Forms of business organization | FIN-Ed

Summary

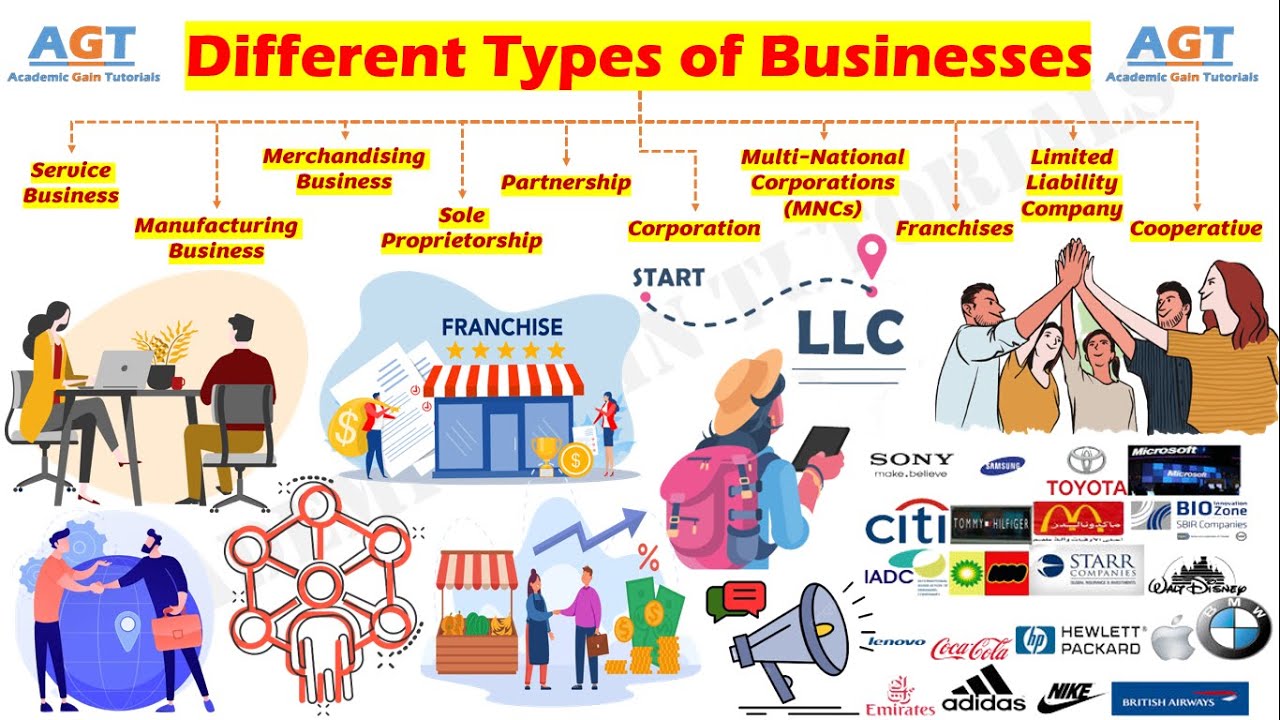

TLDRThis video explains the key differences between various business structures: proprietorships, partnerships, corporations, LLCs, and LLPs. It covers the advantages and disadvantages of each form, such as ease of formation, liability, access to capital, taxation, and longevity. Corporations dominate sales, but partnerships and LLCs offer flexibility and limited liability. Additionally, S-corporations are briefly discussed for their tax benefits. The video provides a clear overview to help viewers understand the best fit for different business needs.

Takeaways

- 😀 The basics of financial management are the same for all businesses, large or small, but the legal structure of a firm affects its operations.

- 😀 There are four main forms of business organizations: proprietorships, partnerships, corporations, and limited liability companies (LLCs).

- 😀 Over 80% of all business is conducted by corporations, based on the dollar values of sales.

- 😀 A proprietorship is an unincorporated business owned by one individual, offering advantages like ease of formation and low taxes but with limitations like unlimited personal liability.

- 😀 Partnerships are unincorporated businesses involving two or more people, with advantages similar to those of a proprietorship but better access to outside capital.

- 😀 A corporation is a separate legal entity with unlimited life, easy ownership transfer, and limited liability, but it faces double taxation and SEC regulations.

- 😀 LLCs are a hybrid between partnerships and corporations, offering limited liability protection and taxation as partnerships.

- 😀 LLPs are similar to LLCs, commonly used by professional firms like accounting, law, and architecture firms, offering limited liability but taxed as partnerships.

- 😀 An S-corporation is a variant of a corporation that is taxed like a proprietorship or partnership, allowing it to avoid corporate income tax.

- 😀 The legal structure of a business significantly impacts its ability to raise capital, liability, taxes, and the business’s longevity.

Q & A

What are the four main types of business organizations?

-The four main types of business organizations are proprietorships, partnerships, corporations, and limited liability companies (LLCs) or limited liability partnerships (LLPs).

What is the main advantage of a sole proprietorship?

-The main advantages of a sole proprietorship are its ease and low cost of formation, fewer government regulations, and lower income taxes.

What are the main disadvantages of a sole proprietorship?

-The main disadvantages are unlimited personal liability, limited lifespan, and difficulty obtaining large amounts of capital.

How is a partnership different from a sole proprietorship?

-A partnership involves two or more people who share ownership, while a sole proprietorship is owned by a single individual. Partnerships have better access to outside capital compared to sole proprietorships.

What are the major advantages of a corporation?

-Corporations have several advantages, including unlimited life, easy transferability of ownership, limited liability for shareholders, and the ability to raise capital easily.

What are the key disadvantages of a corporation?

-The key disadvantages of a corporation are double taxation (on both corporate profits and shareholder dividends) and subject to regulations by the Securities and Exchange Commission (SEC).

What is an LLC, and how is it different from a corporation?

-An LLC is a hybrid business structure that combines features of both partnerships and corporations. Unlike a corporation, an LLC is typically not taxed at the corporate level and offers more flexibility in management.

What is an LLP, and when is it commonly used?

-An LLP is a limited liability partnership, which provides limited liability protection for its partners. It is commonly used in professional fields like accounting, law, and architecture.

How does an S-corporation differ from a regular corporation?

-An S-corporation is taxed similarly to a proprietorship or partnership, meaning it is exempt from corporate income tax. It passes income directly to its shareholders, avoiding double taxation.

Why is the legal structure of a business important?

-The legal structure of a business affects its operations, including taxation, liability, and ability to raise capital. Choosing the right structure is crucial for long-term success and compliance.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)