Review Text "The Psychology of Money" by Nabila PBI A (24021100024) Interpretive Reading Class

Summary

TLDRIn this video, Nabila from PBA class reviews the book 'The Psychology of Money,' exploring how personality and emotions shape financial behavior. She discusses impulsive spending in Indonesia, compulsive buying as a growing mental health concern, and the thrill of bargain hunting during major sales events. Nabila also highlights how businesses use psychological marketing techniques to drive purchases and how behavioral therapy and financial wellness programs are helping Indonesians manage their money better. By connecting text insights with local statistics and real-world examples, the video offers a clear and engaging look at the interplay between psychology, spending habits, and financial awareness in Indonesia.

Takeaways

- 😀 People's spending habits reflect their personalities, with some tending to spend impulsively while others save carefully.

- 😀 A survey in Indonesia shows that 41% of people make impulsive purchases during late-night online sales events.

- 😀 Over half of young adults in Indonesia regret making unplanned purchases, highlighting emotional influences on consumer behavior.

- 😀 Compulsive spending is a growing concern in Indonesia, with 12.5% of urban Indonesians exhibiting compulsive buying behaviors.

- 😀 Research from the University of Indonesia connects compulsive spending with anxiety and feelings of emptiness.

- 😀 The psychology of 'bargain hunting' makes people feel a sense of achievement when they get a good deal, which influences consumer behavior.

- 😀 Major sales events like Indonesia's 9.9 sale show a 37% increase in sales due to consumers seeking 'good deals,' often not based on necessity.

- 😀 Businesses use psychological marketing tactics like scarcity and urgency (e.g., limited stock, countdown timers) to drive consumer purchases.

- 😀 E-commerce platforms like Shopee and TikTok Shop see significant sales increases (up to 40%) through psychological marketing techniques like FOMO (fear of missing out).

- 😀 Financial wellness programs, such as those offered by platforms like Relief and Mind Terra, are becoming increasingly popular in Indonesia to promote healthier money management habits.

- 😀 Social media movements and hashtags like #financialtherapy are helping raise awareness about managing finances and making mindful spending decisions.

Q & A

Who is presenting the review in the video transcript?

-The review is presented by Nabila, who is from the PBA class.

What is the title of the reading Nabila reviewed?

-The title of the reading is 'The Psychology of Money.'

According to the transcript, what does people's behavior with money reflect?

-People's habits with money reflect their personalities, including whether they tend to spend impulsively or save carefully.

What statistics were mentioned about impulsive purchases in Indonesia?

-A survey in August 2025 showed that 41% of Indonesian consumers often make impulsive purchases during late-night online sales events, and over half of young adults regretted buying unplanned items.

How is compulsive spending described in the transcript?

-Compulsive spending is described as a type of addiction similar to substance abuse, associated with anxiety and feelings of emptiness when unable to shop.

What example was given to illustrate 'bargain hunting' behavior?

-During major sales events like the 9.9 sale in September 2025, platforms like Shopee and Tokopedia saw a 37% increase in sales, showing consumers purchase items to feel a sense of victory rather than necessity.

How do businesses use psychology to influence consumer behavior in Indonesia?

-Retailers and e-commerce platforms create urgency and emotional appeal through tactics like limited stock, countdown timers, exclusive deals, and influencer promotions, resulting in significant sales increases.

Can you provide specific examples of psychological marketing in Indonesia?

-Indomaret and Alfamart increased weekend sales by 30% using limited stock promotions, while Shopee and TikTok Shop boosted sales and user engagement with exclusive deals, live streams, and urgency-based marketing.

What role does behavior therapy play in managing money habits according to the transcript?

-Behavior therapy helps individuals control spending habits by increasing awareness and promoting careful financial decision-making.

What initiatives in Indonesia reflect growing awareness of financial wellness?

-Platforms like Relief and Mind Terra launched financial wellness programs in 2025, attracting over 50,000 users, and social media movements using hashtags related to financial therapy have become popular, encouraging healthier money behavior.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Introduction to Psychology

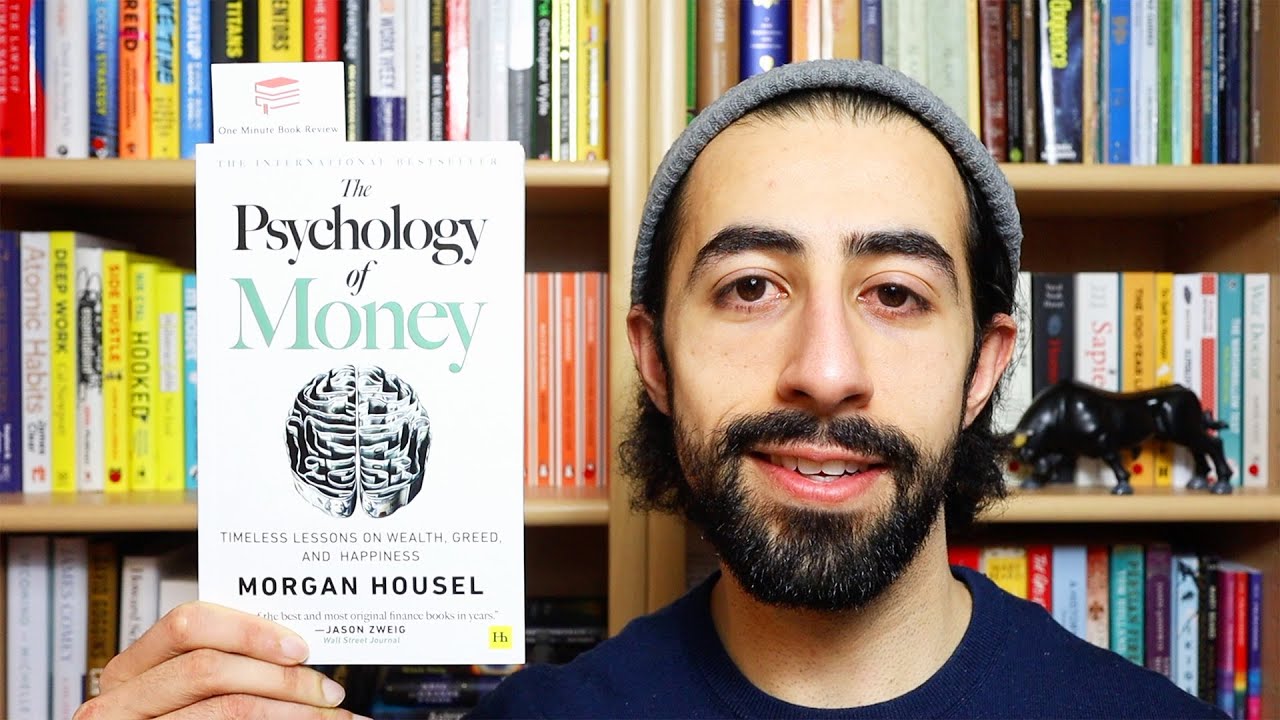

'The Psychology of Money' | One Minute Book Review

Cara Baru Memahami Uang - The Psychology of Money

Apa Itu Kepribadian dan Bagaimana Kepribadian Terbentuk? - [Belajar Psikologi]

The Book That Changes Your Financial Life | The Psychology of Money by Morgan Housel Book Review

17 Lições sobre dinheiro - A psicologia do dinheiro. Morgan Housel

5.0 / 5 (0 votes)