Legal Forms of Business Organization

Summary

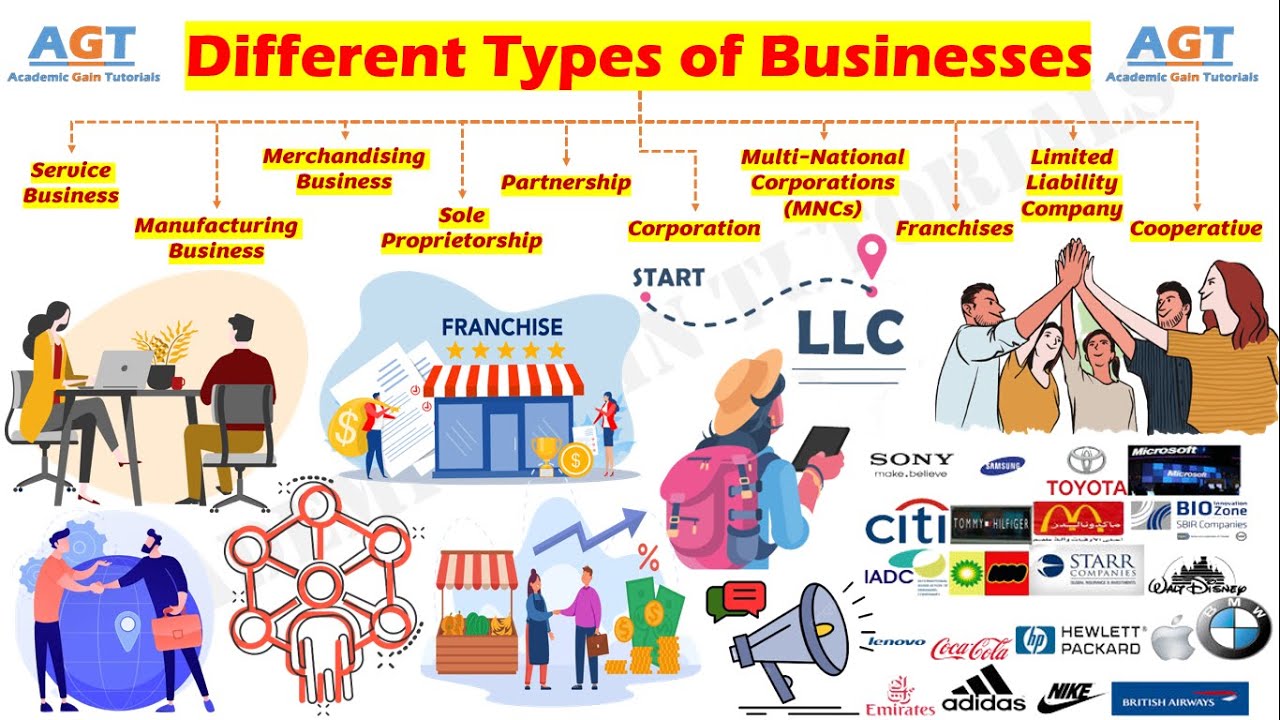

TLDRThis video provides an insightful overview of various legal structures for organizing a business, such as sole proprietorships, partnerships, corporations, S corporations, LLCs, and specialized forms like B Corps and L3Cs. The speaker explains the key advantages and disadvantages of each, focusing on aspects like liability, taxation, formation ease, and transferability of ownership. The goal is to help entrepreneurs make informed decisions about the best legal structure for their business, balancing personal liability, tax implications, and long-term goals. Practical examples and legal considerations are also discussed to guide viewers through the complexities of choosing the right business organization.

Takeaways

- 😀 Sole proprietorships are the easiest and most common way to set up a business, but they come with unlimited personal liability.

- 😀 In a sole proprietorship, the business owner pays both the employer and employee share of Social Security and Medicare taxes.

- 😀 Partnerships require at least two people and involve shared ownership, but they also carry the risk of unlimited personal liability unless it's a limited partnership.

- 😀 Partnerships can be difficult to manage without a clear agreement on ownership and responsibilities, and they are subject to high failure rates.

- 😀 Corporations, like C-corporations, are separate legal entities that provide limited liability for shareholders, but they are subject to double taxation: once at the corporate level and again at the shareholder level.

- 😀 Incorporating a business through Articles of Incorporation creates a formal legal structure with liability protection, but it comes with higher setup costs and complexity.

- 😀 S-corporations offer the liability protection of a corporation, but are taxed like a partnership (pass-through taxation), avoiding double taxation for smaller corporations.

- 😀 Limited Liability Companies (LLCs) combine the benefits of liability protection with pass-through taxation, and they are more flexible than S-corps in terms of ownership distribution.

- 😀 LLCs can be set up by a single person or a partnership, offering flexibility in how profits and losses are allocated, but they are relatively new and less supported by legal precedent.

- 😀 Specialized business structures like Benefit Corporations (B-Corps) and Low-Profit LLCs (L3Cs) are designed to prioritize social or environmental goals while still generating profits, though L3Cs are not legal in all states.

Q & A

What is the simplest legal form of business organization?

-A sole proprietorship is the simplest legal form of business organization. It is owned by one person, and requires minimal legal steps to set up, such as obtaining a business license and filing a fictitious business name if necessary.

What are the main advantages of a sole proprietorship?

-The main advantages of a sole proprietorship include ease of setup, simple accounting, and direct control by the owner. The owner receives all the profits, and there is no interference from other stakeholders.

What are the disadvantages of a sole proprietorship?

-The key disadvantages of a sole proprietorship include unlimited personal liability, which means the owner's personal assets are at risk in case of business debts or lawsuits. The business is also limited in terms of capital and growth potential.

What is a partnership and how does it differ from a sole proprietorship?

-A partnership is a business structure where two or more people share ownership and responsibilities. Unlike a sole proprietorship, which is owned by one person, a partnership divides profits, liabilities, and management responsibilities among partners.

What are some risks or challenges of a partnership?

-In a partnership, disagreements between partners, differing lifestyles, or changing commitments can cause conflicts and lead to business failure. Additionally, partners have 'agency power,' meaning one partner can bind the entire partnership to legal agreements without the others' consent.

What is the main advantage of a corporation compared to sole proprietorships and partnerships?

-The main advantage of a corporation is limited liability, meaning the owners (shareholders) are only liable for the amount they invest in the company. This structure also offers more flexibility in transferring ownership and raising capital.

How is a corporation taxed differently from a sole proprietorship?

-A corporation is subject to dual taxation: it pays corporate taxes on its income, and shareholders pay personal taxes on any dividends or profits distributed to them. In contrast, a sole proprietorship only faces one level of taxation, as business income is reported on the owner's personal income tax return.

What is an S corporation and how does it differ from a C corporation?

-An S corporation is a special type of corporation that avoids double taxation by passing income directly to shareholders, who then report it on their personal tax returns. It offers the liability protection of a corporation while being taxed like a partnership. A C corporation, on the other hand, faces double taxation.

What is the main advantage of forming a limited liability company (LLC)?

-The main advantage of an LLC is that it combines the limited liability protection of a corporation with the pass-through taxation of a partnership. This means that the owners (members) are not personally liable for business debts, and the business's profits are only taxed once, on the members' personal returns.

What is the main difference between an LLC and an S corporation?

-An LLC offers more flexibility in terms of ownership and profit distribution, allowing for different ownership percentages and more fluid adjustments in how profits are shared. In contrast, an S corporation has stricter rules regarding ownership and profit distribution and can only have up to 75 shareholders, all of whom must be individuals or certain trusts.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Forms of business organization | FIN-Ed

Entrepreneurship New Ventures and Business Ownership Dr George Mochocki

Overview of Business Organizations

Business Structure - How to Choose the Right Structure for your Business

Small Business Tutorial - Exploring business entity types

10 Different Types of Businesses

5.0 / 5 (0 votes)