Amerika’da Yaşamak Pahalı mı? Aylık Masraflarım 2025

Summary

TLDRIn this video, the creator gives an in-depth look at his monthly expenses and lifestyle after moving into his own home in Florida. He details costs for mortgage, utilities, solar panels, car payments, insurance, groceries, social outings, dating, and pets, totaling around $5,000 per month. Despite a stable QA tester income, he emphasizes careful budgeting, saving, and investments while sharing insights on reducing costs through home cooking, solar energy, and an electric car. The video also touches on his YouTube efforts, startup venture, and reflections on managing debt, quality of life, and financial planning in the U.S.

Takeaways

- 🏠 The speaker purchased a five-room house in August 2020 with a 30-year mortgage at 3% interest and a 5% down payment.

- 💵 Monthly expenses total around $4,850–$5,000, including mortgage, utilities, car payments, groceries, dating, and pet care.

- 🔌 Electricity costs are high due to AC usage, but 44 solar panels help reduce energy expenses despite financing costs.

- 🚗 The speaker drives a Tesla, charging it at home with solar energy, which reduces gas expenses compared to a traditional car.

- 🍳 Most meals are cooked at home, keeping food expenses around $400 per month, with occasional dining out or fast food.

- 🐱 Two cats contribute about $70 per month in food and litter costs, highlighting pet-related expenses in monthly budgeting.

- 🎉 Entertainment and social activities, including nights out and dates, are budgeted at approximately $450 per month.

- 💻 Primary income comes from a QA tester job (~$6,000 net per month) with YouTube and startups providing side investment opportunities.

- 💰 The speaker emphasizes the importance of saving and investing, suggesting setting aside $1,000–$2,000 monthly for future use.

- 🤝 Despite financial considerations, the speaker values friendships and personal connections over money and maintains a simple, balanced lifestyle.

- 📊 Living alone has changed some expenses compared to living with roommates, reducing shared costs but increasing certain individual bills.

- 🚿 Pool maintenance and professional cleaning cost $115 monthly, showing additional costs of a larger property in Florida.

- 📉 The speaker warns about the risks of debt, preferring to minimize credit card use and pay off loans gradually.

Q & A

What is the speaker’s current source of income?

-The speaker currently earns from working as a QA tester, which provides a monthly salary of around $6,000 to $7,000. They also mention investing time into YouTube and starting a new startup, though these do not yet generate significant income.

How does the speaker describe the financial challenges of living in the US?

-The speaker explains that while their salary might be $100,000 annually, after taxes, retirement plans, and other expenses, their monthly income is reduced to about $6,000 to $7,000. This highlights the high cost of living in the US, especially in terms of taxes and the need for regular investments.

What does the speaker suggest as a way to manage financial challenges?

-The speaker advises not to rely on a single source of income and encourages investing in multiple opportunities, such as personal development and side projects. They stress the importance of always seeking new opportunities to ensure financial growth.

What are the speaker’s thoughts on starting a business?

-The speaker is enthusiastic about their new startup venture and plans to share more details once their partner, Furkan, arrives. The speaker sees entrepreneurship as a way to generate income and enhance their financial situation.

How does the speaker's current lifestyle compare to the past?

-The speaker notes that their lifestyle has improved compared to before. In the past, they lived in shared rooms with minimal expenses, but now they have a higher quality of life, which also comes with increased expenses. They are adapting to these changes while working harder.

What does the speaker mean by the phrase 'You have to keep chasing'?

-The phrase 'You have to keep chasing' refers to the necessity of always looking for opportunities, whether it’s a new job, investment, or side project. The speaker emphasizes the importance of remaining proactive and persistent to secure financial success.

What financial lesson does the speaker want the audience to take away from the video?

-The speaker wants the audience to understand that even with a decent income, managing expenses and investing wisely are essential for long-term financial stability. They emphasize saving and constantly looking for ways to invest and grow wealth.

How does the speaker view the role of a white-collar job in financial success?

-The speaker sees white-collar jobs, such as being a QA tester, software engineer, or UI/UX designer, as stable sources of income. However, they highlight that these jobs alone may not guarantee financial freedom unless combined with smart investments and additional income streams.

Why does the speaker talk about living expenses and financial management?

-The speaker discusses living expenses and financial management to demonstrate that even a moderate salary in the US might not be enough to secure a comfortable lifestyle without proper budgeting, savings, and investments. They want to show the audience that managing finances is critical, even for those with a white-collar job.

What does the speaker mean by 'always need to make an investment'?

-By 'always need to make an investment,' the speaker is emphasizing the importance of regularly putting money into ventures, projects, or assets that will generate future returns. This could include saving, starting side businesses, or investing in skills and knowledge to increase income potential.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

全英|在美国生活,一个月要花多少钱?How much does it cost to live in America? This is how much I spend in a month.

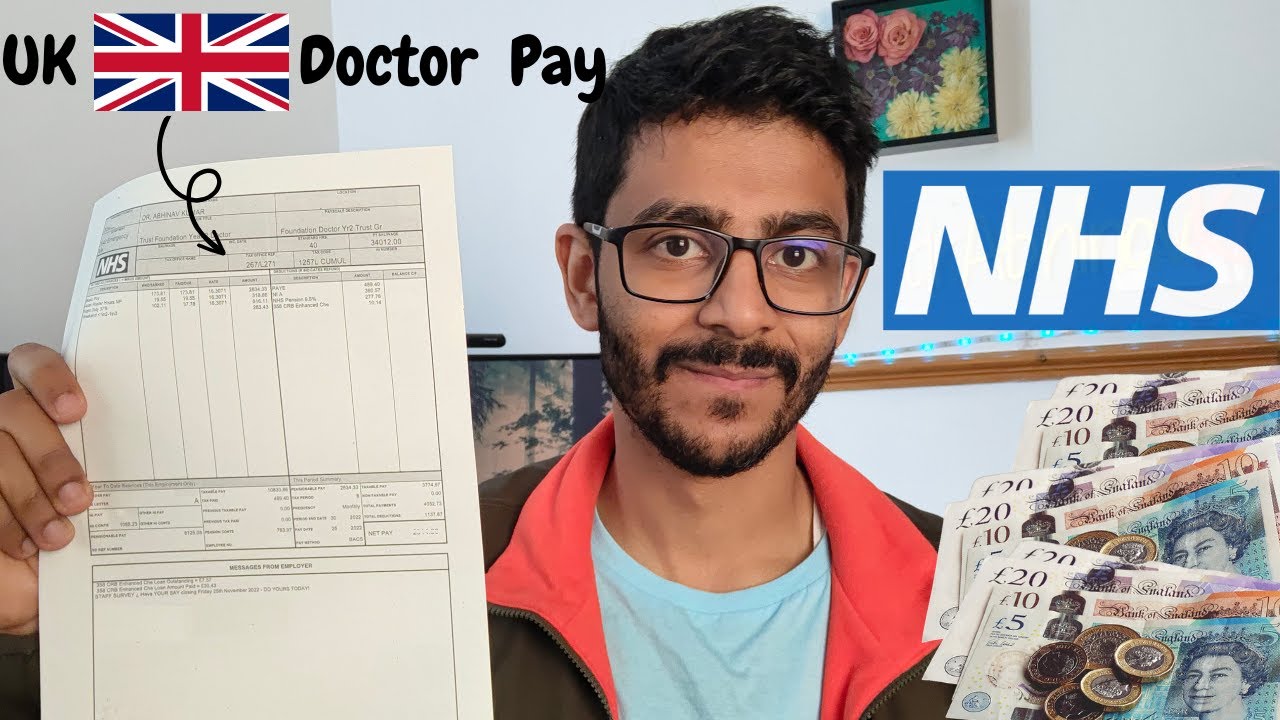

How much do I earn as a Doctor in the UK (Full breakdown of my salary 2024)

His 160 Sqft Tiny House offers BIG financial & mental health benefits

Vivere in #Thailandia NON È ECONOMICO! Ti Hanno Preso in Giro!

The Millionaire Who Lives in a Van

Cost Of Living In The Philippines After Ten Months Living Here!

5.0 / 5 (0 votes)