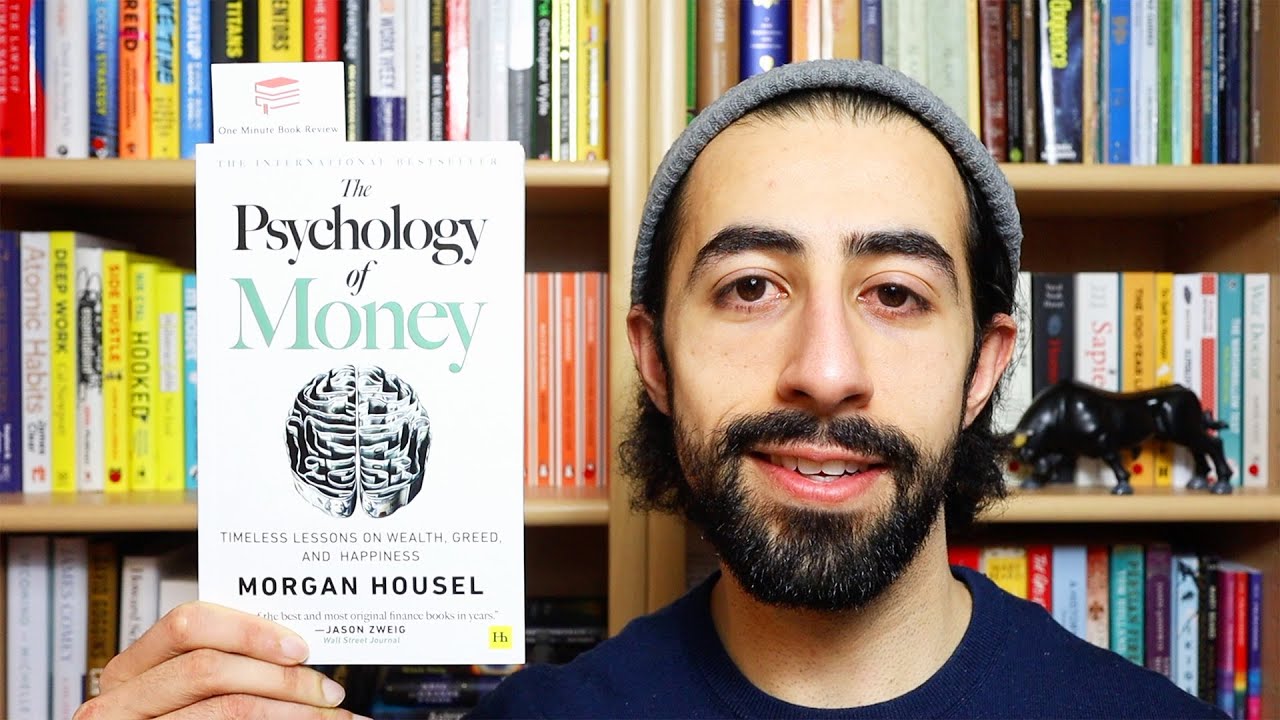

The Book That Changes Your Financial Life | The Psychology of Money by Morgan Housel Book Review

Summary

TLDRWeronika introduces a YouTube series spotlighting The Investor’s Podcast Network’s favorite books, focusing here on Morgan Housel’s The Psychology of Money. The video argues that financial success is a soft skill—behavior matters more than technical knowledge—and explores how personal history, emotions, culture, and luck shape money choices. Key takeaways include recognizing risk and luck, knowing when enough is enough, distinguishing being wealthy (financial freedom) from being rich (showy spending), building a margin of safety, saving without a specific goal, avoiding advice from people playing different games, and harnessing compounding and time to achieve lasting financial peace.

Takeaways

- 🧠 Financial success is a soft skill — how you behave matters more than what you know.

- 👪 Personal history, family, culture and the era you grew up in shape how you view risk, saving and investing.

- 🤝 Don’t harshly judge others’ financial choices — people play different games with different constraints.

- 🍀 We underestimate luck and risk; outcomes depend on forces beyond individual effort.

- 🔁 Build systems so single decisions (wins or losses) don’t wipe you out — plan to keep going after setbacks.

- 🏁 Learn to recognize when you have 'enough' — constantly chasing more can be dangerous and unsatisfying.

- 💰 Distinguish being wealthy (ability to keep freedom) from being rich (visible consumption); saving matters as much as earning.

- ⏳ Controlling your time is the highest dividend money pays — financial independence buys freedom.

- 🛡️ Maintain a margin of safety: prepare for plans to fail and protect yourself against worst-case scenarios.

- 🧩 Don’t take advice from people playing a different game — ensure strategies match your goals and time horizon.

- 💸 Save for no specific reason: a high savings rate (leftovers) builds wealth even without a high income.

- 🔬 The magic of compounding requires patience and time — consistent, long-term investing beats quick wins.

- 🧭 Be aware of biases: we often believe what we want and react to dramatic stories rather than facts.

- 🔁 Design a Plan B and prioritize sleep-at-night decisions — protect family, reputation and peace of mind.

Q & A

What is the core message of *The Psychology of Money* by Morgan Housel?

-The core message of the book is that financial success is more about behavior and emotions than about hard financial knowledge. How we manage money is deeply influenced by our personal experiences, values, and emotions.

How does personal upbringing influence financial decisions?

-Our financial decisions are shaped by the family values and financial behaviors we were exposed to growing up, as well as the time period and environment in which we were raised. This means that everyone's perspective on money is different.

What role do emotions play in financial decision-making?

-Emotions significantly impact how we spend, invest, and save money. Many people make financial decisions based on emotional factors and personal experiences rather than solely on data or logic.

How does luck influence financial success?

-Luck plays a huge role in financial outcomes, often determining success or failure in unpredictable ways. Even well-prepared individuals can fail due to bad luck, and luck can also explain unexpected successes.

What does Housel mean by the phrase 'We never have enough' in relation to money?

-'We never have enough' refers to the idea that once we reach a financial goal, we often desire more. This can lead to constant dissatisfaction and pressure to earn more, even at the cost of personal well-being or happiness.

What is the difference between being 'rich' and being 'wealthy'?

-Being rich is about visible displays of wealth, such as large homes or expensive possessions, while being wealthy is about having financial independence and the ability to maintain wealth without the need to show it off.

How can we achieve financial freedom according to the book?

-Financial freedom comes from controlling your time. It means having the ability to choose how you spend your days without being financially constrained. This is often a higher priority for younger generations who value flexibility over higher income.

What is the 'margin of safety' and why is it important?

-The margin of safety is the concept of planning for uncertainty. It means preparing for worst-case scenarios in your financial decisions, as things rarely go exactly as planned. Having a margin of safety helps protect you from financial setbacks.

Why should we not take financial advice from people playing a different game than us?

-Financial advice can be dangerous if the person giving it is playing a different financial game than you. For example, short-term traders and long-term investors have different goals, so advice from one group may not apply to the other.

What is the importance of saving money 'for no reason'?

-Saving money without a specific goal allows you to prepare for uncertain times. It's about creating a financial cushion for unexpected events, rather than saving for a specific purchase. This helps build long-term financial security.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)