How to Trade the Forex Weekend Gaps

Summary

TLDRIn this trading-focused video, Mark discusses the impact of Brexit news on the pound and the importance of adapting to significant market movements. He emphasizes the need to revisit trading strategies, especially in the face of increasing volatility due to geopolitical events. Mark outlines his approach to trading gaps, highlighting the power of such trades when they occur outside of key levels. He also details two primary gap trade scenarios and explains how to identify and capitalize on these opportunities, focusing on risk quantification and high-probability setups.

Takeaways

- 📉 The pound has experienced a significant 'gap down' due to Brexit news, indicating a sharp price drop at the opening of the market.

- 🌐 Brexit developments are expected to cause more significant currency movements in the future, affecting various financial instruments including indices and bonds.

- 🔍 Traders should revisit their trading playbooks and refine strategies to take advantage of market volatility, especially in the context of significant news events.

- 🎯 Gaps are more powerful when they occur out of a key level, as they attract more market participants and can lead to strong emotional order flow.

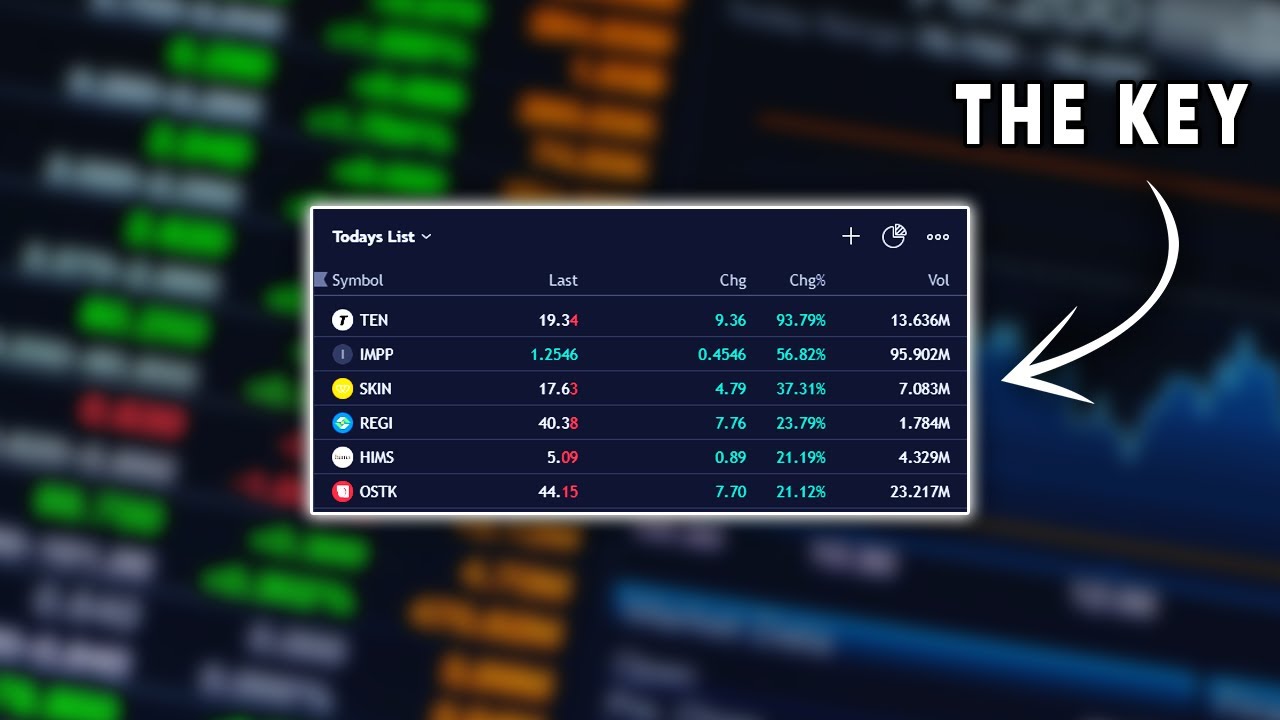

- 📈 Stock trading is preferred for gap trades due to the presence of more gaps, cash closes, and larger volumes during the cash open.

- 🌀 Currency trading may not have as many gaps due to 24/5 market hours, but news over the weekend can still cause significant gaps.

- 📊 When trading gaps, it's crucial to consider the bigger picture and the context of the current market situation.

- 🔄 After a gap, the market can either consolidate, continue in the direction of the gap, or attempt to fill the gap with a pullback.

- 🛒 Buying the first pullback after a strong drive up in a gap situation is a common trading strategy, as it can indicate a temporary balance in supply and demand.

- 📉 If the market struggles to move higher after a gap and forms a topping pattern, it may indicate that supply is still in control and a revisit to the gap low could be likely.

- ⏳ Traders should be prepared for more gaps as political events unfold, and should set up tools like screeners and scanners to identify trading opportunities.

Q & A

What is the main topic discussed in the video script?

-The main topic discussed in the video script is trading strategies, particularly focusing on how to trade gaps in the market, especially in the context of significant events like Brexit affecting currency movements.

Why are gaps in the market significant for traders according to the script?

-Gaps in the market are significant for traders because they can indicate a shift in market sentiment and can lead to large price movements, which if understood and traded correctly, can provide opportunities for profit.

What does the speaker suggest is a key factor when trading gaps?

-The speaker suggests that a key factor when trading gaps is the context of the gap in relation to significant price levels or ranges. Gaps are more powerful when they occur out of a key level, indicating a higher level of market participation and potential for price action.

What are the three possible outcomes of a gap according to the speaker?

-The three possible outcomes of a gap, as mentioned by the speaker, are: 1) the market does nothing and the gap remains; 2) there is a continuation of the gap's direction, often flushing out stops; and 3) an attempted gap fill, where the market moves back towards the gap area.

What trading strategy does the speaker recommend for the initial gap fill drive?

-The speaker recommends buying the first pullback after a strong drive up following a gap down. This is considered a 'bread and butter' trade for the speaker, especially when it occurs in the context of a gap situation.

What is the importance of observing the market's response to a gap?

-Observing the market's response to a gap is important because it helps traders assess whether the gap is being treated as a bargain or if the market is indifferent. This assessment can inform trading decisions and strategies moving forward.

How does the speaker approach trading gaps in stocks versus currencies?

-The speaker prefers trading gaps in stocks because they tend to have more gaps due to cash closes and open sessions, leading to more significant volume and price action. However, gaps can also occur in currencies due to news events, especially over weekends.

What does the speaker mean by 'price action trader' or 'tape reader'?

-A 'price action trader' or 'tape reader' refers to a trader who makes decisions based on the movement of prices and the patterns they form, rather than relying on other forms of technical analysis or fundamental analysis.

What is the speaker's view on the importance of quantifying risk in trading?

-The speaker emphasizes the importance of quantifying risk in trading as it allows for a high probability trade setup where the potential loss is known and manageable, increasing the chances of successful trades.

How does the speaker suggest traders prepare for potential gap opportunities?

-The speaker suggests that traders should revisit their trading playbook, dust off volatility strategies, and be prepared to use tools like screeners and scanners to identify and capitalize on gap opportunities as they arise.

What is the speaker's approach to trading when the market stalls after a gap?

-When the market stalls after a gap, the speaker advises traders to take notice and consider shorting the market with a stop above the cluster of highs, anticipating a revisit to the gap low or the midpoint, thus quantifying the risk.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

ICT Forex & Futures Market Review October 4, 2025

Trading forex menggunakan Fundamental (News) di forex factory : winrate tinggi

一転、日本株も総売りへ。止まらない米国株安と急落相場

Stone Age Option Buy Longterm || By #NK_Sir |#nkstocktalk #nitishsirhilegamilega

How To Find Stocks To Day Trade

ICT FOR DUMMIES | Liquidity PT. 2 EP. 7

5.0 / 5 (0 votes)