How to create assets in the stellar network

Summary

TLDRThis video delves into the concept of custom assets within the Stellar network, distinguishing them from native assets like cryptocurrency. It explains how custom assets can be created by users or institutions, offering flexibility for stablecoins, securities, and more. The focus is on Stellar's native functionalities, which simplify asset issuance and distribution through operations such as minting and burning. It also touches on managing the asset supply using a distribution account and controlling access through authorization flags, allowing tailored control over asset behavior and permissions.

Takeaways

- 😀 Custom assets are distinct from native assets, which are born with the network (e.g., Ether on the Ethereum network or Lumens on the Stellar network).

- 😀 Native assets, like Ether or Lumens, are used for network fees and are created alongside the network, whereas custom assets are issued later by user accounts.

- 😀 Smart contracts are applications deployed to a network (e.g., on Ethereum, Solana, Polygon), but Stellar offers an alternative through native functionalities.

- 😀 Stellar's native functionalities (called Stellar Classic) allow users to issue and manage custom assets directly without the need for complex smart contracts.

- 😀 Stellar's native functionalities are pre-built operations that can be combined to personalize assets, manage their profiles, and distribute them in the ecosystem.

- 😀 The issuing account in Stellar controls the custom asset. It determines the asset’s profile, access permissions, distribution, and minting/burning abilities.

- 😀 The issuing account is responsible for minting (creating) and burning (removing from circulation) units of the custom asset. The supply is managed through payment operations.

- 😀 A design pattern widely used in the ecosystem is the 'issuing-distribution pair,' where two accounts (issuing and distribution) are used to manage minting and burning separately.

- 😀 Stellar custom assets are non-permissioned by default, meaning anyone can interact with them. However, additional control mechanisms can be applied using authorization flags.

- 😀 Authorization flags in Stellar allow customization of access control and behavior of assets, transitioning them from non-permissioned to permissioned according to specific use cases.

- 😀 The use of authorization flags lets asset issuers create tailored access controls, ensuring the asset behaves according to the desired rules and permissions in different contexts.

Q & A

What is the difference between native assets and custom assets on a blockchain network?

-Native assets are built into the blockchain network from its launch, like Ether on Ethereum or Lumens on Stellar, and are primarily used to pay network fees. Custom assets are created afterward by user-controlled or issuing accounts and can represent stablecoins, CBDCs, securities, or other tokens.

What are smart contracts and how do they differ from native functionalities on Stellar?

-Smart contracts are on-chain applications deployed on networks like Ethereum, Solana, and Polygon, requiring planning, coding, and deployment. Native functionalities on Stellar, like Stellar Classic, are prebuilt operations that allow asset creation, distribution, and control without coding smart contracts.

What role does the issuing account play in Stellar?

-The issuing account creates and controls a custom asset, including its supply, profile, access permissions, and distribution. It is permanently linked to the asset and is the only account that can mint or burn units.

How is the supply of a custom asset managed in Stellar?

-The supply is managed using payment operations. Sending units from the issuing account to another account mints new units (adding to circulating supply), while sending units back to the issuing account burns them (removing from circulation).

What is the issuing-distribution pair pattern and why is it used?

-The issuing-distribution pair pattern uses two accounts: the issuing account mints units to the distribution account, which then distributes tokens to the ecosystem. This isolates supply management from distribution, providing better control and autonomy.

What is a non-permissioned asset in Stellar?

-A non-permissioned asset is the default type of asset that can be transacted by any account without restrictions, meaning anyone can create a trust line and send or receive the asset freely.

How do authorization flags affect a custom asset?

-Authorization flags allow the issuer to control who can hold and transact the asset. Enabling different flags moves the asset along a spectrum from non-permissioned to fully permissioned, creating a personalized profile for the token.

Can the issuing account hold its own asset in Stellar?

-No, the issuing account technically cannot hold a balance of the asset it controls. It only manages supply through operations like minting and burning via other accounts.

Why might a developer choose native functionalities over smart contracts on Stellar?

-Native functionalities are simpler and faster to implement since they are prebuilt. Developers can issue, profile, and distribute assets without coding, which saves time and reduces complexity compared to deploying smart contracts.

What types of assets can be created as custom assets on Stellar?

-Custom assets on Stellar can be any type of token, including stablecoins, CBDCs, securities, investment tokens, or any other digital asset defined by the issuing account.

How does the distribution account facilitate ecosystem participation?

-The distribution account is responsible for distributing the minted tokens to other accounts in the ecosystem. This separation from the issuing account allows secure and controlled distribution while maintaining the issuer's control over the total supply.

What is the significance of the asset profile in Stellar?

-The asset profile defines the behavior, permissions, and access control of the token. By customizing the profile through authorization flags, issuers can tailor the asset to specific use cases and regulatory requirements.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Aset? Ada yang Lancar, Ada yang Enggak Lho!! | #akuntansi #akuntansidasar

21 ASSETS that make you financially free | How to get rich HINDI |30 FREE Assets | GIGL

What is an Asset?

Bitcoin Tops $65,000, how much higher can it go?

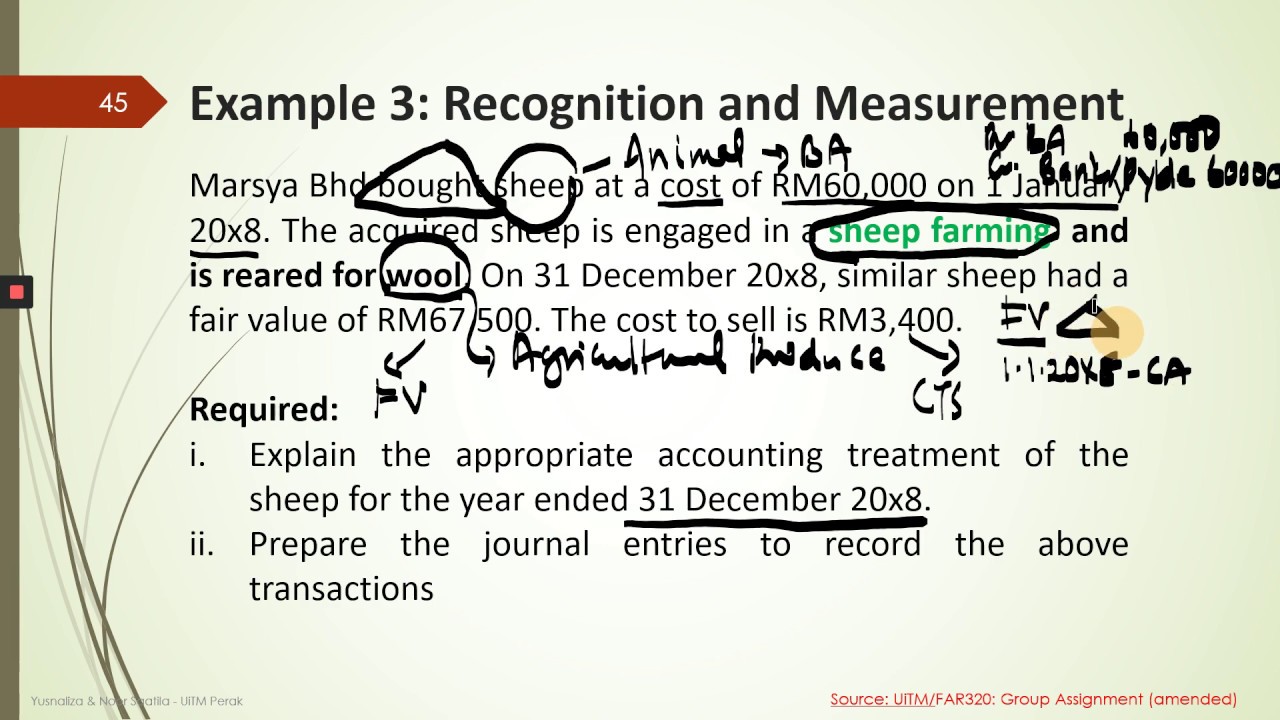

LECTURE 4/4 : MFRS 141/ IAS 41 AGRICULTURE (BIOLOGICAL ASSETS) : FAR320 TOPIC 2-PART 4

The 4th Turning - (Endgame Part 2)

5.0 / 5 (0 votes)