Banks Are BENDING THE KNEE to Bitcoin... But There's a Catch (OCC Greenlight's Crypto Deals!)

Summary

TLDRThe video discusses the U.S. government's green light for banks to engage in Bitcoin transactions, marking a dramatic shift in the financial world. Major banks like PNC are now facilitating Bitcoin trades for wealthy clients, signaling the growing mainstream acceptance of Bitcoin. The video highlights how banks are capitalizing on Bitcoin’s appreciation and offering credit against Bitcoin and its derivatives. Michael Saylor’s prediction of banks embracing Bitcoin is coming true, with financial giants like JPMorgan, Wells Fargo, and others now issuing credit against digital assets. The speaker warns viewers about the importance of self-custody of Bitcoin, emphasizing real freedom and wealth through direct ownership.

Takeaways

- 😀 US government has given banks the green light to facilitate Bitcoin transactions, marking a significant shift in regulatory stance.

- 😀 Banks are now issuing credit against Bitcoin or Bitcoin derivatives like IBIT, which was previously unthinkable just a year ago.

- 😀 The Office of the Controller of the Currency (OCC) has confirmed that national banks can act as crypto intermediaries, facilitating Bitcoin trades without holding it on their books.

- 😀 Banks are embracing Bitcoin not out of altruism, but because they recognize the opportunity to profit from the rapidly growing crypto sector.

- 😀 PNC Bank is allowing qualified clients to buy actual Bitcoin directly within their digital banking app, marking a major step in crypto adoption by a traditional bank.

- 😀 Michael Saylor, a Bitcoin advocate, predicted that large banks would start issuing credit against Bitcoin, and this is now becoming a reality with many major banks involved.

- 😀 Bitcoin is emerging as the digital capital base of the entire crypto economy, and it's increasingly seen as an alternative to traditional assets like gold, real estate, and bonds.

- 😀 Banks benefit from Bitcoin’s built-in appreciation, as Bitcoin naturally generates yield, making it an attractive asset for credit issuance and lending.

- 😀 There is growing concern about the fees and intermediaries involved in Bitcoin transactions, as some banks and financial institutions profit from providing services to users who could otherwise self-custody their Bitcoin.

- 😀 The video stresses the importance of self-custody in Bitcoin ownership, urging users to take control of their own keys to ensure true ownership and avoid reliance on third parties.

- 😀 As Bitcoin adoption increases, financial institutions are flipping their stance from hostility to support, with top US banks like JP Morgan, Wells Fargo, and Bank of America now offering crypto-related services.

Q & A

Why is the US government allowing banks to get involved in Bitcoin transactions now?

-The US government, through the Office of the Controller of the Currency (OCC), has given national banks the green light to act as crypto intermediaries. This is part of a broader move to allow banks to facilitate Bitcoin trades, even without holding Bitcoin on their books. Banks now see Bitcoin as a viable digital capital asset that could drive new financial opportunities, such as issuing digital credit backed by Bitcoin.

How are banks integrating Bitcoin into their services?

-Banks are facilitating Bitcoin transactions by acting as intermediaries between buyers and sellers. They are offering credit based on Bitcoin or Bitcoin derivatives and providing a way for clients to buy and sell Bitcoin directly from their apps. For example, PNC Bank has begun allowing high-net-worth clients to buy actual spot Bitcoin through its digital banking platform.

What is meant by 'digital credit' in the context of Bitcoin?

-Digital credit refers to issuing credit against Bitcoin or Bitcoin-backed assets instead of traditional collateral like gold. Since Bitcoin has an appreciating value, it offers a different type of collateral compared to conventional credit, which is often backed by depreciating assets. This allows banks to offer credit against a more stable and appreciating asset.

Why are banks now interested in Bitcoin after years of skepticism?

-Banks were initially hesitant about Bitcoin due to its volatility and decentralized nature. However, they have recently realized the potential of Bitcoin as a new asset class with the ability to offer digital credit and yield. As Bitcoin gains acceptance as digital capital, banks see a major opportunity to profit from new financial products like Bitcoin-based lending, ETFs, and derivative trading.

What role does Michael Saylor play in the adoption of Bitcoin by banks?

-Michael Saylor, the CEO of MicroStrategy and a prominent Bitcoin advocate, has been a key figure in promoting Bitcoin as a legitimate asset for institutional investors. He has helped shift the views of major banks and financial institutions by publicly endorsing Bitcoin and demonstrating its potential for corporate treasuries and financial markets.

What are the risks associated with using banks for Bitcoin transactions?

-While banks provide convenience by offering Bitcoin access through their platforms, they also introduce significant risks, such as losing control over your own assets. By keeping Bitcoin in banks or custodial services, you don’t have direct ownership of your private keys, which means you could be vulnerable to fees, manipulation, or even bank freezes during financial crises.

Why is the pilot program structured with safeguards and limitations?

-The pilot program is designed with safeguards to ensure that Bitcoin transactions remain secure and well-regulated. This is particularly important after issues in offshore exchanges. The program limits how Bitcoin can be used, focusing on collateralizing contracts rather than offering it as a full currency substitute. It aims to monitor the system closely to prevent any operational issues related to digital asset collateral.

What is the significance of PNC Bank's move to allow Bitcoin trading?

-PNC's decision to allow Bitcoin trading is a landmark moment because it is the first major US bank to offer real Bitcoin trading to its clients, albeit limited to high-net-worth individuals. This move signals the growing acceptance of Bitcoin as an asset class by traditional financial institutions, and it opens the door for similar services from other banks.

How does self-custody of Bitcoin differ from holding it through a bank?

-Self-custody means that you own and control your Bitcoin directly through a personal wallet, without any intermediary. This ensures full ownership and security of your assets. On the other hand, holding Bitcoin through a bank or a custodial service means that you rely on a third party to manage your assets, which exposes you to risks like fees, custody issues, and potential loss of control over your funds.

Why should people consider moving Bitcoin off exchanges and into self-custody?

-Moving Bitcoin off exchanges and into self-custody is crucial because exchanges are vulnerable to hacking, freezing of accounts, or other disruptions in times of financial instability. By holding Bitcoin in your own wallet, you ensure that only you control your private keys, offering greater security and protection from potential issues that may arise with third-party custodians.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

Embedded Linux | Introduction To U-Boot | Beginners

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

How to Diagnose and Replace Universal Joints (ULTIMATE Guide)

FEDERALES TENIAN EN LA MIRA A CDOBLETA

Complements of Sets

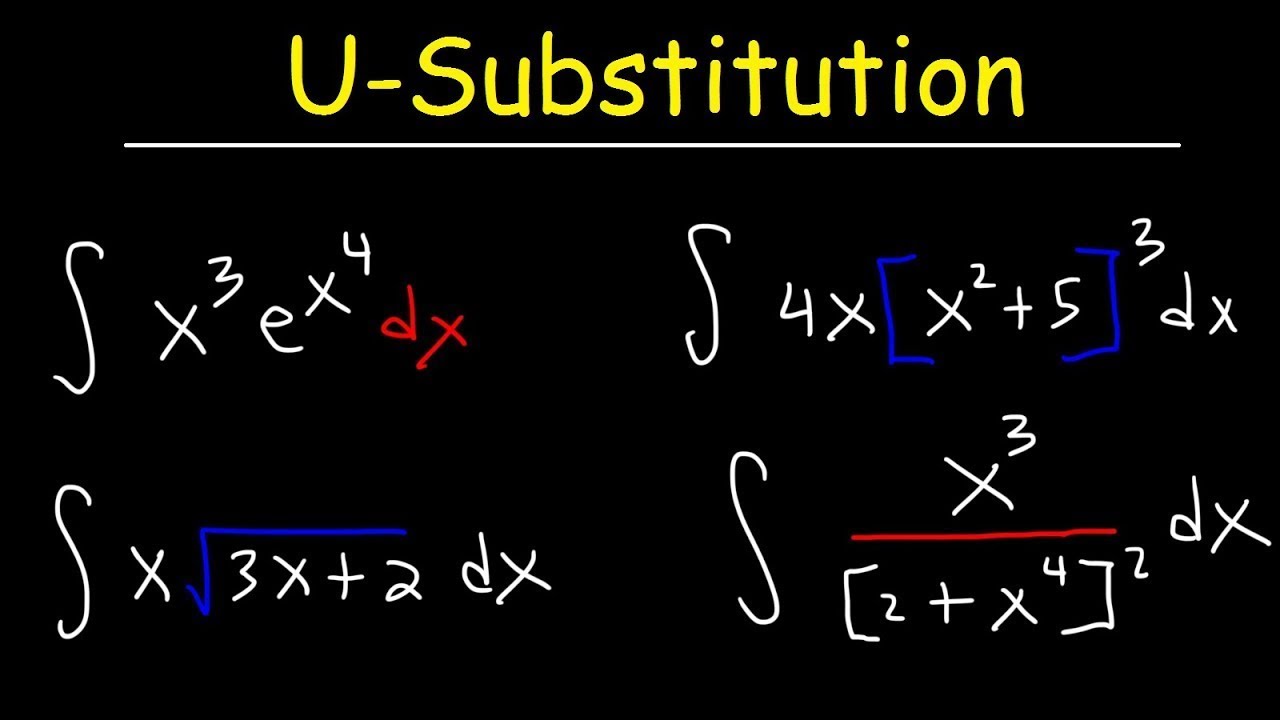

How To Integrate Using U-Substitution

5.0 / 5 (0 votes)