Michael Burry Says This Chart Should Terrify Investors

Summary

TLDRMichael Bur, the investor known for predicting the 2008 financial collapse, warns that the current AI boom may be forming a bubble. He compares today's market to the dotcom era, highlighting inflated valuations, inflated earnings due to stretched depreciation assumptions, and a massive trillion-dollar AI infrastructure buildout. Bur's caution stems from the disconnect between hype-driven expectations and actual demand. He urges investors to question assumptions, stay diversified, and avoid chasing trends, emphasizing that a smart, measured approach is key in a market filled with uncertainty.

Takeaways

- ⚠️ Michael Burry warns the current AI boom may be forming a massive financial bubble similar to the dot-com era.

- 🧠 Burry is respected because his predictions come from deep analysis, not speculation—the same approach that led him to foresee the 2008 crisis.

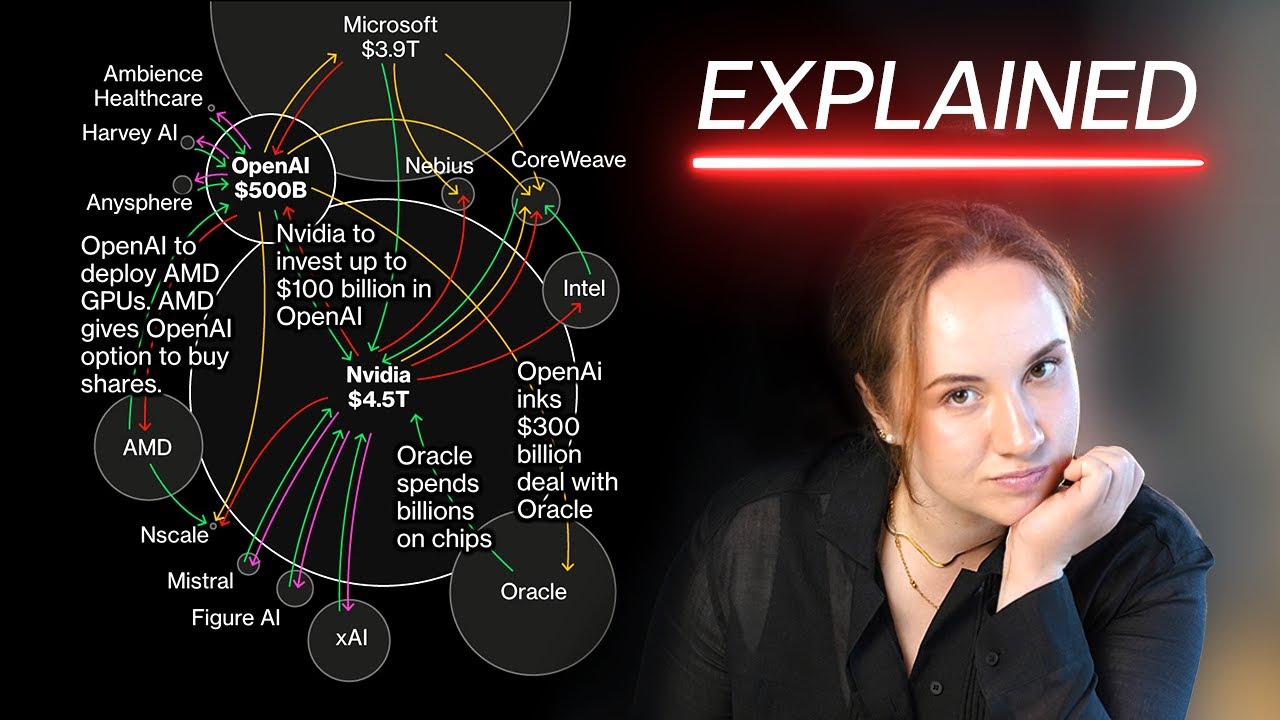

- 📈 AI stocks, particularly Nvidia, have surged dramatically, increasing 10–12x in just two years and temporarily reaching over $4 trillion in valuation.

- 💰 Major tech companies (Microsoft, Alphabet, Meta, Amazon, Oracle) are projected to spend over $1 trillion on AI infrastructure like chips and data centers.

- 📉 Burry warns this spending may outpace real demand, similar to unused fiber-optic capacity during the 1990s tech boom.

- 🧮 A major red flag is depreciation manipulation—tech companies extended server life estimates, boosting profits on paper but not in real economic terms.

- 📊 Burry estimates depreciation may be understated by $176B between 2026–2028, inflating earnings by 20–27% for companies like Meta and Oracle.

- 🔗 Nvidia sits at risk because its business depends on customers whose profits may be exaggerated by accounting choices.

- 💥 A slowdown could trigger sharp corrections of 40–70% or long stagnation as earnings attempt to catch up to hype.

- 📉 Burry has placed over $1.1B in put positions—mostly against Palantir and Nvidia—showing he believes valuations are stretched unsustainably.

- 🛡 The message for investors is not panic but risk awareness: ensure portfolio concentration aligns with goals and tolerance for volatility.

- 🚫 FOMO should not drive investment decisions—slow accumulation, diversification, and patience are smarter than chasing hype.

- 🧭 The core takeaway: think independently, question assumptions, and don’t let excitement replace real financial analysis.

Q & A

What makes Michael Bur's warning about AI significant?

-Michael Bur's warning about the AI boom is significant because he has a track record of accurately predicting financial bubbles, including the 2008 financial collapse. He is focusing on the financial aspects of the AI boom, arguing that it's similar to the dotcom bubble, with valuations and expectations growing faster than real demand.

Why does Bur believe the AI market is like the dotcom bubble?

-Bur believes the AI market mirrors the dotcom bubble because, like in the late 1990s, massive amounts of capital are being poured into AI technology and infrastructure based on inflated expectations. The actual demand and usage may not be able to justify these investments, which could lead to a market correction.

What are the 'public horsemen of AI' mentioned by Bur?

-The 'public horsemen of AI' refers to major companies like Microsoft, Alphabet, Meta, Amazon, Oracle, Nvidia, and startups like OpenAI. Together, these companies are projected to spend over a trillion dollars on AI-related infrastructure like chips, data centers, and cloud services.

How does Bur view the financials of companies like Nvidia and Meta?

-Bur is concerned that companies like Nvidia and Meta are reporting inflated profits due to accounting practices, particularly the way they stretch the depreciation of their assets. This makes their current earnings appear larger than they truly are, which could distort investor perceptions and contribute to the AI bubble.

Why does Bur focus on depreciation as a major issue?

-Bur focuses on depreciation because it has a significant impact on reported profits. Many tech companies have extended the useful life of their servers and network equipment, which reduces depreciation expenses and inflates profits. Bur estimates that this could lead to overstated earnings by 20-27% for major companies like Meta and Oracle.

What does Bur mean by the 'circular' nature of AI demand?

-Bur suggests that much of today's AI demand is circular, meaning that big tech companies are spending billions on AI infrastructure, and startups are raising money to develop AI products. These startups then pay big tech for cloud services, creating a feedback loop that inflates revenue numbers but doesn't reflect real customer demand.

What are the potential outcomes Bur sees for the AI market?

-Bur identifies three possible outcomes for the AI market: (1) a sharp correction, where valuations reset quickly; (2) a slow bleed, where stocks decline gradually over time as earnings catch up to hype; and (3) selective survival, where a few companies thrive while others fade due to unsustainable demand.

How does Bur manage risk in his investment strategies?

-Bur manages risk by taking concentrated, asymmetric bets rather than making wild, speculative investments. He has positioned himself with significant put options against companies like Palantir and Nvidia, betting on a market correction or slowdown. This strategy reflects his belief that the market is priced for perfection, which won't last.

What should investors do if they hold AI stocks according to Bur?

-Bur advises investors holding AI stocks to reassess their exposure to these stocks and ensure it aligns with their goals, risk tolerance, and investment timeline. He emphasizes avoiding panic and being mindful that valuations may be overstated, which could lead to significant losses if the market corrects.

What lesson does Bur teach about investing in technology sectors like AI?

-Bur teaches that big ideas do not require big bets. Instead, investors should focus on making smart decisions based on data and reality, rather than chasing hype. Building positions gradually, waiting for pullbacks, and diversifying investments are key strategies to avoid FOMO-driven decisions and protect against potential bubbles.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

المُخبر الاقتصادي+ | لماذا قد تنهار إنفيديا وتتسبب في أزمة مالية عالمية أسوأ من 2008؟

Analyst Who Predicted 2008 Crash Sounds Alarm "Gold & Silver To Be Rocket-Propelled" - Mike Maloney

Are we in an AI Bubble? (These 5 Warning Signs Will Tell You)

Inside AI’s Circular Economy: Geopolitical Loopholes, Hidden Debt, and Financial Engineering

The Line That Explains The Coming Housing Depression

Why Everyone Is Wrong About the AI Bubble

5.0 / 5 (0 votes)