Average Net Worth By Age (Not What You'd Think)

Summary

TLDRThis video script emphasizes the importance of understanding personal net worth, which is calculated as assets minus liabilities, and is distinct from annual income. It provides average net worth figures by age group from the Federal Reserve's survey, highlighting the impact of homeownership and investments on wealth. The script offers advice on increasing net worth through debt reduction, investing in appreciating assets, reducing expenses, and creating additional income streams, underscoring the significance of patience and strategy in building wealth.

Takeaways

- 💰 Knowing your personal net worth is important for tracking financial progress and comparing to the average person.

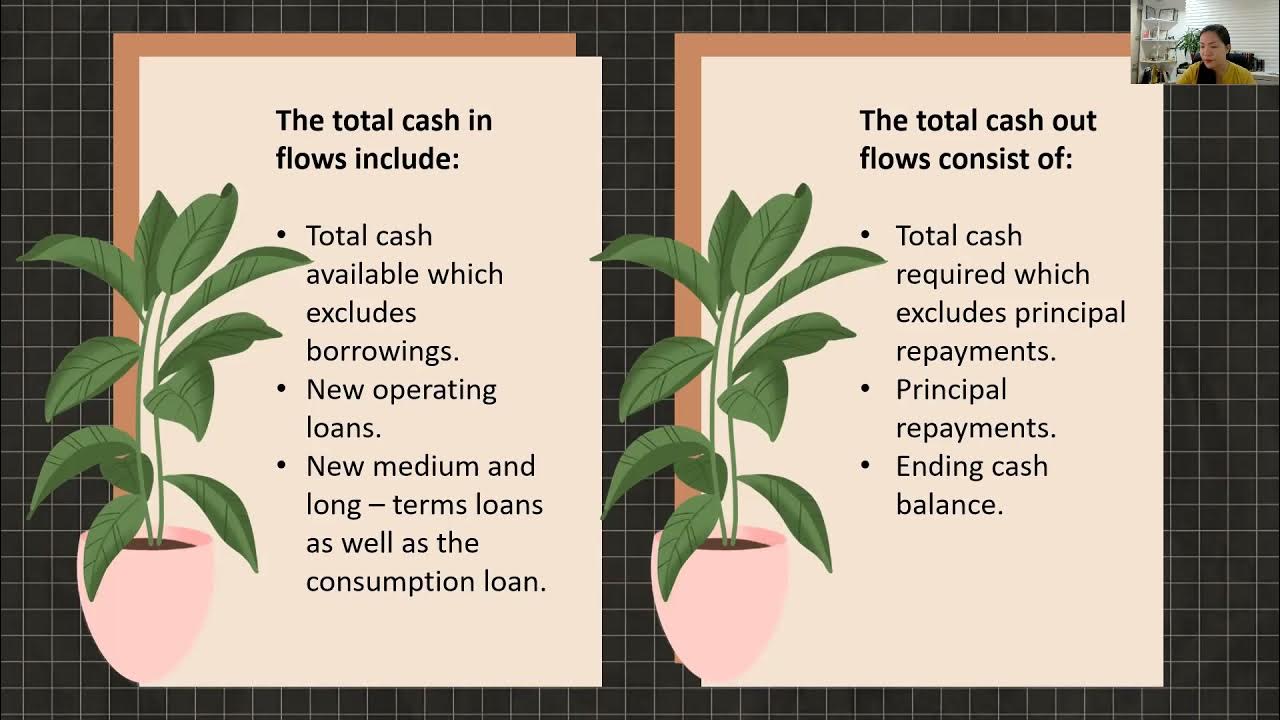

- 📊 Net worth is calculated by subtracting your debts from your assets, not by your annual income.

- 🏠 Assets typically include your home, cars, and other valuable possessions, while debts include mortgages, car loans, and credit card debts.

- 📈 The Federal Reserve Board conducts a survey of consumer finances every three years to collect data on family incomes and net worth.

- 🌐 The mean net worth for U.S. households is high due to the influence of ultra-rich households, but the median provides a more accurate representation of the average person.

- 🔢 The overall median net worth of U.S. households is significantly lower than the mean, indicating a wide disparity in wealth distribution.

- 👶 For those under 35 and head of the family, the median net worth is much lower, often due to the early stages of their careers and potential student loan debts.

- 🏡 Homeownership significantly impacts net worth, with homeowners having a much higher median net worth compared to renters.

- 💼 As age increases, so does the median net worth, reflecting the accumulation of assets and potential reduction of debts over time.

- 💼 The 55 to 64 age group sees a small increase in net worth, possibly due to investments growing and mortgages being paid down.

- 👴 For those aged 75 and older, a decrease in median net worth may occur, but this can be due to spending down assets in retirement.

- 🚀 To increase net worth, focus on paying down debts, investing in appreciating assets, reducing expenses, and creating additional income streams.

- 💼 Passive income and annual expenses are better indicators of financial health and independence than net worth alone.

Q & A

Why is it important to know your personal net worth even if you're not as wealthy as famous investors or CEOs?

-Knowing your personal net worth is important because it allows you to track your financial progress over time and compare your financial status to the average person, which can be helpful in understanding how you're doing financially without the need for competition.

How is personal net worth calculated?

-Personal net worth is calculated by subtracting your total debts from the total value of your assets. Assets include items like your home, cars, bank accounts, investments, and valuable possessions, while debts include mortgages, car loans, and credit card debts.

What is the difference between mean and median net worth as reported by the Federal Reserve Board?

-The mean net worth is the average value, which can be skewed high by extremely wealthy individuals, while the median net worth is the midpoint value, providing a more accurate representation of the financial status of an average household.

According to the Federal Reserve Board's survey, what was the overall median net worth of U.S. households as of the 2019 report?

-The overall median net worth of U.S. households was reported to be $121,700.

Why might the median net worth of households headed by someone under 35 be significantly lower than the overall median?

-The median net worth for households headed by someone under 35 is lower due to factors such as the early stages of their careers, potential student loan debts, and possibly not having started investing for retirement or owning a home which can significantly impact net worth.

How does homeownership impact the median net worth of individuals according to the Federal Reserve?

-Homeownership has a significant impact on net worth, with homeowners having a median net worth of $255,000 compared to renters who have an average net worth of just $6,300.

What is the median net worth for the age group 35 to 44, and what factors contribute to this figure?

-The median net worth for the age group 35 to 44 is $91,300. Factors contributing to this include established careers with increased incomes, the purchase of a home which appreciates in value, and regular contributions to retirement accounts.

Why is it suggested that focusing on passive income and expenses is a better measure of financial health than net worth alone?

-Focusing on passive income and expenses provides a better measure of financial health because it indicates whether one can cover their annual expenses without needing to work, which is more relevant to financial independence than the total value of assets.

What are some ways to increase personal net worth as suggested in the script?

-Some ways to increase personal net worth include paying down debts, investing in appreciating assets, decreasing expenses, creating additional sources of income, and being patient as wealth building takes time.

Why is patience important when it comes to building wealth according to the script?

-Patience is important because building wealth is a long-term process that involves paying off debts, investing wisely, and allowing time for investments to grow and compound, which does not happen overnight.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Como Fazer O DINHEIRO CRESCER l 3 Fases das Finanças Pessoais

Ex-Head of Finance Explains: Are You Better Than Average (Net Worth By Age)?

Revenues & Expenses - Accounting 101 #3

Financial Statements (September 30, 2021)

Statement of Financial Position (Balance Sheet)

Why everyone around you seems MORE RICH! | Ankur Warikoo Hindi

5.0 / 5 (0 votes)