Issue a customer invoice | Odoo Accounting

Summary

TLDRThis video tutorial demonstrates how to manage customer invoices in the ODU accounting system. It covers the creation of invoices, the use of the sales journal, and the prioritization of income accounts. The video guides viewers through adding products and sections to an invoice, explains the hierarchy of account selection, and shows how to confirm, send, and print invoices. It also highlights the invoice list view, which provides a customizable overview of invoice details, including payment status and currency.

Takeaways

- 📚 The video is a tutorial on managing customer invoices in an accounting system called ODU.

- 🔍 Customer invoices are recorded as journal entries in the sales journal with three journal items: income, tax, and receivable accounts.

- 🛠️ The video demonstrates how to navigate the accounting app within the ODU database to manage these invoices.

- 📝 The script explains how to configure the sales journal with default income accounts and other options.

- 💼 It shows the process of creating a new customer invoice, including adding sections for different types of items like plants, supplies, and garden gnomes.

- 🌟 The script highlights the importance of setting the correct income account for each product, either on the product itself, the product category, or the sales journal.

- 📈 The video explains the prioritization of accounts, starting with the most specific (individual invoice line) to the more general (sales journal).

- 📊 The 'Journal items' tab is used to view and organize the journal entries for the invoice, including product lines, tax, and receivable entries.

- ✍️ Before confirming an invoice, it's important to set the invoice date, which can be done manually or automatically using the current date.

- 🖨️ The video shows how to send and print an invoice, which is presented in a 'chatter' format, ready for distribution.

- 📋 The final part of the script reviews the list view of invoices, which includes details such as invoice number, dates, amounts, currency, payment status, and invoice status.

Q & A

What is the purpose of recording customer invoices as journal entries in the sales journal?

-Recording customer invoices as journal entries in the sales journal helps in tracking income, tax, and receivables, which are essential for managing a business's financial transactions.

How many journal items are involved in a customer invoice according to the script?

-A customer invoice involves three journal items: income and tax accounts on the credit side, and the receivable account on the debit side.

What is the role of the 'income account' in the context of a customer invoice?

-The income account is used to record the revenue generated from the sale of goods or services to customers, which is credited in the journal entry.

How can the default income account be set in the sales journal?

-The default income account can be set in the configuration section of the sales journal within the accounting app.

What is the process of creating a new customer invoice in the script?

-The process involves jumping into the accounting app, going into the customer invoices, creating a new invoice for a specific customer, adding sections for different products or services, and organizing the invoice lines.

Why is it important to organize the invoice with sections for different products or services?

-Organizing the invoice with sections helps in maintaining clarity and order, making it easier to manage and understand the different components of the invoice.

What does ODU stand for in the context of the script?

-ODU is not explicitly defined in the script, but it seems to refer to the accounting software or database being used for managing customer invoices.

How does the script handle different account sets for products, product categories, and individual invoice lines?

-The script prioritizes the most specific account over the more general ones. If no account is set on an individual invoice line, ODU will use the account set on the product, then the product category, and finally the sales journal if all previous fields are empty.

What is the significance of the 'Journal items' tab mentioned in the script?

-The 'Journal items' tab is significant as it organizes and displays the journal entries related to the invoice, showing the distribution of income, tax, and receivables.

How can the invoice date be set in the script's process of creating a customer invoice?

-The invoice date can be set manually during the invoice creation process, or it can be automatically set to the current date upon confirmation of the invoice.

What information is displayed in the list view of invoices as per the script?

-The list view of invoices displays information such as invoice number, customer, invoice date, due date, activities, amounts with tax excluded and included, total in currency, payment status, and the status of the invoice whether it is posted or still in draft.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Payments and outstanding accounts | Odoo Accounting

Odoo Accounting: Unmatched productivity. Online.

What is Batch Payment in Odoo 17 Accounting | How to Group Payments Into a Single Batch in Odoo 17

Issue a credit note | Odoo Accounting

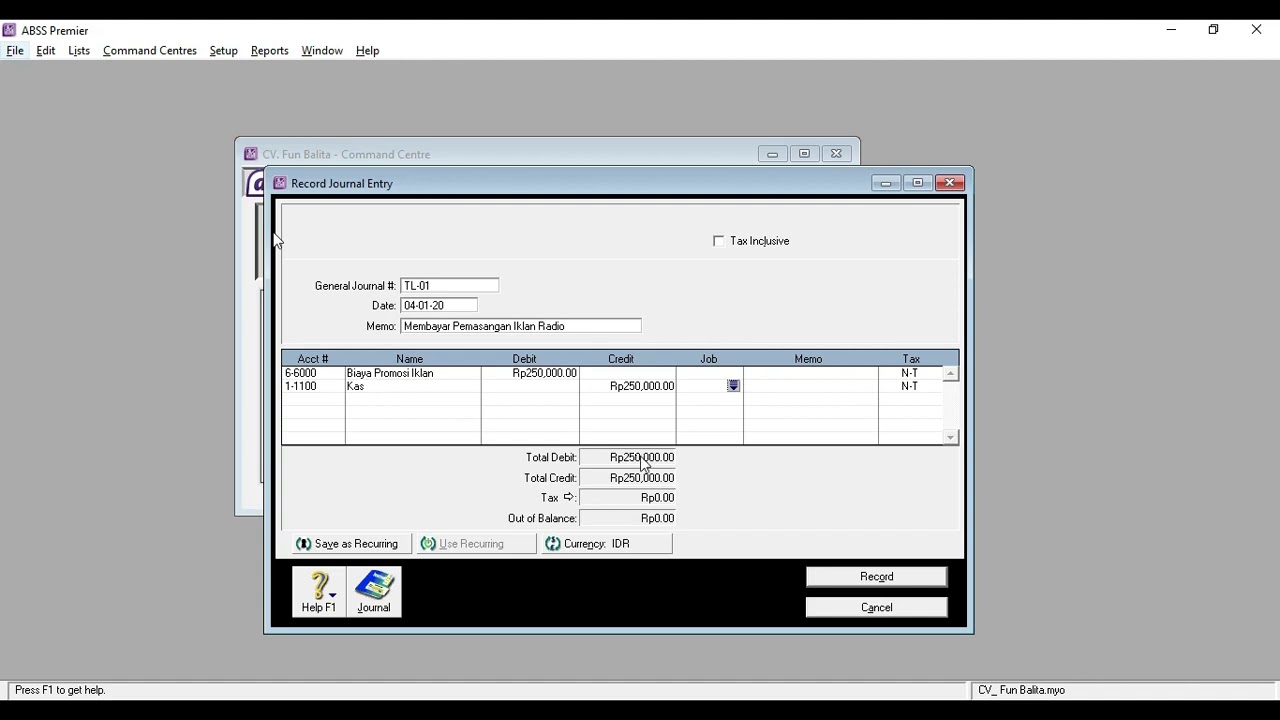

028 Aplikasi Komputer Akuntansi II (ABSS) Pertemuan 3 (Part3)

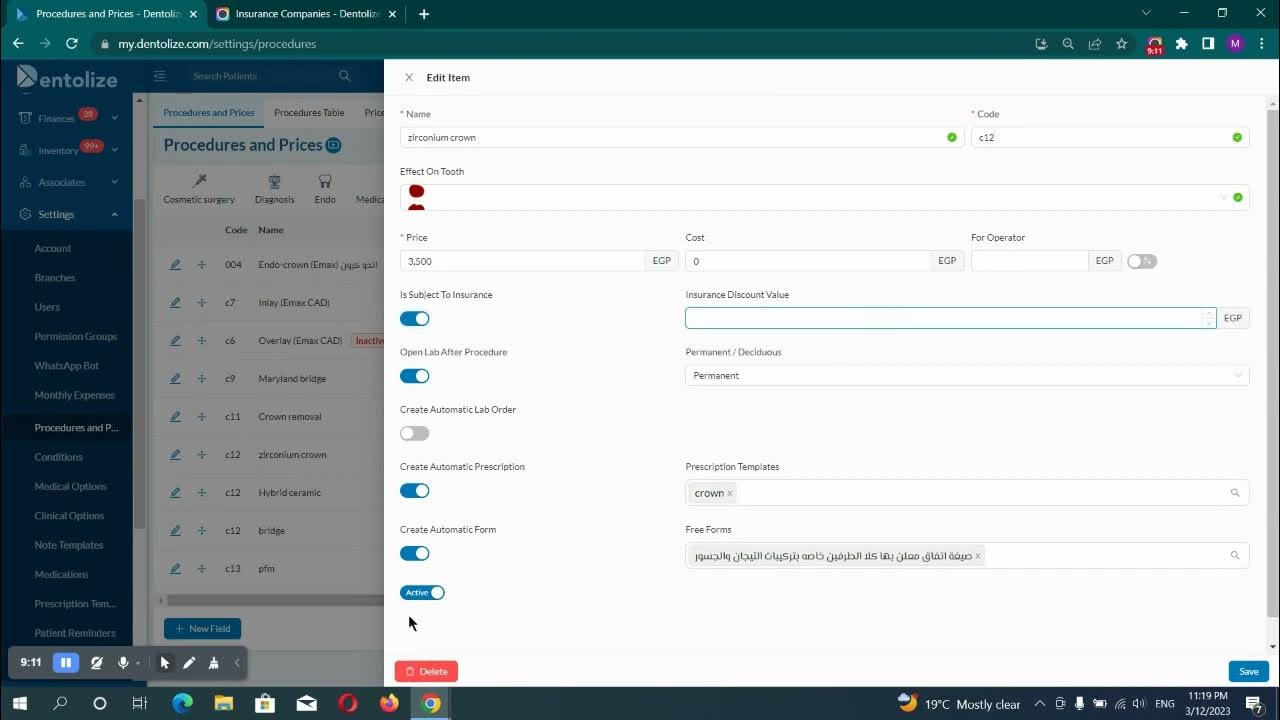

Insurance company

5.0 / 5 (0 votes)