LIC Policy Pros & Cons 2025 | Sahi Investment Ya Galat? | Gurleen Kaur Tikku

Summary

TLDRThis video provides an in-depth analysis of LIC (Life Insurance Corporation of India) policies, exploring their advantages and disadvantages. It highlights the safety, trust, tax benefits, forced saving habits, and insurance coverage that make LIC policies appealing, especially for older investors seeking financial security. The video also addresses drawbacks, such as low returns, long-term lock-in, and limited pure insurance cover, comparing traditional LIC plans with alternatives like term insurance plus mutual funds. By emphasizing the importance of aligning investment choices with individual risk appetite and financial goals, it offers practical guidance for viewers deciding between safety and wealth creation.

Takeaways

- 😀 LIC policies are considered highly safe and reliable, providing peace of mind with minimal risk of loss.

- 😀 LIC encourages a forced saving habit, helping policyholders consistently set aside money through regular premium payments.

- 😀 Premiums paid towards LIC policies are eligible for tax deductions under Section 80C, and maturity or death benefits are tax-free under Section 10(10D).

- 😀 LIC policies offer a combination of savings and life insurance, providing both financial growth and protection for the family.

- 😀 Traditional LIC plans are long-term products, which may be less attractive to those seeking flexible, short-term, or liquid investment options.

- 😀 Returns on traditional LIC policies are generally lower (5–7%) compared to higher-risk, higher-return options like mutual funds (10–12%).

- 😀 Combining savings and insurance in LIC policies often results in higher premiums for relatively lower insurance coverage compared to pure term insurance plans.

- 😀 There is an opportunity cost in choosing LIC over alternative investment strategies; splitting funds between term insurance and mutual funds may yield higher returns and coverage.

- 😀 Older individuals (45+) tend to prefer LIC for safety and guaranteed returns, while younger investors (20–30) often favor term insurance plus mutual funds for wealth creation.

- 😀 Choosing the right financial product depends on your risk appetite, financial goals, and whether you prioritize safety or higher returns.

- 😀 LIC continues to be a trusted option for households seeking traditional insurance and savings, despite newer investment alternatives being available.

Q & A

What is the primary benefit of taking an LIC policy?

-The primary benefit of taking an LIC policy is safety and security. LIC is considered one of the safest options for investment with very low risk of failure, giving policyholders peace of mind that their money is safe.

How does an LIC policy help in developing a saving habit?

-LIC policies encourage a forced saving habit by making policyholders pay a premium every year. The commitment to pay a fixed amount annually creates a consistent savings routine, which people tend to follow for years to secure their financial future.

What tax benefits can be availed through an LIC policy?

-LIC policies offer tax benefits under Section 80C, where you can save up to ₹1.5 lakh on the premium paid. Additionally, under Section 10(10D), the maturity or death claim amount received from the policy is also tax-free.

What is the role of an LIC policy in providing insurance cover?

-An LIC policy combines savings with insurance coverage, ensuring that in the event of death, the policyholder’s family receives a lump sum amount. It is often seen as a way to cover both risk and savings, providing life insurance along with a return on the investment.

Why is LIC considered a long-term investment product?

-LIC policies are long-term products, meaning that they require a commitment for a longer period, usually several years. This can be seen as a disadvantage for people today who prefer short-term, flexible, and liquid investment options.

What happens if I want to surrender my LIC policy before it matures?

-If you surrender your LIC policy before maturity, you will incur a loss. While a surrender option exists, it results in financial loss, as the policyholder will not receive the full benefits they would have if they had held the policy until maturity.

What are the expected returns from an LIC policy compared to other investment options?

-LIC policies generally offer low returns, around 5-7%, as they are low-risk investments. This is in contrast to higher-risk options like mutual funds, which can yield returns of 10-12% in the long term. The trade-off for low returns with LIC is the safety it offers.

How does the insurance cover in an LIC policy compare to a pure term insurance policy?

-LIC policies that combine savings with insurance offer lower coverage compared to pure term insurance policies. For example, you may pay higher premiums for lower coverage with LIC, while term insurance offers higher coverage for a lower premium.

What is the opportunity cost of investing in an LIC policy?

-The opportunity cost of investing in an LIC policy is the potential higher returns that could be earned by investing in other financial products like mutual funds. By choosing LIC, you may miss out on higher returns and greater insurance coverage offered by products like term insurance combined with mutual funds.

Who would benefit most from investing in LIC policies?

-LIC policies are ideal for individuals looking for safety and stability, especially those in older age groups (45-50+). For people seeking a combination of life insurance with guaranteed returns, LIC is a suitable option. However, younger individuals looking to grow wealth may find better returns in mutual funds combined with term insurance.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Complete Insurance Awareness for NIACL AO Mains 2021 | Chapter - 1 @OliveboardApp

IC 38 Important Questions in Hindi | LIC Agent Exam | IC 38 Exam #lic #insuranceagent

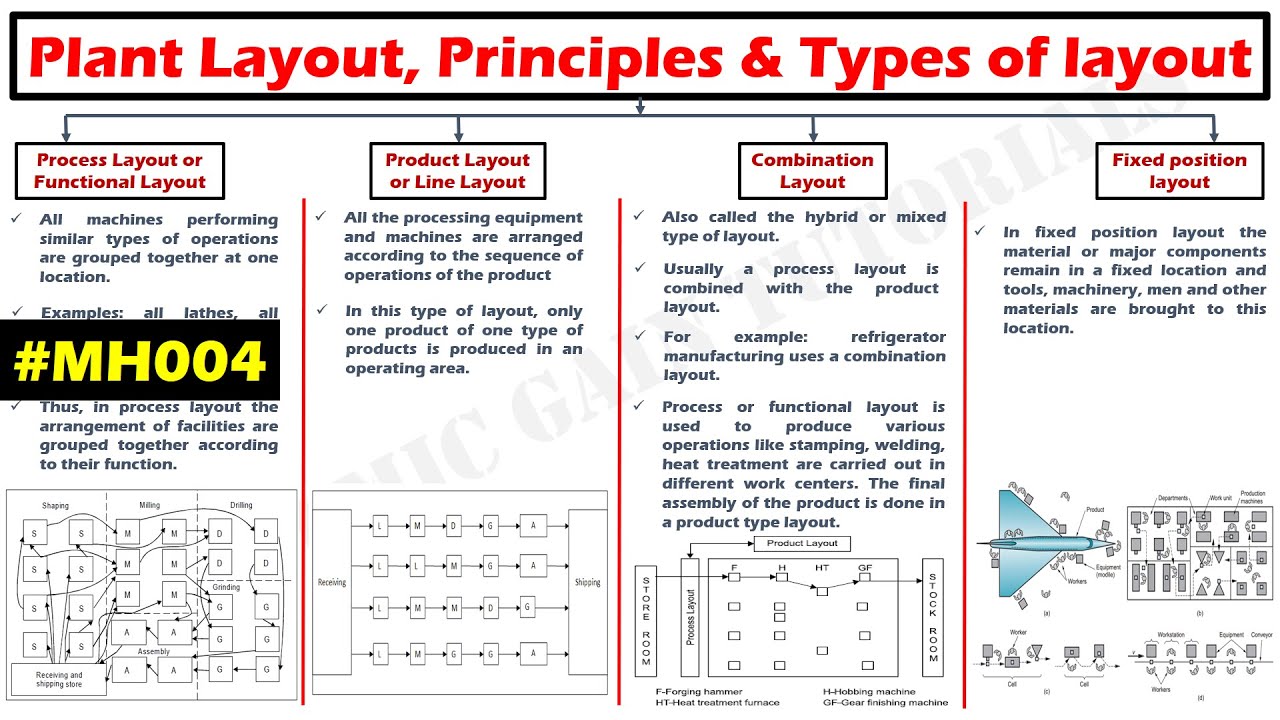

#MH004 Plant Layout, Principles of plant layout & Types of layout.

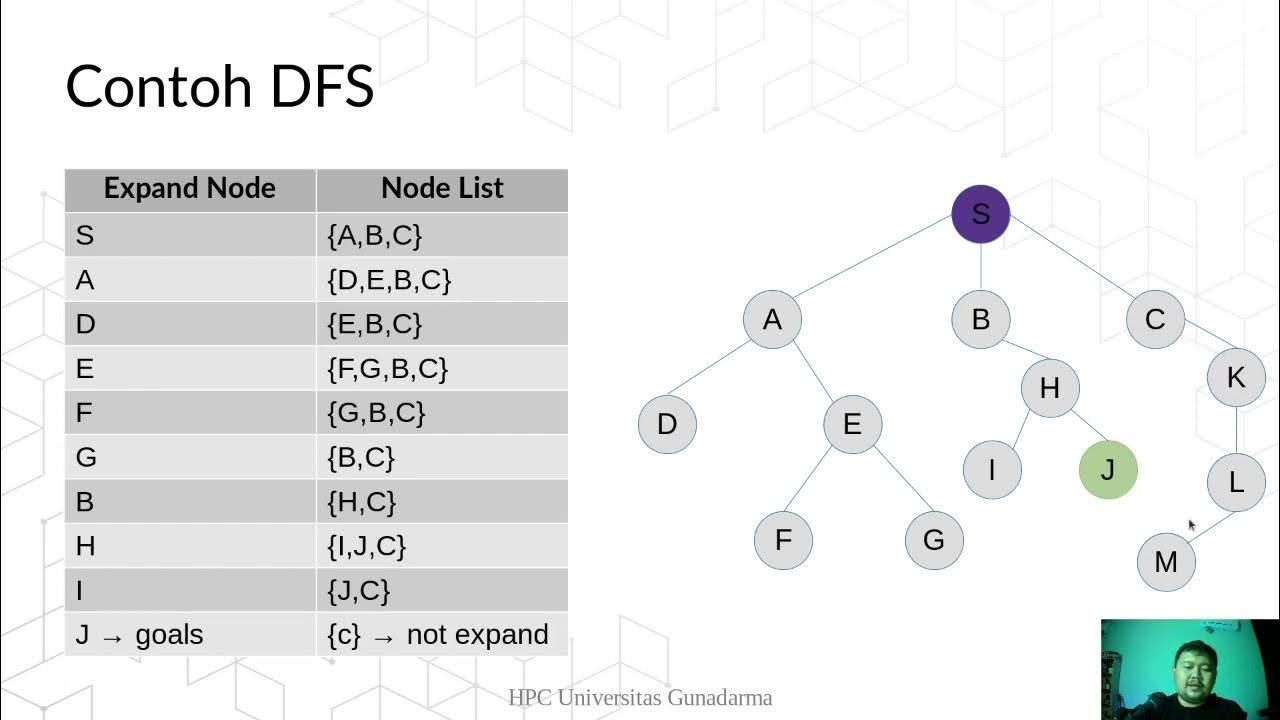

DFS -Depth First Seach

INTRODUCTION Overview of Financial Management

LIC Jeevan Umang VS Jeevan Utsav | LIC जीवन उमंग VS जीवन उत्सव | LIC Plan 945 VS Plan 871|LIC Insure

5.0 / 5 (0 votes)