Romeo Video 3

Summary

TLDRThis script delves into the 'Monthly Power of Three' trading strategy, focusing on Bitcoin's price action through a four-hour lens. It emphasizes the importance of blending time and price for effective trading, highlighting key levels and Fibonacci retracement as critical for framing trade ideas. The speaker illustrates how to identify entry points, set stop losses, and recognize patterns like accumulation, manipulation, and distribution within monthly candles, advocating for a disciplined approach to maintain a bullish bias until invalidated.

Takeaways

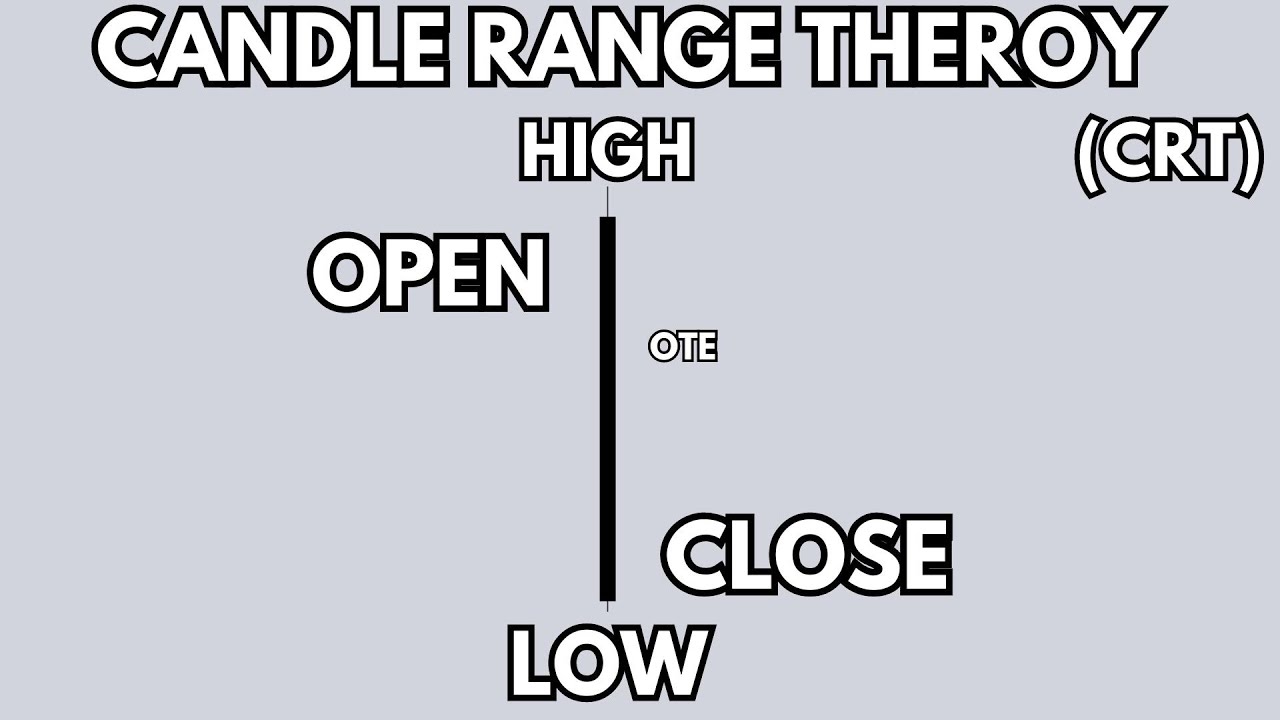

- 📊 The concept of 'Monthly Power of Three' involves analyzing the open, high, low, and close of Bitcoin through a four-hour time frame lens.

- 🔍 Importance is placed on the blend of time and price analysis, emphasizing that price levels are significant when considered with time, and vice versa.

- 📈 A bullish bias on Bitcoin is maintained, with the expectation of being drawn to higher time frame levels, specifically targeting the 32,000 price point.

- 🧲 The 'magnet' for Bitcoin is identified at the higher time frame liquidity level of 32,000, where the expectation is to buy retracements until this level is reached.

- 🗓 The previous month's candle on Bitcoin's chart was bearish but did not close below the low, suggesting a continuation of the bullish trend rather than a bearish reversal.

- 📉 The refusal to close below certain lows and the presence of key levels, such as the 0.618 Fibonacci level, are critical in framing trade ideas and maintaining a bullish bias.

- 📝 The speaker emphasizes the importance of sticking to a trading bias until it is invalidated, highlighting the need for discipline in trading strategies.

- 📌 Key levels, such as lows that break highs or highs that break lows, are crucial for identifying potential entry and exit points in trading.

- 📉 The strategy of 'entering with a wick' is discussed, which involves buying below the opening price in a bullish market or selling above the opening price in a bearish market.

- 📊 The division of each candle into three parts (or four for monthly candles) is highlighted as a method for understanding the phases of accumulation, manipulation, and distribution in the market.

- 🔑 The importance of confirming the high being broken before entering a trade is stressed to avoid being tricked into a false bottom or top.

Q & A

What is the 'Monthly Power of Three' concept mentioned in the script?

-The 'Monthly Power of Three' refers to analyzing the monthly candlestick chart in terms of its open, high, low, and close, and dividing it into three parts or phases: accumulation, manipulation, and distribution. This method helps in understanding the market sentiment and predicting future price movements.

What does the speaker mean by 'blend of time and price'?

-The 'blend of time and price' refers to the integration of both time and price factors in technical analysis. It suggests that price levels alone are not sufficient for making trading decisions; they need to be considered in conjunction with the time element for a more accurate analysis.

Why is the speaker focusing on Bitcoin in the script?

-The speaker is focusing on Bitcoin because it has been offering a clear bias or trend, making it easier to analyze and predict its price movements. Additionally, Bitcoin has a higher time frame liquidity level at 32,000, which is a key level the speaker is watching for potential buying opportunities.

What is the significance of the 'monthly fvg' mentioned in the script?

-The 'monthly fvg' or Fibonacci volume glow refers to a technical analysis tool that combines Fibonacci levels with volume analysis. It helps in identifying key support and resistance levels where the price is likely to react, providing potential entry and exit points for trades.

What does the speaker mean by 'sticking to your bias until it is invalidated'?

-This means that a trader should maintain their market outlook or 'bias' as long as the market conditions continue to support it. If new information or market movements contradict the trader's bias, it should be re-evaluated or 'invalidated', prompting a change in strategy.

What is the importance of 'closing below lows and above highs' in the context of the script?

-Closing below lows and above highs is significant because it can indicate a potential trend reversal or continuation. If a candle closes below its low, it might suggest a bearish sentiment, whereas closing above its high could indicate a bullish sentiment.

How does the speaker define a 'wick entry' in trading?

-A 'wick entry' is a trading strategy where a trader enters a position at the end of a candle's wick, which is the small line extending from the body of the candle. It is considered a good entry point because it signifies a potential reversal of the current trend, especially when the wick occurs below the opening price in a bullish market or above the opening price in a bearish market.

What does the speaker suggest as the first step in framing a trade idea?

-The first step in framing a trade idea, according to the speaker, is to determine where the price is likely to be drawn to, either up or down. This is known as identifying the 'magnet' or the key level that the price is expected to reach.

What is the role of the 'opposing end' or 'invalidation level' in the trade idea?

-The 'opposing end' or 'invalidation level' is a price point that the trader considers unlikely to be reached before the target or 'draw liquidity' is achieved. If this level is breached, it could indicate that the trade idea is no longer valid, and the trader may need to exit or adjust their position.

How does the speaker describe the process of 'accumulation manipulation distribution' in the context of trading?

-The speaker describes 'accumulation manipulation distribution' as a three-phase process within a higher time frame candle. Accumulation is when buyers enter the market, manipulation is when the market is influenced to create a false impression, and distribution is when sellers exit their positions. This process helps traders understand the market's behavior and anticipate potential price movements.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)