Weekly Forecast - January 11th, 2026

Summary

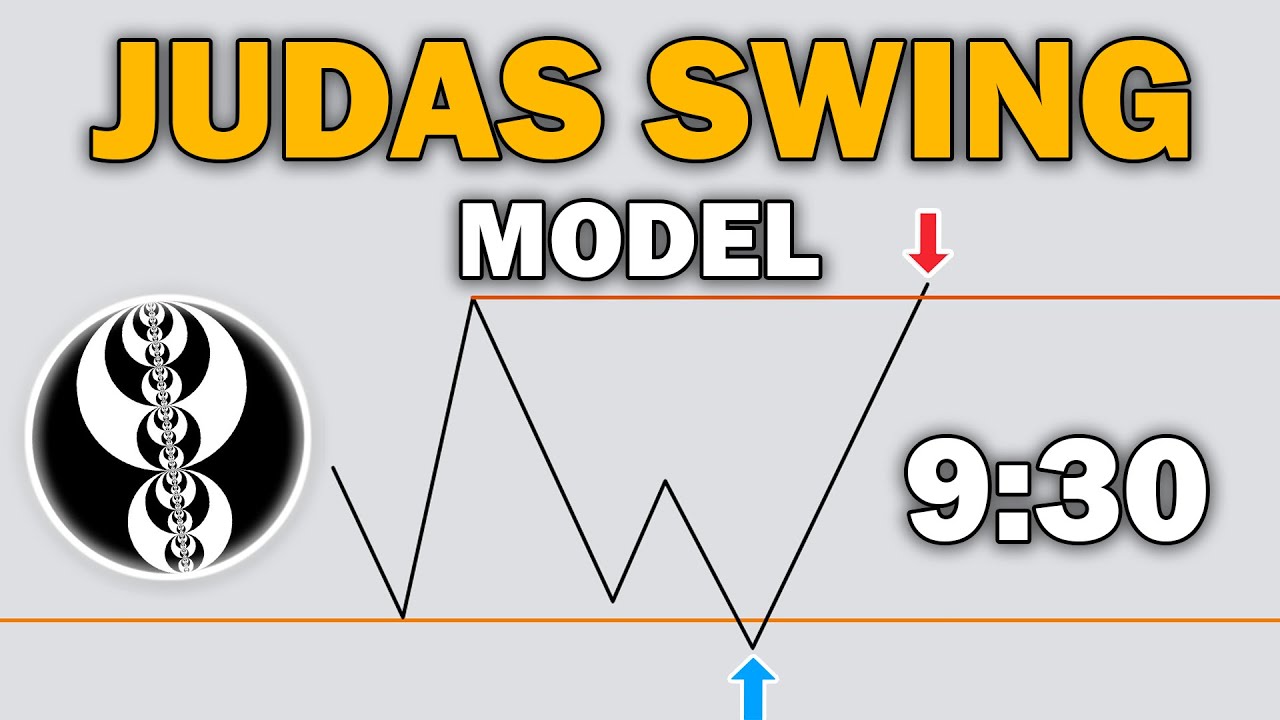

TLDRIn this video, the trader outlines a strategic approach to navigating the upcoming week's market, focusing on economic events, key liquidity zones, and trading psychology. Emphasizing the importance of understanding market conditions, the trader provides an in-depth analysis of NASDAQ, S&P, and Dollar movements, discussing both buy and sell-side liquidity, and how to refine trading setups. The trader stresses the need for patience, clarity, and selective engagement, encouraging traders to avoid emotional impulses and focus on long-term growth through disciplined decision-making and well-executed strategies.

Takeaways

- 😀 The economic calendar is a key tool for predicting market volatility and potential big moves. Traders should always be aware of upcoming red-folder news events to avoid surprises.

- 😀 Monday's lack of red-folder news may lead to slower trading conditions, but it doesn't mean no trades should be made. Traders should focus on understanding market conditions and wait for favorable setups.

- 😀 The importance of being objective and analyzing market conditions without rushing into trades. If there's no clear directional bias or clarity, it's best to wait for more structure.

- 😀 On Tuesday, pay attention to red-folder news at 8:30 a.m. and 10 a.m. Orange-folder news. While red-folder events require more caution, orange-folder news can still be traded if a solid setup is found.

- 😀 Traders should prioritize risk management, avoiding entering trades around high-impact news events to protect their stop-losses and minimize the risk of market manipulation.

- 😀 The market shows a divergence between indices like NASDAQ, S&P, and Dow. While NASDAQ has failed to reach all-time highs, S&P and Dow have surpassed them. This divergence creates uncertainty, so traders should take it day by day.

- 😀 Confluence is key in trading. Traders should aim to find multiple reasons for price movement in one direction. If there's equal confluence for both bullish and bearish scenarios, it's best to avoid trading and wait for clearer conditions.

- 😀 In cases where there’s a mixed bias between buy-side and sell-side objectives, it’s important to allow more time for the market to reveal its structure before making a trade.

- 😀 Market behavior in 2026 could be unpredictable due to external factors, and it's crucial for traders to focus on clarity, high-quality setups, and managing their mental capital.

- 😀 Dollar analysis shows that after sweeping several sell-side liquidity levels, there’s no clear directional bias. Traders should remain flexible and avoid forcing trades when the market is uncertain.

- 😀 Trading success is about consistency, discipline, and the ability to detach from the need to trade every day. Focusing on high-quality setups and preserving mental capital is essential for long-term success.

Q & A

Why is it important to check the economic calendar before starting a trading week?

-The economic calendar helps traders anticipate potential volatility and manipulation in the market. Major news events, especially red-folder events, can drastically impact market behavior, so it's crucial to be aware of them before making trading decisions.

What is the speaker's approach to trading on days without red-folder news events?

-The speaker does not follow a strict rule of avoiding trades on days without red-folder news. Instead, they analyze the market's behavior and only avoid trading if there is no clear directional bias or favorable conditions during the opening range.

What is the 'SMT' (Smart Money Technique) mentioned in the video, and why is it important?

-The SMT refers to the divergence between different indices like NASDAQ, S&P, and Dow. It’s important because it can indicate potential market behavior, such as one index (like NASDAQ) playing catch-up to others (like the S&P or Dow). Traders need to understand these divergences to adjust their bias accordingly.

How does the speaker deal with market conditions when both buy-side and sell-side confluence are present?

-When both buy-side and sell-side arguments are present, the speaker suggests doing nothing and waiting for more structure to develop. This helps to avoid trading in a consolidated or unclear market, where no clear bias is formed.

What does the speaker mean by 'engineered buy-side liquidity pool'?

-An engineered buy-side liquidity pool refers to a price level that is set up to attract buying activity. This typically occurs when a price point is just below another significant buy-side objective, creating a strong pull for price to reach and potentially surpass it.

Why is it important to take a step-by-step approach when analyzing the market?

-Taking a step-by-step approach helps traders avoid making rushed decisions. Instead of forcing a trade, the speaker emphasizes focusing on the closest draw in liquidity, analyzing market conditions day by day to adapt to real-time data and behavior.

What role does risk management play in the speaker's trading strategy?

-Risk management is a top priority. The speaker stresses that protecting the account and ensuring trades align with clear setups is more important than forcing trades. This involves waiting for favorable market conditions and avoiding emotional decisions like revenge trading.

What does the speaker mean by 'confluence' in trading, and how does it affect decision-making?

-Confluence refers to multiple factors or reasons that support a specific market direction. The more confluence there is in one direction (bullish or bearish), the higher the probability of success. If confluence exists in both directions, it suggests consolidation, and it’s better to wait for clarity.

What does the speaker mean by 'not forcing a trade'?

-Not forcing a trade means avoiding the urge to take a position when market conditions are unclear or when there is no solid setup. It’s about being patient, understanding that not every day will offer an opportunity, and preserving mental capital for when conditions are favorable.

What is the significance of the dollar's current price action, and how does it influence market decisions?

-The dollar's price action is significant because it provides insights into broader market trends. The speaker highlights that the dollar has swept various liquidity levels, and its future movement could affect other markets. Analyzing the dollar’s behavior can help refine market bias for other assets like NASDAQ, S&P, and Dow.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)