Top 3 Altcoins for 2025 Bull Run (Expert Picks)

Summary

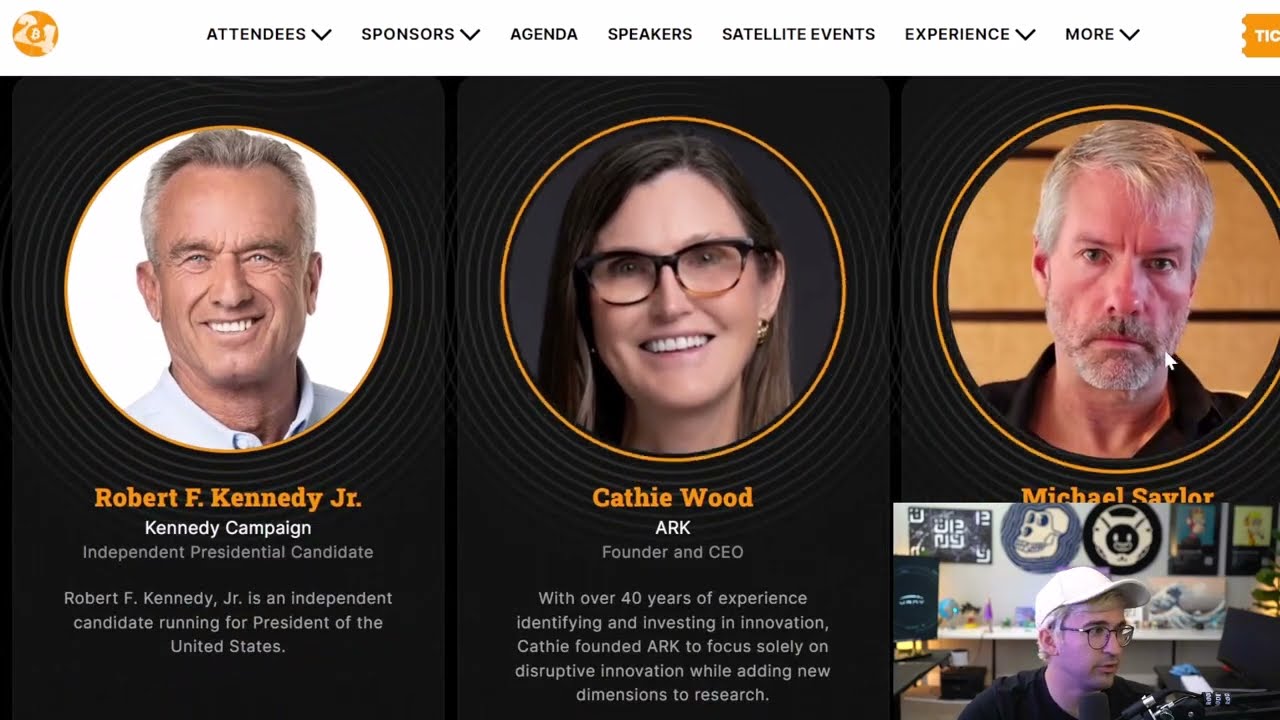

TLDRIn a thought-provoking crypto conference discussion, panelists explore the impact of potential US political shifts on Bitcoin and the broader market. They debate democracy's state, speculate on Bitcoin's price movements under different administrations, and delve into the strategic implications of Bitcoin as a reserve asset. The conversation also touches on the influence of media, the potential of altcoins, and the future of digital currencies in the context of a changing world order.

Takeaways

- 🗳️ The discussion questions the state of democracy in the United States, with references to historical events and current political figures like Kamala Harris and Donald Trump.

- 💡 There is a belief expressed that Bitcoin can act as a safeguard for personal freedoms, especially in the context of government overreach or control, such as asset freezing.

- 🤔 Skepticism is shown towards mainstream media, suggesting it may manipulate narratives for views and clicks, potentially contributing to the perception that democracy is in danger.

- 💰 The conversation speculates on the U.S. government's potential holdings of Bitcoin and whether they could publicly acknowledge such holdings, hinting at possible covert influence on the market.

- 🌐 The role of perception and media control by those in power is discussed, suggesting a hierarchy of control mechanisms that extend to monetary policy and the potential for government-backed digital currencies.

- 📉 Concerns are raised about the impact of political decisions on Bitcoin mining and the broader implications for innovation and economic stability in the U.S.

- 🏦 Mention of the Federal Reserve's role as a PR company and its potential influence over the adoption and value of Bitcoin as a strategic reserve asset.

- 📊 The transcript discusses the potential impact of political figures' stances on Bitcoin, with a focus on how different administrations might influence its price and adoption.

- 💬 There is speculation about the influence of political stunts and media narratives on public perception and the crypto market, particularly in relation to Kamala Harris's alleged comments on Bitcoin.

- 🌐 The conversation touches on the global implications of U.S. policy on Bitcoin, suggesting that the U.S. needs to maintain dominance in Bitcoin mining to preserve its global financial influence.

- 🚀 The participants share their top altcoin picks for the market, highlighting various projects and their potential for growth and impact on the crypto ecosystem.

Q & A

Is democracy considered dead in the United States according to the discussion in the script?

-No, the script suggests that while there are concerns and discussions about democracy's state, the participants do not believe democracy is dead in the United States. They mention media manipulation and political strategies but also highlight the resilience of democratic systems.

What is the potential impact of Bitcoin being used as a strategic reserve according to the speakers?

-The speakers suggest that if Bitcoin were to be used as a strategic reserve, it could safeguard against government control and provide a means for individuals to express dissent and secure their financial autonomy.

What are the implications of Kamala Harris's potential stance on Bitcoin as discussed in the script?

-The script implies that Kamala Harris may have a negative stance on Bitcoin, associating it with criminal activities, which could potentially influence regulatory policies if her administration were to take a similar position.

How does the script discuss the role of the media in shaping public perception of democracy in the United States?

-The script suggests that the media may be manipulating public perception by promoting the idea that democracy is in danger, possibly for the sake of gaining views and clicks, rather than providing an accurate representation.

What is the perspective on the potential for Bitcoin to be controlled or influenced by powerful entities as discussed in the script?

-The script indicates a belief that powerful entities, such as the government or large financial institutions, may already have significant control over Bitcoin, and that this could increase if certain political figures or parties gain power.

How does the script address the potential for a digital currency to replace or complement traditional money?

-The script discusses the possibility of a central bank digital currency (CBDC) and its potential impact on individual freedoms and privacy. It suggests that while CBDCs could offer some benefits, they also pose risks to personal financial autonomy.

What are the views expressed in the script regarding the future of Bitcoin regardless of political outcomes?

-The script suggests that Bitcoin's future is largely independent of political outcomes. It will continue to thrive regardless of who is in office due to its decentralized nature and the growing ecosystem around it.

What is the significance of the discussion around the potential for the US government to hold a large percentage of Bitcoin?

-The script raises the idea that if the US government were to hold a significant percentage of Bitcoin, it could lead to a monumental surge in Bitcoin's value and a rush by other nations to adopt and secure Bitcoin.

How does the script touch on the topic of institutional involvement in the crypto space?

-The script acknowledges the growing role of institutions in the crypto space, suggesting that while institutional involvement can bring stability and adoption, it may also lead to a more centralized and potentially less democratic financial system.

What are the favorite altcoins mentioned by the speakers in the script, and why are they favored?

-The speakers mention Aerodrome, Jupiter, Immutable X, and others as their favorite altcoins. They are favored for various reasons, such as potential for growth, technological innovation, and their roles within the crypto ecosystem, such as in decentralized finance (DeFi) or gaming.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Insider EXPOSES The Secret ATTACK On The Bitcoin Industry! Chokepoint 2.0 with Caitlin Long

DCA Live: 📉Rates Down, 🚀Risk On!

Is The U.S. Going Bankrupt? Will Your Assets Be Confiscated? Economist Steve Hanke Answers

THIS WEEK IS HUGE FOR CRYPTO

MAJOR BITCOIN EVENT ON APRIL 15TH (BEFORE THE HALVING).

BITCOIN: We Are Facing The Perfect Storm (How I’m Investing)

5.0 / 5 (0 votes)