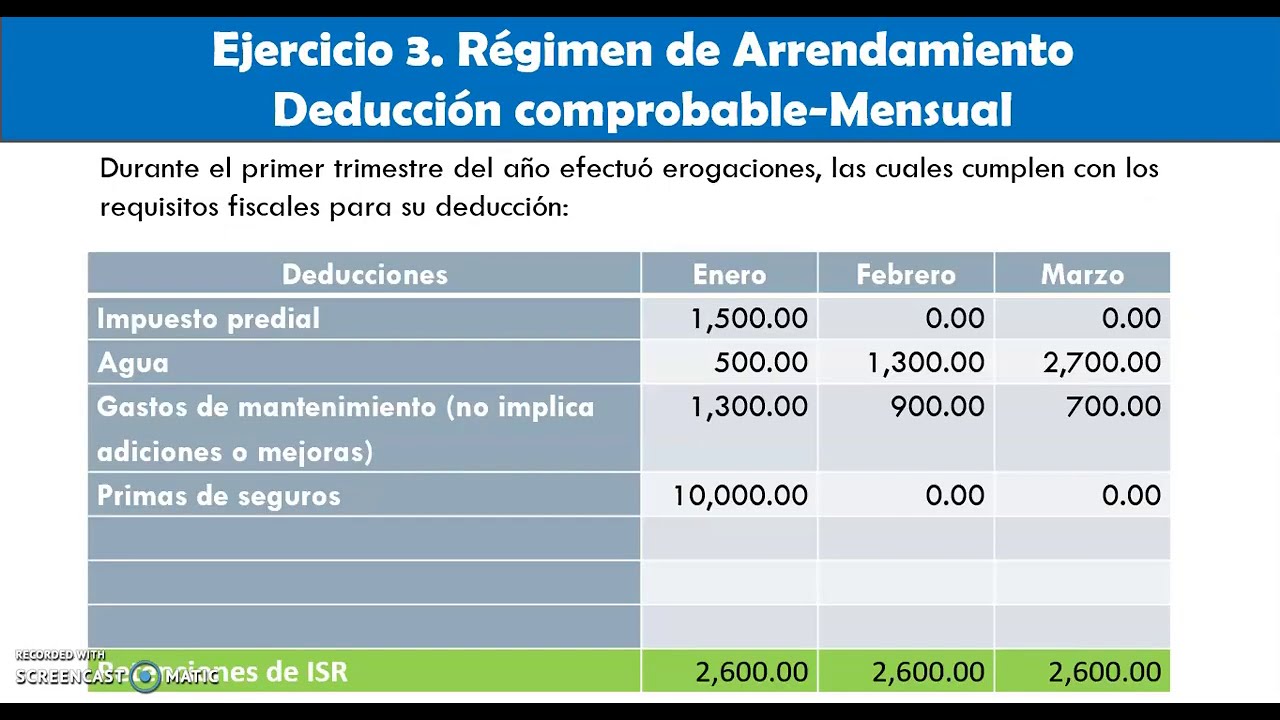

Pagos provisionales de ISR en Régimen de Arrendamiento parte 2

Do this To Legally Pay LESS TAXES in Australia

[FABM2] Lesson 043 - Basic Taxation Principles [Tagalog]

Pengenalan PPh Pasal 22, tarif PPh Pasal 22, dan Contoh Soal PPh Pasal 22

Menghitung Pajak Penghasilan - PPh

Princípio do Não Confisco (Direito Tributário): Resumo Completo

5.0 / 5 (0 votes)