NVDA Stock - Big Move Coming ?

Summary

TLDRIn this Nvidia daily update, the speaker reviews the company’s recent earnings report, noting a muted market reaction with initial drops stabilizing around $181. Key technical levels are analyzed, highlighting support at $179–180 and resistance near $181–182. The discussion emphasizes caution, avoiding emotional trading, and observing post-earnings volatility, especially around weekly and monthly closes. Potential bearish patterns, retracement levels, and Fibonacci indicators are explored, while the speaker shares personal risk/reward strategies, favoring purchases near previous all-time highs (~$147–150). Overall, the video provides a step-by-step, objective guide for monitoring Nvidia post-earnings and identifying high-probability trading setups.

Takeaways

- 📊 Nvidia reported earnings with mixed reaction: initially down ~4%, closed near flat (~$181.6), after-hours down ~2%.

- 📉 Market expected a 3–6% move post-earnings; the actual reaction was slightly less than expected.

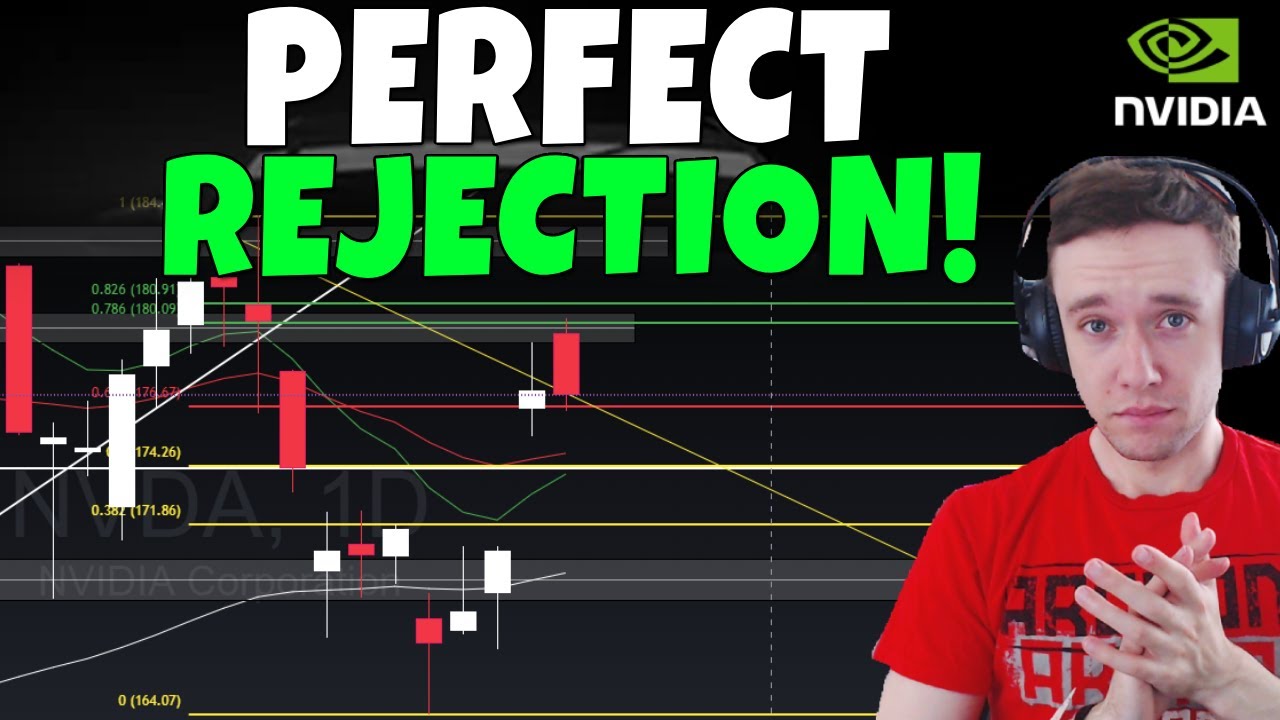

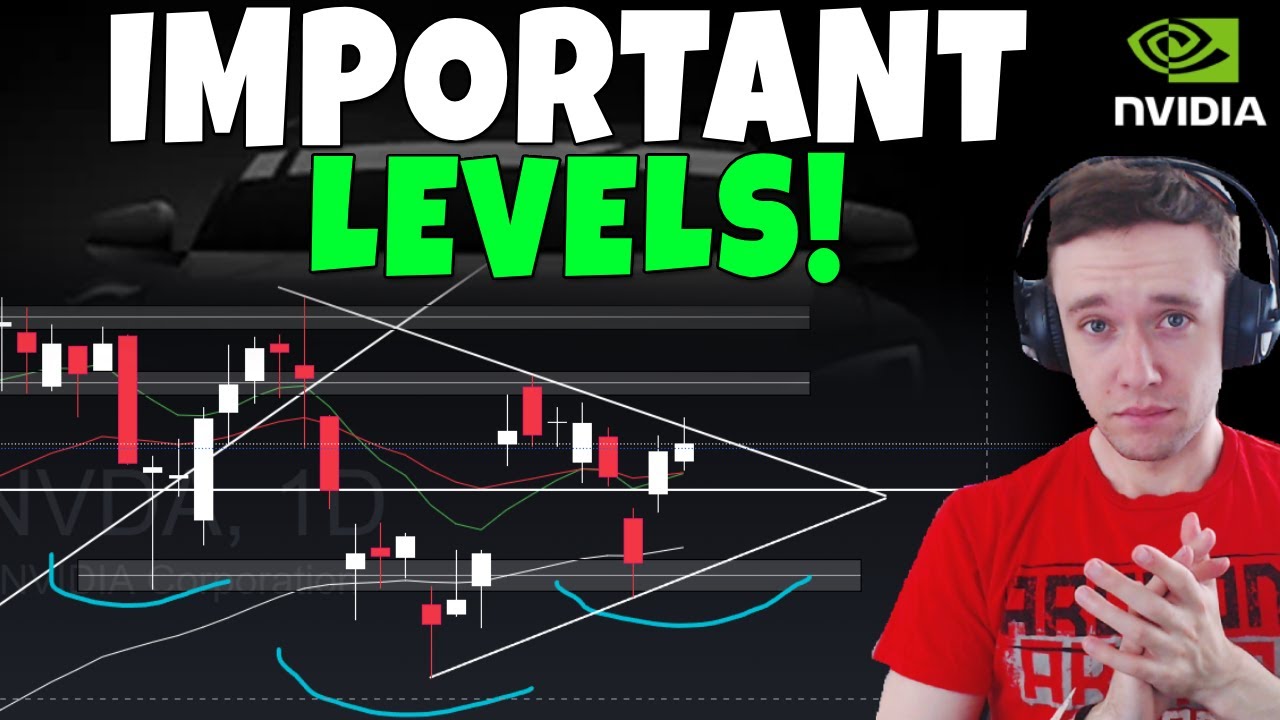

- 🟢 Key support levels are around $179–180, while resistance is at $181–182.

- ⚠️ Technical patterns suggest potential bearish continuation with a dead cat bounce or bear flag, possibly dropping to mid-160s if weak.

- 📈 Possible bullish scenario: a bull flag could form if support around mid-170s holds, preserving upward momentum.

- 📅 Closing weekly candles below ~$175 would be concerning for bulls and could indicate higher downside risk.

- 🎯 Long-term risk/reward entry is more favorable near prior all-time highs around $150–147, aligning with the 0.382 Fibonacci level.

- 🧠 Trading psychology: avoid emotional reactions to short-term price movements and remove FOMO from decisions.

- ⏱️ Step-by-step observation is important: monitor daily, weekly, and monthly charts before drawing conclusions or acting.

- 💡 Options sellers likely benefited from the muted earnings reaction, while alternative opportunities may exist in stocks like Apple, Netflix, or United Healthcare.

- ⚖️ Overall, short-term Nvidia trading is risky post-earnings; patience and careful analysis of price action and key levels are crucial.

Q & A

What was Nvidia's stock reaction immediately after the earnings report?

-Nvidia's stock initially dropped about 4% after the earnings report, but later recovered to around a 1.5% decrease by market close. After-hours trading showed roughly a 2% decline.

What is the significance of the $179–180 and $181–182 price levels?

-$179–180 is considered a short-term support range, while $181–182 acts as immediate resistance. The stock has been oscillating between these levels post-earnings.

Why does the speaker emphasize waiting before judging earnings reactions?

-Because post-earnings price movements can be volatile and may reverse. Judging too quickly can lead to emotional trading mistakes. Allowing the dust to settle gives a clearer picture of the trend.

What are the key technical patterns mentioned in the script?

-The speaker references dead cat bounces, bear flags, and potential bull flags, which indicate short-term reversals, retracements, or continuation setups in the stock price.

Which indicators are highlighted for technical analysis?

-The speaker mentions Fibonacci retracement levels, weekly MACD, and SMI (Stochastic Momentum Index) to analyze the stock's momentum, trend, and potential support/resistance.

What is the speaker’s mid-term target for Nvidia stock based on risk/reward?

-The speaker considers the $150 range, near previous all-time highs and the 0.382 Fibonacci retracement, as an attractive risk/reward level for longer-term entry.

What should traders watch in the coming week post-earnings?

-Traders should monitor how the stock opens the next day, intraday price action, and weekly/monthly candle closes, particularly around mid-170s for support.

How does the speaker approach trading Nvidia compared to Tesla?

-The speaker does not experience FOMO with Nvidia, which allows objective and disciplined trading. In contrast, Tesla triggers FOMO, which can influence decisions negatively.

Why does the speaker suggest other stocks might be better trades currently?

-Because Nvidia is considered a risky short-term long post-earnings, while other stocks like Apple, Netflix, and United Healthcare offer safer setups with better risk/reward ratios and less exposure to earnings volatility.

What does the speaker say about the potential for a larger retracement?

-If weekly candles close below about $175, it could trigger a larger retracement, potentially taking the stock into the mid-160s, signaling a more significant correction.

How does the speaker suggest traders manage emotions during volatility?

-Traders should remove emotion, not panic if the stock falls, and not get overly excited if it rises. An objective, emotionless approach helps in evaluating trades accurately.

What does the speaker consider the best-case scenario post-earnings?

-The best-case scenario is a strong bull flag formation, where the stock stabilizes and potentially rallies, indicating a healthy continuation of the bullish trend.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)