The $400 Trillion Problem No One Wants to Talk About

Summary

TLDRPensions are facing a global crisis due to shifting demographics, longer life expectancies, and declining birth rates. Systems built for a time with more workers per retiree are crumbling, leading to potential insolvencies and strained national budgets. Countries like the US, Japan, and France face severe challenges, with fewer workers supporting a growing elderly population. While solutions like raising the retirement age, cutting benefits, and privatization have been explored, they often spark political turmoil. Countries like Denmark, Sweden, and Germany are taking gradual, automatic reforms to keep systems solvent, offering valuable lessons on how to tackle this pressing issue.

Takeaways

- 😀 Pension systems worldwide are facing a crisis due to aging populations, with fewer workers supporting more retirees.

- 😀 In the 1950s, the US had 16 workers for every retiree; today, that ratio has dropped to fewer than three, and it's expected to decline further by 2035.

- 😀 Japan's working-age population has shrunk by 14 million since 1995, and by 2050, nearly 40% of Japan's citizens will be over 65.

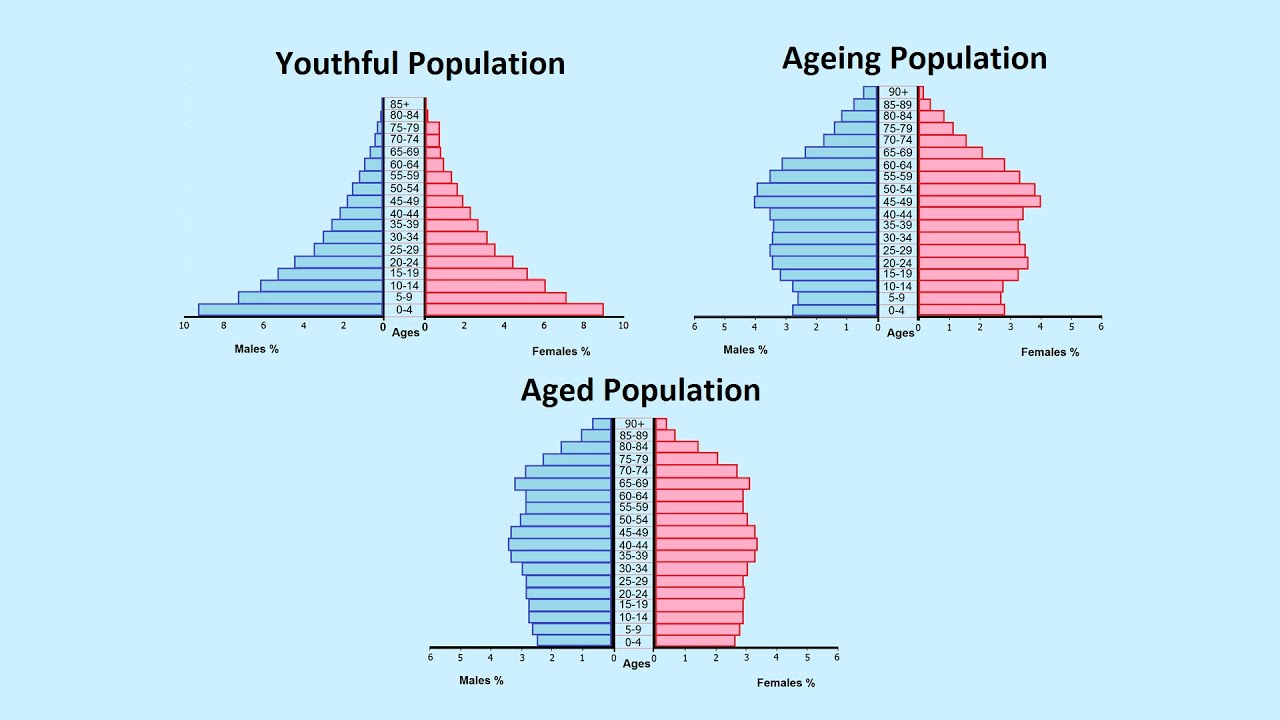

- 😀 By 2050, one in six people globally will be over 65, while fertility rates have dropped, leading to fewer workers entering the labor force.

- 😀 Most pension systems are based on a 'pay as you go' model, which worked when birth rates were high and people had fewer years in retirement.

- 😀 In the US, Social Security's trust funds are projected to run out by 2035, potentially leading to a 17% cut in benefits for retirees.

- 😀 Countries like Japan and France are facing fiscal pressure due to pension spending eating up significant portions of GDP.

- 😀 Rising life expectancy and lower birth rates mean pension systems are underfunded, leading to concerns about insolvency and poverty for future retirees.

- 😀 Political leaders often avoid pension reforms because the necessary changes—like raising the retirement age or cutting benefits—are unpopular and hard to implement.

- 😀 Some countries, like Denmark and Sweden, have successfully linked retirement ages to life expectancy, offering a more predictable and gradual approach to pension reform.

- 😀 Privatized pension systems, like the one in Chile, initially seemed successful but later revealed significant flaws, leading to protests and government intervention.

- 😀 Countries with self-funded retirement systems, like Australia’s Superannuation, have had success in easing public pension burdens, though they create new equity issues for lower-income workers.

Q & A

What is the main issue with pension systems in developed countries today?

-The main issue is that pension systems, which were built for a time of high birth rates and low life expectancy, are now unsustainable due to longer life expectancies and lower birth rates. As a result, there are fewer workers supporting more retirees, creating financial strain on pension funds.

How has the worker-to-retiree ratio changed in the United States since the 1950s?

-In the 1950s, there were 16 workers for every retiree in the U.S. Today, that ratio has dropped to just 2.7 workers per retiree, and it is expected to fall further to 2.3 by 2035.

What is a 'dependency ratio crisis' and how is it affecting pensions?

-A dependency ratio crisis occurs when there are too few workers to support a growing number of retirees. This leads to financial strain on pension systems, as fewer workers are paying into the system while more retirees are drawing benefits.

Why is Japan's pension system facing particular challenges?

-Japan's pension system is under pressure due to a rapidly aging population, with nearly 40% of citizens expected to be over 65 by 2050. Additionally, Japan's working-age population has shrunk by 13 million since 1995, and many young workers have not had a fair shot at saving for retirement.

What is the projected impact of the U.S. Social Security Trust Fund running out by 2035?

-If the U.S. Social Security Trust Fund runs out by 2035, payroll taxes will only cover about 83% of promised benefits, potentially leading to a 17% cut in retiree benefits, which could significantly impact retirees' income.

What is the 'Employment Ice Age' in Japan, and how does it affect pensions?

-The 'Employment Ice Age' refers to a period in Japan after the early 1990s economic bubble burst when many young graduates were locked out of traditional corporate careers. This generation worked in part-time or temporary jobs without access to the main pension system, resulting in low savings and patchy pension contributions for many.

How is China’s pension system different from other developed countries, and what challenges does it face?

-China's pension system is relatively new but faces the challenge of an aging population due to the legacy of the One-Child Policy. By 2050, over 366 million Chinese citizens will be over 65, and the national pension fund may run dry by the early 2030s, making it difficult to support retirees.

What is the projected $400 trillion gap in global pension savings by 2050?

-The World Economic Forum estimates that by 2050, there will be a $400 trillion gap between what people need for retirement and what has actually been saved globally. This gap is roughly four times the size of the entire global economy today.

What are some of the political obstacles to pension reform in many countries?

-Pension reform is politically difficult because it often involves asking people to work longer, pay more, or receive fewer benefits, none of which are popular with voters. Most politicians avoid taking action due to the political consequences, often leading to long-term issues being ignored.

What are the advantages and disadvantages of privatizing pension systems, as seen in Chile’s experiment?

-Privatizing pension systems, like Chile's 1981 reform, shifts the responsibility from the government to individuals. While it initially looked successful, many workers couldn’t contribute enough, and market downturns reduced pension returns. This led to widespread dissatisfaction, and the government had to guarantee minimum payouts, essentially re-socializing the system.

How does Australia’s superannuation system work, and what are its pros and cons?

-Australia’s superannuation system requires employers to contribute a percentage of employees' income into personal retirement accounts. These accounts grow through investments, which can replace or supplement government pensions. While the system has helped build a large retirement savings pool, it is expensive for the government due to tax breaks, and lower-income workers benefit less than wealthier individuals.

How do countries like Denmark and Sweden handle pension reform differently?

-Denmark and Sweden have implemented automatic, predictable adjustments to their pension systems. For example, Denmark ties the retirement age to life expectancy, automatically increasing it as people live longer. Sweden reformed its system in the 1990s to tie benefits to lifetime contributions and adjust payouts based on economic conditions, helping the system stay solvent without causing political turmoil.

What is means testing, and how is it used in countries like Australia and Canada?

-Means testing involves reducing or cutting pension benefits for wealthier retirees. Countries like Australia and Canada use this approach to ensure that public funds are targeted to those who truly need support, rather than providing equal benefits to all retirees regardless of income.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)