28. Retirement Of Partner - Partners Capital & Current amount balances are given in the B/ S

Summary

TLDRThis video tutorial explains how to handle the retirement of a partner in a partnership firm using the fixed capital method. The process involves preparing the capital and current accounts, handling goodwill distribution, and accounting for revaluation profits or losses. The instructor walks through an example with three partners—Ram, Raheem, and Robert—detailing adjustments like goodwill, workman compensation, stock, and building appreciation. The explanation also covers journal entries, ledger accounts, and balance sheet preparation. By the end, the viewers will learn how to manage retiring partners' capital, handle current accounts, and update the balance sheet accordingly.

Takeaways

- 😀 A retiring partner's capital and current accounts must be adjusted during their retirement process, with goodwill, revaluation profit/loss, and other adjustments recorded in the current account.

- 😀 Goodwill of the firm is valued and distributed to partners based on their profit-sharing ratio (3:1:2 in this case), and it must be transferred to the current accounts.

- 😀 Revaluation of assets and liabilities must be carried out, and the profit or loss from revaluation is transferred to the current accounts of the partners.

- 😀 The retiring partner's current account balance is transferred to their capital account, and if not paid out immediately, it becomes a loan account.

- 😀 The capital account represents the fixed capital of each partner, which generally remains unchanged unless an adjustment is required (e.g., profit-sharing ratio change or retirement).

- 😀 Current accounts are used to record adjustments, such as goodwill, revaluation profits, and losses. These accounts are regularly updated with changes in assets or liabilities.

- 😀 Any profit or loss from revaluation, such as stock appreciation or depreciation of buildings, is recorded in the revaluation account and then transferred to the current accounts.

- 😀 When a partner retires, the final balance in their current account is paid out as part of their retirement settlement, depending on the firm's policy.

- 😀 In the balance sheet after the retirement process, the continuing partners' capital accounts and current accounts are shown, while the retiring partner’s capital balance is transferred to a loan account.

- 😀 It's crucial to correctly handle the distribution of profits or losses from revaluation and goodwill, and ensure proper journal entries for all adjustments during the retirement of a partner.

Q & A

What is the main focus of the lesson described in the transcript?

-The lesson focuses on the retirement of a partner in a partnership firm, specifically how to handle capital and current accounts, distribute goodwill, and make adjustments in the balance sheet when a partner retires.

How are capital accounts and current accounts treated in a fixed capital method?

-In the fixed capital method, the capital accounts are maintained as fixed, with no changes except for capital introduced or withdrawn. Adjustments, such as profit sharing, goodwill, and revaluation adjustments, are recorded in the current accounts.

How is goodwill distributed when a partner retires?

-Goodwill is valued and then distributed among the continuing partners in the profit-sharing ratio. In this case, the goodwill of the firm is valued at 45,000 and distributed in the ratio of 3:1:2 for Ram, Robert, and Raheem, respectively.

What is the treatment of the provision for bad debts in this scenario?

-The provision for bad debts is already provided in the balance sheet. Since there’s no further adjustment needed, it is not included in the revaluation account and is considered as a gain for the firm.

What happens to the revaluation account when the value of patents decreases?

-If the patents lose value, it is recorded as a loss in the revaluation account. In this case, the loss from patents is transferred to the credit side of the revaluation account.

How is the workman compensation liability treated in the balance sheet?

-The outstanding liability for workman compensation, which is a loss, is created in the revaluation account on the debit side. In the balance sheet, it appears as a liability.

What is the process for handling the profit from the revaluation account?

-The profit from the revaluation account, which in this case is 5,040, is transferred to the current accounts of the continuing partners. It is not distributed to the retiring partner.

How are the balances in the current accounts of the partners dealt with?

-The balances in the current accounts are adjusted based on the opening balances, goodwill distribution, revaluation profit or loss, and any other adjustments like the general reserve. The final amounts are then carried forward in the balance sheet.

What happens to the retiring partner's capital and current account?

-The retiring partner's capital account balance is transferred to their loan account if it’s not paid in cash, and their current account balance is adjusted and distributed among the remaining partners.

How is the capital account of the retiring partner handled in the balance sheet?

-The retiring partner’s capital account balance is transferred to a loan account in the balance sheet if no immediate cash settlement is made. This amount is shown as a liability in the balance sheet.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

AKUNTANSI UNTUK PENDIRIAN FIRMA : salah satu anggota nya sudah memiliki usaha

Accounting for IGCSE - Video 31 - Financial statements of Partnerships

Introduction to the Theory of the Firm

The Only 7 Reasons a Law Firm Will Make You Partner

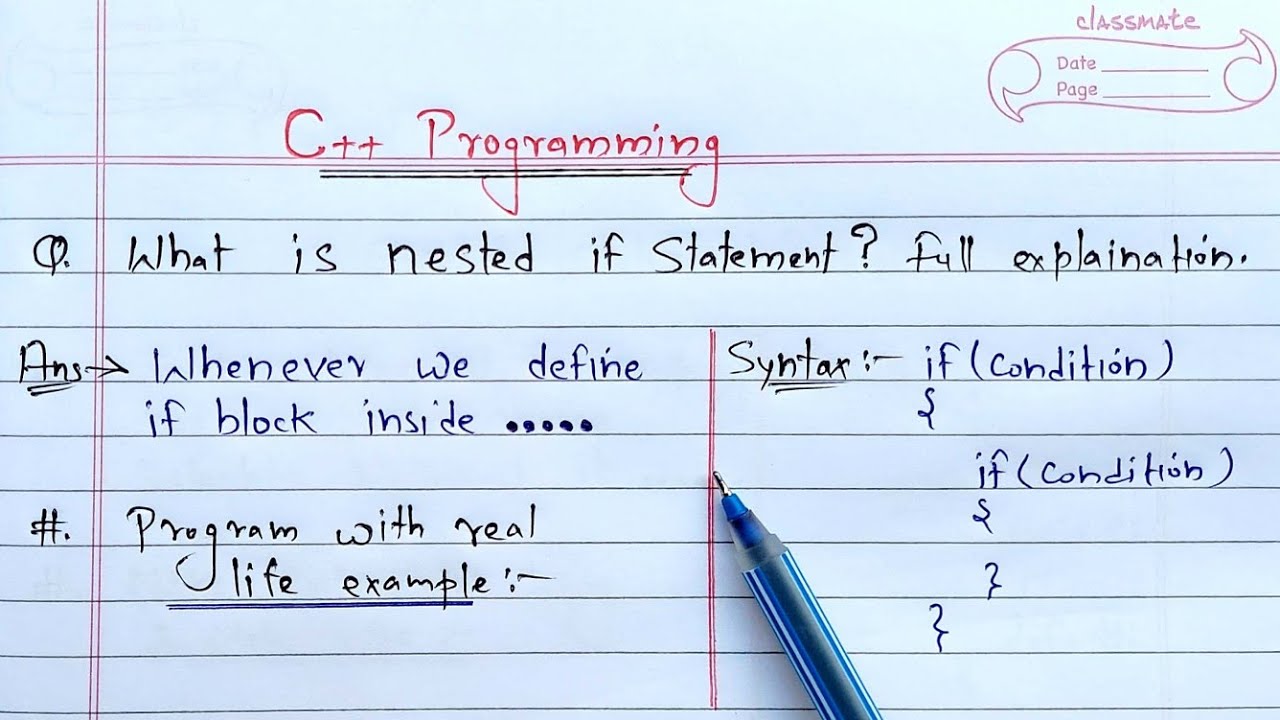

C++ Nested If Statement | Learn Coding

Aposentadoria Especial Hoje 2024 - Insalubridade - Reforma da Previdência PLP 42

5.0 / 5 (0 votes)