CUSTEIO

Summary

TLDRThis video script discusses the concept of average cost in inventory management, using the example of an aluminum profile purchase for construction projects. The hypothetical scenario involves buying 100 units at 25 reais per kilogram and later 5,000 units at a reduced price of 20 reais per kilogram. The script explains how to calculate the weighted average cost of inventory, emphasizing the importance of adjusting the cost with each new purchase. It demonstrates the formula for calculating the new average cost and highlights how this method brings the cost closer to the price of the larger quantity purchased, ultimately affecting the cost of goods sold.

Takeaways

- 📈 The video discusses the concept of average cost in inventory management, particularly in the context of aluminum prices and stock adjustments.

- 🛠️ The scenario involves a hypothetical aluminum framing industry that purchases materials at different times and prices.

- 💰 The first purchase of 100 units of aluminum profile is made at a price of R$25 per kilogram, including an 18% tax deduction.

- 📦 The second purchase of 5000 units is made at a better price of R$20 per kilogram, due to the larger quantity purchased.

- 🔢 The average cost is calculated using a weighted average formula, which takes into account the quantity and value of both the existing stock and the new purchase.

- 🧮 The formula for calculating the weighted average cost is: (existing quantity * existing value + new quantity * new value) / (existing quantity + new quantity).

- 📈 In the example, the new average cost of the aluminum bars in stock is R$16.48, after the second purchase.

- 📊 The average cost tends to approach the cost of the product with the larger quantity, which in this case is the second purchase with a lower cost.

- 🚪 For all outgoing stock, the cost should be considered at the most recent average cost until a new purchase is made and the unit cost is recalculated.

- 📝 The video emphasizes the importance of recalculating the unit cost after each new entry to reflect the most current average cost for subsequent sales.

- 👍 The video encourages viewers to subscribe for more tips on inventory management for the aluminum market.

Q & A

What is the main topic discussed in the video script?

-The main topic discussed in the video script is the concept of average cost in inventory management, specifically in the context of aluminum profiles purchased for construction projects.

Why is it important to understand the concept of average cost in inventory management?

-Understanding the concept of average cost is important because it helps in determining the cost of goods sold and the value of remaining inventory, which is crucial for accurate financial reporting and decision-making.

What is the scenario presented in the script regarding the purchase of aluminum profiles?

-The script presents a hypothetical scenario where an industry buys 100 units of a specific aluminum profile at a price of 25 reais per kilogram and later purchases 5,000 units at a better price of 20 reais per kilogram.

How does the quantity purchased affect the price per unit in the given example?

-In the example, the industry gets a better price for the second purchase of 5,000 units due to the larger quantity, which results in a unit price of 20 reais per kilogram compared to the initial 25 reais per kilogram for the first purchase of 100 units.

What is the formula used to calculate the weighted average cost of the inventory?

-The formula used to calculate the weighted average cost is: (old quantity * old cost + new quantity * new cost) / (old quantity + new quantity).

What is the unit cost of the first purchase of aluminum profiles in the example?

-The unit cost of the first purchase of aluminum profiles is 20 reais and 50 centavos after accounting for an 18% tax deduction.

What is the unit cost of the second purchase of aluminum profiles in the example?

-The unit cost of the second purchase is 16 reais and 40 centavos after accounting for the same tax deduction.

How does the weighted average cost help in inventory valuation?

-The weighted average cost helps in inventory valuation by providing a single cost figure for all items in stock, which is particularly useful when items are purchased at different prices over time.

What happens to the average cost when there is a new purchase of inventory?

-When there is a new purchase, the average cost is recalculated to reflect the new weighted average, which may bring the cost closer to the price of the product with the higher quantity.

Why should the cost of goods sold be based on the most recent average cost?

-The cost of goods sold should be based on the most recent average cost to ensure that the cost reflects the current market conditions and the actual cost of the inventory being sold.

What is the final average cost of the aluminum profiles in the example after the second purchase?

-The final average cost of the aluminum profiles after the second purchase is 16 reais and 48 centavos.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

FA 34 - Inventory - Weighted Average (Average Cost) Method

Aprenda Como Funciona o Cálculo de Custo Médio no TOTVS Protheus

Inventory Cost Flow Assumptions | Principles of Accounting

Inventory Management System

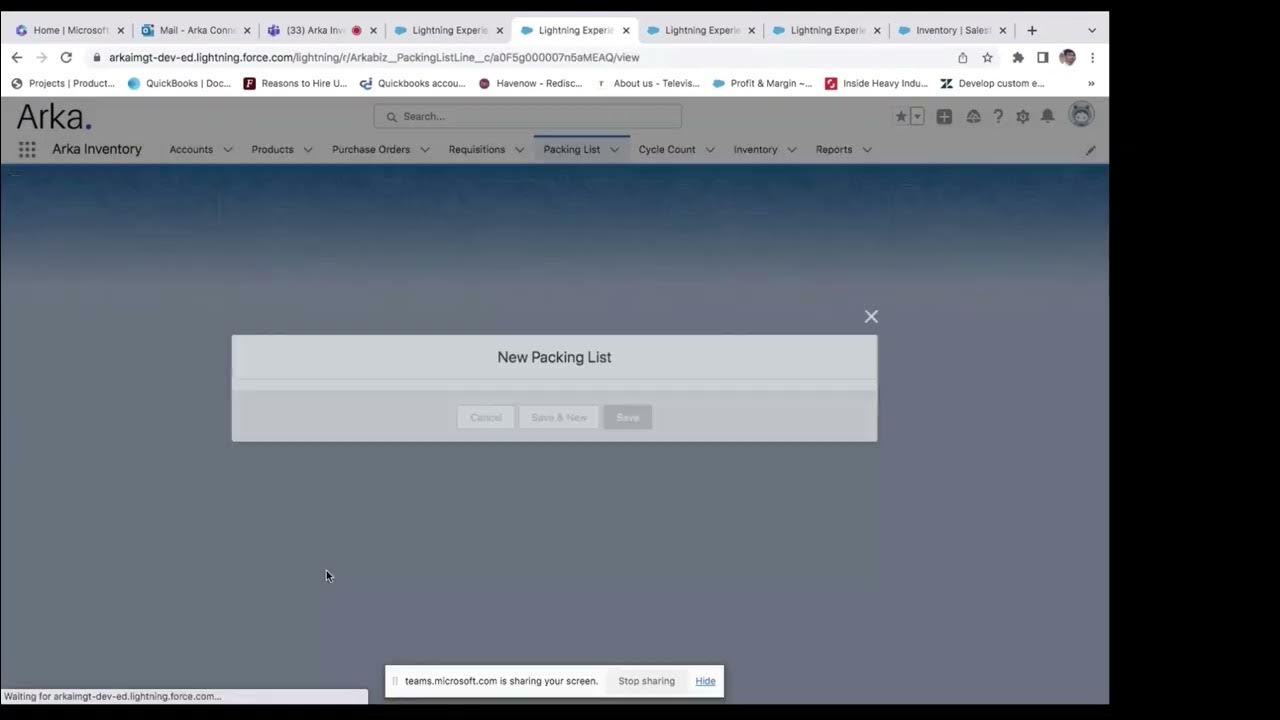

Arka Inventory Demo

PENJELASAN MUDAH!!!! SIKLUS AKUNTANSI PERUSAHAAN DAGANG BAGIAN 1 (KELAS 12)

5.0 / 5 (0 votes)