The BEST Candlestick Pattern Guide You'll Ever Find

Summary

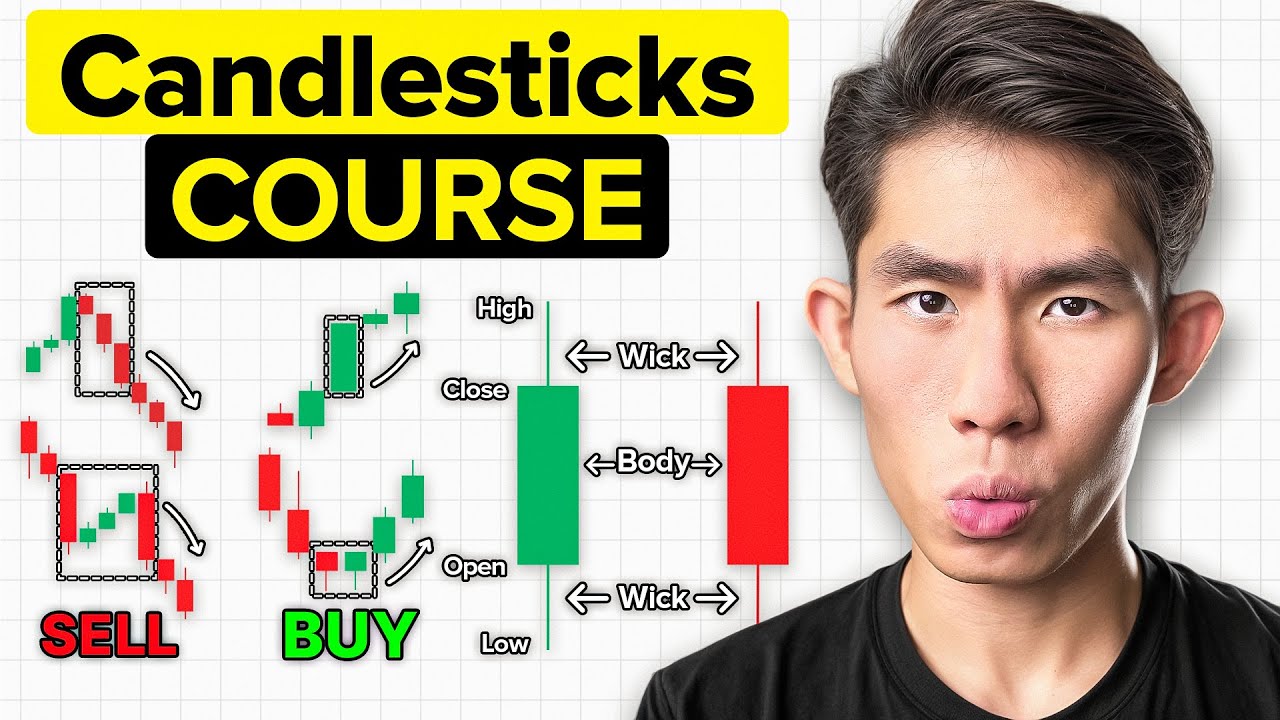

TLDRIn this video, the presenter discusses the most effective candlestick patterns for profitable trading. Through personal experience, they highlight six proven patterns: Engulfing, Pin Bar, Three Bar Continuation, Three Bar Reversal, Breakout Candles, and Shrinking Candles. The video emphasizes the importance of understanding candlestick formations and combining them with key levels of support, resistance, and trendlines for higher success. The presenter also introduces an advanced price action strategy for more accurate trade entries, offering a free guide with additional resources for traders aiming to elevate their skills.

Takeaways

- 😀 Candlestick patterns are crucial for technical analysis and can significantly enhance trading success when used correctly.

- 😀 Not all candlestick patterns are effective; focus on high-win rate patterns tested over time for better results.

- 😀 Key components of candlestick charts include the open, close, high, and low, providing valuable insights into market behavior.

- 😀 Bullish candlesticks close higher than the open, while bearish candlesticks close lower than the open, helping traders identify market sentiment.

- 😀 Patterns like **Bullish Engulfing** and **Bearish Engulfing** are important for spotting potential reversals in trends.

- 😀 The **Pin Bar** pattern, with its long wick, signals potential trend reversals depending on its position in the chart.

- 😀 **Three-Bar Continuation** and **Three-Bar Reversal** patterns help traders spot continuation and reversal signals respectively, based on the relationship between three consecutive candles.

- 😀 **Shrinking Candles** indicate that the current trend might be losing strength, and a reversal could be imminent when followed by a large opposite-colored candle.

- 😀 Using candlestick patterns in conjunction with price action (support, resistance, and trendlines) increases the probability of a successful trade.

- 😀 Confluence levels, where multiple key levels (like support and resistance) intersect, are ideal areas for trading opportunities, especially when confirmed by a candlestick pattern.

- 😀 Joining a community or using free guides can provide additional resources for traders to enhance their skills and stay updated with market analysis.

Q & A

What is the significance of candlestick patterns in trading?

-Candlestick patterns provide a visual representation of price movements, helping traders to understand market sentiment and predict future price action. They offer valuable insights into potential trend reversals and continuation patterns, allowing traders to make informed decisions.

Why do most candlestick patterns fail to deliver consistent profits?

-Most candlestick patterns fail because they are used without proper context or understanding of price action. Without confirmation from other factors like support/resistance levels or trendlines, these patterns can be misleading and lead to false signals.

What are the six candlestick patterns discussed in the video?

-The six candlestick patterns are: Engulfing, Pin Bar, Three-Bar Continuation, Three-Bar Reversal, Breakout Candles, and Shrinking Candles. Each of these patterns has distinct characteristics that make them useful for predicting price movements.

How does the Engulfing pattern work in trading?

-The Engulfing pattern consists of two candles, where the second candle fully engulfs the body of the first. A Bullish Engulfing suggests a potential upward reversal, while a Bearish Engulfing signals a potential downward reversal.

What does a Pin Bar indicate in trading?

-A Pin Bar is a candlestick with a long wick and a small body. A Bullish Pin Bar indicates that buyers have rejected lower prices, suggesting a potential upward reversal, while a Bearish Pin Bar shows that sellers have rejected higher prices, signaling a potential downward reversal.

What is a Three-Bar Continuation pattern?

-A Three-Bar Continuation pattern consists of three candles: a large candle, followed by a smaller opposite-colored candle, and another large candle. This pattern suggests that the prevailing trend is likely to continue.

Can you explain the Three-Bar Reversal pattern?

-The Three-Bar Reversal pattern involves three candles: two of the same color followed by a large opposite-colored candle. This pattern signals a strong reversal in price direction, with the third candle being larger than the first two.

What are Breakout Candles and how do they work?

-Breakout Candles are a series of small candles followed by a large breakout candle. This pattern suggests that the market is breaking out of a consolidation phase, indicating a potential continuation of the trend.

What does the Shrinking Candles pattern suggest?

-The Shrinking Candles pattern consists of three smaller candles of the same color, followed by a large opposite-colored candle. This indicates that momentum is fading, and a trend reversal is likely.

How does confluence play a role in identifying key levels for trading?

-Confluence occurs when multiple key levels, such as trendlines, support, and resistance, intersect. When these levels align, they create a higher probability for price reversals, making them ideal areas for traders to enter or exit trades.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Boot Camp Day 2: Candlesticks

ULTIMATE Candlestick Patterns Trading Guide *EXPERT INSTANTLY*

Les FIGURES de Chandelier! | Formation Trading du Captain!

Best Pullback Trading Strategy That Will Change The Way You Trade

Simple and Effective: 5 Minute Forex Scalping with EMA

The Best Scalping Strategy to Make $1,000 Daily in 2025 – Proven & Tested

5.0 / 5 (0 votes)