高大訪談 Part2 下集(Ai字幕請打開_時間標記已上)

Summary

TLDRThe video script discusses strategies for high-frequency trading, focusing on detecting unusual order placements and identifying support and resistance levels in the market. It emphasizes the importance of observing major stocks for market sentiment, especially during arbitrage opportunities. The speaker shares insights on the impact of corporate debt on shareholder value and the significance of earnings growth in stock valuation. The discussion also touches on the importance of timing in stock trading, suggesting that investors should hold onto profitable stocks and sell the underperforming ones, akin to playing poker where one retains good cards and discards bad ones.

Takeaways

- 😀 The speaker discusses the importance of detecting unusual order book activity in high-frequency trading, particularly in large-cap stocks like TSMC, and how to react to price breaks for potential trading opportunities.

- 📊 The script highlights the significance of technical analysis in determining entry and exit points in trading, with a focus on the role of support and resistance levels in decision-making.

- 💡 It emphasizes the concept of 'first come, first serve' in stock trading, suggesting that large orders may be placed to secure positions but can be quickly withdrawn if market conditions change.

- 🤔 The speaker shares personal experience on the pitfalls of holding onto losing positions ('bad cards') in the stock market, advising to sell the losers and keep the winners.

- 📈 Commentary on the potential of TSMC and other large-cap stocks in affecting the overall stock market, especially in the context of arbitrage opportunities.

- 📝 The importance of understanding a company's fundamentals is underscored, including the impact of new products and their potential market penetration on stock valuation.

- 📉 A discussion on the interpretation of a company's debt and how it can be beneficial for shareholders by leveraging fixed equity to create larger profits.

- 💼 The speaker's view on the value of corporate transparency and its reflection in investor relations, using TSMC as an example of a company that is open and communicative.

- 🚀 The potential impact of the U.S. presidential election on stock market behavior, with a suggestion that uncertainty may lead to a more conservative market stance leading up to the election.

- 🔮 The script suggests that the second half of the year may present opportunities in sectors like CPO, semiconductors, and AI, with TSMC's new CoWoS production capacity expected to benefit downstream companies.

- 🌐 A final note on the importance of aligning investment strategies with personal interests and expertise, and the offer for personalized advice after a deeper understanding of the individual's background.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

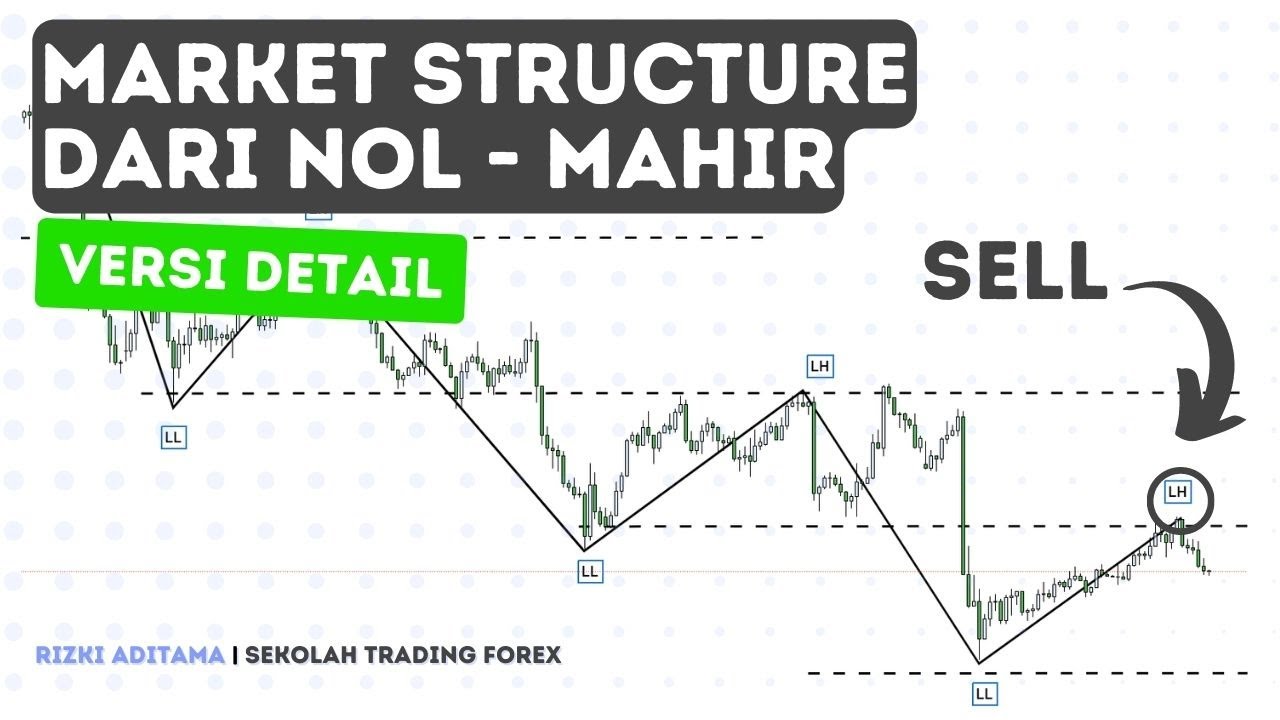

Trading Cepat dan Mudah dengan Market Structure (Detail)

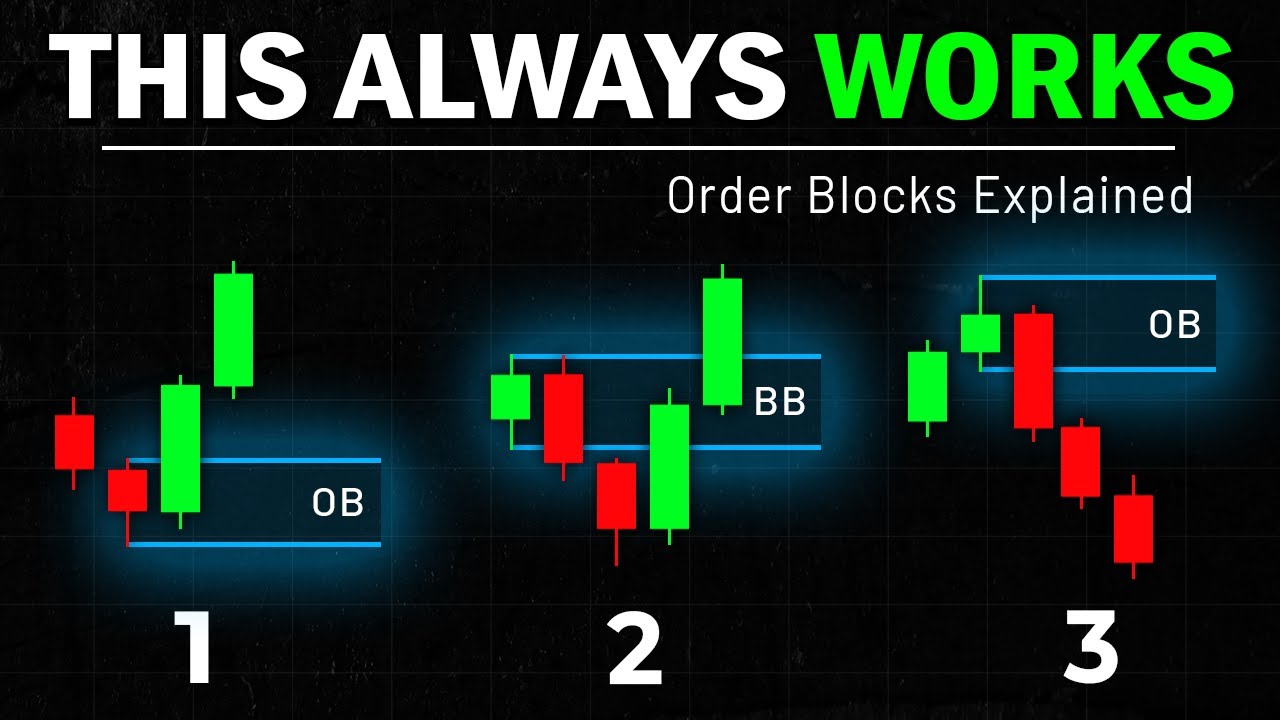

Order Blocks Explained: 3 Best Strategies Revealed

How To Trade This Week - (How To Win In Trading)

Схема построения технического анализа. Урок 1-1

How To Trade Smart Money Concepts | LuxAlgo Full 2025 Updated Guide and Trading Strategy

ICT Gems - Selecting High Probability Market Structure Shifts

5.0 / 5 (0 votes)