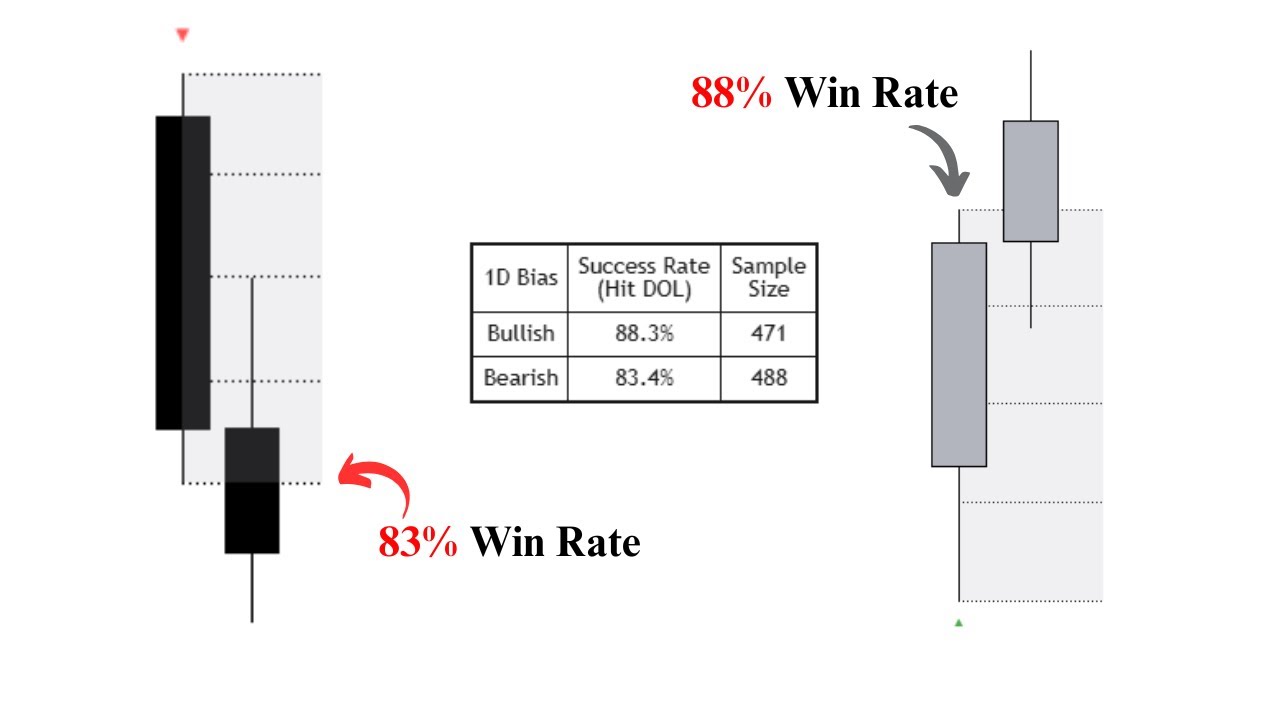

E.B.P- The most Profitable Candlestick Day Trading Strategy [88.3% Win rate]

Summary

TLDRThis video details the Engulfing Bar Play (EBP) trading strategy, highlighting its proven high success rates—88% bullish and 83% bearish—using backtested data. It explains two methods: Method 1 focuses on daily timeframe setups aiming for liquidity targets, while Method 2 uses 4-hour charts to identify trend continuations or reversals. The tutorial covers key concepts like bullish/bearish engulfing bars, Power of Three candle formations, fair value gaps, and multi-timeframe entries. Viewers are guided through practical examples on Gold and NQ, with insights on risk management, stop-loss placement, and optimizing R:R. The video emphasizes simplicity, patience, and replicability for profitable trading.

Takeaways

- 😀 Continuation setups are identified when the market pulls back into a discounted price zone, forming a fair value gap and showing potential for higher prices after liquidity is taken out.

- 😀 Engulfing bars on the 4-hour time frame are powerful tools for confirming either trend continuation or reversal. These bars indicate significant shifts in market sentiment.

- 😀 For trend continuation, traders look for price to retrace into key levels (25%, 50%, or 75%) before entering a trade, with stop losses placed below the candle’s low or above the high.

- 😀 A bullish or bearish engulfing bar confirms that the market is likely to continue in the direction of the engulfing move, particularly after liquidity has been swept or a gap is formed.

- 😀 When trading reversals, look for failed attempts to break key highs or lows. A reversal is often confirmed when the market fails to push higher or lower and forms a rejection candle.

- 😀 A fair value gap is an important tool for identifying areas where price is likely to return to, providing ideal entry points after the market forms a confirmation signal like an engulfing bar.

- 😀 The concept of liquidity is central: the market needs to take out previous highs and lows (liquidity pools) before making a significant move, often forming a clear continuation or reversal setup.

- 😀 Traders can use the **EBP strategy** to identify and confirm key setups, such as engulfing bars, to predict short-term market direction with higher accuracy.

- 😀 In reversal setups, the market often forms a gap or liquidity sweep before failing to continue in the original direction, providing a strong signal to enter a trade in the opposite direction.

- 😀 For trade management, use risk-reward ratios to set realistic expectations. Targets can be set based on key support/resistance zones or market inefficiencies, typically aiming for 2R or higher in trades.

- 😀 The **EBP indicator** offers traders alerts and setups, automatically plotting key entry points based on the EBP strategy, which helps to streamline trading decisions and improve consistency.

Q & A

What does EBP stand for in the context of this trading strategy?

-EBP stands for Engulfing Bar Play, which is a method of identifying potential market reversals or continuations using engulfing candlestick patterns.

What are the two types of engulfing bars described in the video?

-The two types are bullish engulfing, where price sweeps the prior candle's low and closes above its opening price, and bearish engulfing, where price sweeps the prior candle's high and closes below its opening price.

What is the concept of 'Power of Three' (P3) in this strategy?

-Power of Three (P3) refers to the typical movement of a candlestick: an initial push in one direction creating a high or low, a reversal in the opposite direction creating the opposite extreme, and a final close at a specific price. It helps frame potential trade entries and targets.

What is meant by 'DO' or 'Draw on Liquidity'?

-DO, or Draw on Liquidity, refers to identifying levels where the market is likely to move next to capture liquidity, usually the prior candle's low for bearish moves or high for bullish moves.

How does Method 1 of the EBP strategy work?

-Method 1 focuses on using engulfing bars on higher time frames (daily) to frame trades by identifying the DO level and using lower time frames (1H or 4H) for precise entry points, typically targeting the DO level for profit.

How is Method 2 of the EBP strategy different from Method 1?

-Method 2 uses the 4-hour timeframe primarily to determine potential trend direction and bias. It identifies continuation or reversal patterns and uses lower time frames to time entries more precisely, focusing on short-term gains within the trend.

What role do Fair Value Gaps (FVG) play in the strategy?

-Fair Value Gaps are areas of price inefficiency where liquidity is likely to be captured. They act as potential targets or retracement zones for entries, confirming continuation or reversal trades.

How are stop-loss levels typically determined in this strategy?

-Stop-loss levels are generally placed just below the low of the engulfing bar for bullish setups or just above the high for bearish setups, sometimes adjusted to 25%, 50%, or 75% of the range to optimize risk.

What does the speaker mean by using higher time frames to 'frame' day trades?

-Framing day trades means using higher time frames (daily or 4H) to establish the market’s overall bias or potential liquidity targets, and then using lower time frames for precise entries that align with the higher time frame trend.

What are some practical examples given for using the EBP strategy?

-The video uses examples on NQ (Nasdaq) and gold, showing how engulfing bars, swing highs/lows, fair value gaps, and liquidity pools can be used to identify entries and targets, demonstrating both trend continuation and reversal scenarios.

Why is patience emphasized as important in trading with this system?

-Patience is critical because high-probability setups are limited. Waiting for the right engulfing bar and fair value gap confirmation allows traders to maximize gains while minimizing unnecessary risk.

How does the EBP indicator assist traders?

-The EBP indicator automates the plotting of engulfing bars, liquidity levels, and fair value gaps, provides alerts for setups on any timeframe, and helps traders quickly identify potential entries and risk/reward zones.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The most profitable Daily Bias Strategy [EBP- 88% Proven Win Rate]

The BEST FINAL Entry Confirmation - SMC & ICT Concepts

The BEST Candlestick Pattern Guide You'll Ever Find

I make a living trading Price Action, here’s how.

NEW Chat GPT-4 Trading Strategy Turned $100 to $7313!

TESLA Stock - Is TSLA Bearish?

5.0 / 5 (0 votes)