Analisis Laporan Keuangan, Sufi Jikrillah, ST, MM, CRA, CRMP

Summary

TLDRThis lecture on financial statement analysis, presented by Sufi Zikrillah, explores how financial reports serve as a reflection of a company's health, performance, and future prospects. It covers key financial ratios—including liquidity, asset management, debt management, profitability, and market value—and demonstrates analytical tools such as trend analysis, the DuPont system, and benchmarking. The lecture emphasizes the strategic importance of interpreting these ratios alongside qualitative factors like data quality, diversification, and management succession planning. Overall, it highlights financial statement analysis as a powerful tool for informed decision-making, improving performance, and strengthening a company's competitiveness in the market.

Takeaways

- 😀 Financial report analysis provides a clear reflection of a company's financial health, performance, and future development.

- 😀 The purpose of financial statement analysis is to help investors and managers make informed decisions about investments and business strategies.

- 😀 Financial ratios simplify complex financial data into understandable indicators, helping assess a company's competitiveness and financial position.

- 😀 Liquidity ratios, like current and quick ratios, measure a company's ability to pay off its short-term liabilities with current assets.

- 😀 Asset management ratios assess how efficiently a company uses its assets to generate sales, with key indicators like inventory turnover and fixed asset turnover.

- 😀 Debt management ratios reveal a company's reliance on debt and its ability to meet financial obligations, helping assess financial risk.

- 😀 Profitability ratios evaluate how effectively a company generates profit, reflecting the combined performance of liquidity, asset management, and debt management.

- 😀 Market value ratios, such as price-to-earnings and market-to-book value ratios, help assess investor perception of the company's future prospects.

- 😀 Trend analysis tracks the company's performance over time, helping identify patterns and potential risks or improvements in financial conditions.

- 😀 The DuPont system provides a breakdown of return on equity (ROE) into factors like profit margin, asset turnover, and financial leverage, offering insights into financial performance.

Q & A

Why is financial statement analysis important for both investors and managers?

-Financial statement analysis is important because it provides insight into a company's financial health, performance, and future direction. Investors use it to determine if a company is worth investing in, while managers use it to formulate strategies, maintain business continuity, and improve profitability.

What is the primary purpose of calculating financial ratios?

-The primary purpose of calculating financial ratios is to simplify complex financial data into easier-to-understand indicators that reveal a company's strengths, weaknesses, and competitive position within the industry.

What do liquidity ratios measure and why are they significant?

-Liquidity ratios measure a company's ability to pay off short-term liabilities using its current assets. They are significant because insufficient liquidity can disrupt operations and increase financial risk.

How do asset management ratios help assess a company's performance?

-Asset management ratios measure how effectively a company uses its assets to generate sales and profits. They include inventory turnover, Days Sales Outstanding (DSO), fixed asset turnover, and total asset turnover, providing insights into operational efficiency and resource utilization.

What does the debt management ratio indicate about a company?

-Debt management ratios indicate the extent to which a company relies on debt financing and its ability to meet financial obligations. Key measures include the debt ratio, times interest earned, and fixed charge coverage, which help assess financial risk and capital structure stability.

Which ratios are included in profitability analysis, and what do they reveal?

-Profitability ratios include profit margin on sales, basic earning power, return on assets (ROA), and return on equity (ROE). They reveal a company's ability to generate profit from its operations, assets, and shareholder equity, reflecting overall management effectiveness.

How do market value ratios assist investors?

-Market value ratios, such as price-to-earnings (PE) and market-to-book (MB) ratios, help investors assess how the market perceives the company's performance and future growth potential, indicating investor confidence and valuation expectations.

What is the role of trend analysis in financial statement evaluation?

-Trend analysis plots financial ratios or figures over time to evaluate the direction of company performance. It helps identify patterns of improvement or decline, providing long-term insights for strategic planning and risk assessment.

Explain the DuPont system and its practical use.

-The DuPont system breaks down return on equity (ROE) into profit margin, asset turnover, and equity multiplier components. It shows the underlying factors affecting ROE, allowing management to identify areas for improvement in operations, efficiency, and capital structure.

Why is benchmarking important in financial analysis?

-Benchmarking compares a company's financial performance against peers or industry standards. It identifies competitive positioning, areas needing improvement, and best practices that can enhance performance and market competitiveness.

What additional factors should complement ratio analysis for a complete financial evaluation?

-Beyond ratios, financial evaluation should consider data quality, company diversification, and management succession planning. These factors ensure accurate analysis, resilience to market changes, and continuity of strategic management.

What are the limitations of ratio analysis?

-Ratio analysis alone cannot provide a complete picture; it must be interpreted alongside industry conditions, economic trends, and company management policies. Ratios are indicators, not definitive answers, and should be integrated into broader strategic evaluation.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Konsep Fundamental, Analisis dan Laporan Keuangan || Pengantar Bisnis || Kelompok 12

Kenalan dengan Laporan Keuangan Emiten | feat. Brenda Andrina

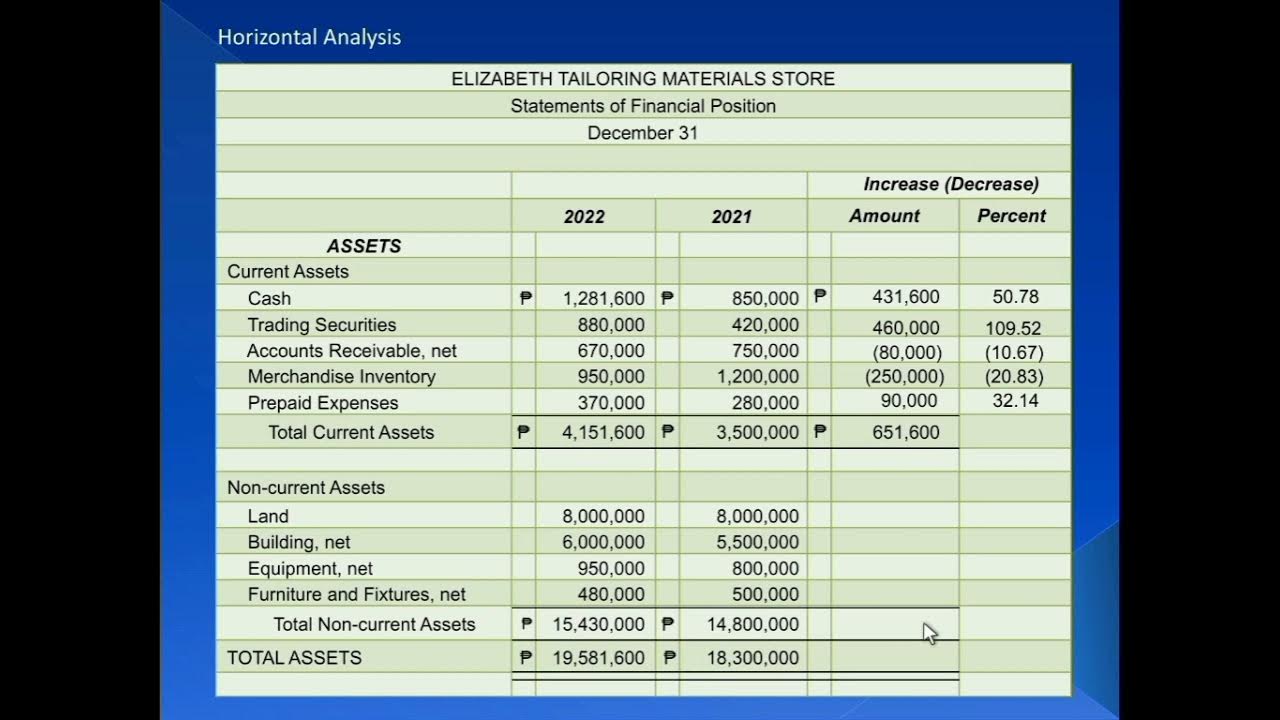

Part 1: Financial Statements Analysis (Intro, Horizontal Analysis and Vertical Analysis)

Types of Financial Analysis

Ratio Analysis Part 1

07- Análisis Horizontal y Vertical dentro de los Estados Financieros

5.0 / 5 (0 votes)