How to project standard deviations

Summary

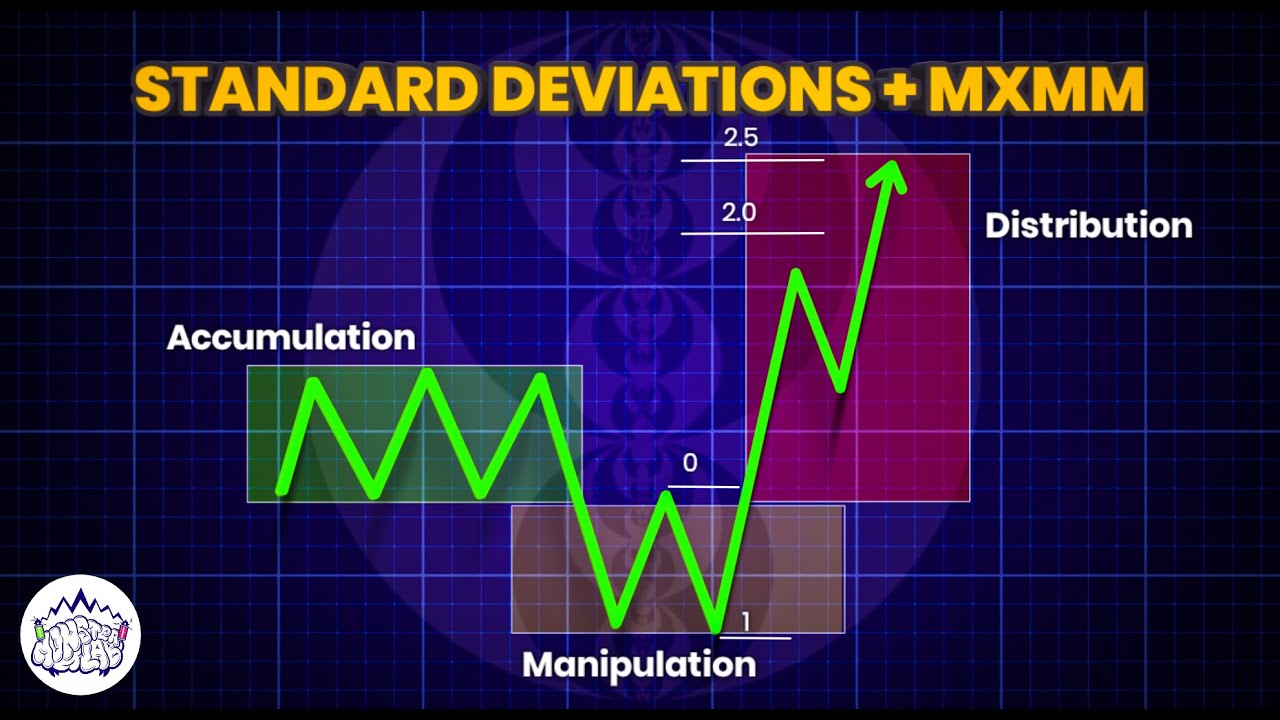

TLDRIn this video, the speaker discusses advanced trading techniques, focusing on price manipulation, standard deviation levels, and the importance of the 'power of three' in predicting market behavior. They emphasize the significance of backtesting to build confidence in a trading model, rather than relying on forward testing. Key concepts like market swings, CPI highs, and SMT (similar market tops) are explored to help traders anticipate price movements. The speaker stresses patience, learning from past data, and taking calculated risks for improved accuracy in predicting future trades.

Takeaways

- 😀 Confidence in trading comes from backtesting, not forward testing. Ensure you have a data-driven foundation before executing trades.

- 📈 Always follow your trading plan. Trust your model and stay disciplined in executing the strategy.

- 🔍 Understanding key price levels, such as the 'power of three', can give insight into potential market movements.

- 💡 Opening prices are crucial; they can reveal the strength of a buy or sell model and help project future price behavior.

- 📊 The 'last manipulation leg' and standard deviation analysis are key to predicting price swings and market trends.

- 🔄 NQ and ES index pairs can be analyzed together to confirm price movements and entry points, improving accuracy.

- 📏 Tools like Fibonacci retracement and distribution legs are essential in identifying potential market reversals and trends.

- ⚖️ Statistical analysis and the concept of standard deviations play a critical role in making informed decisions and setting expectations for market behavior.

- 🧠 Trading accuracy improves with experience and backtesting. The more you analyze past data, the better you’ll become at reading the market.

- ⏳ Patience is key. Even after consecutive losses, trust in the model's statistical probability to deliver results in the long term.

Q & A

What is the key to success in trading according to the speaker?

-The key to success in trading, as emphasized by the speaker, is following a structured plan, backtesting the strategy to build confidence, and consistently applying the method even after experiencing losses.

What does the speaker mean by 'the power of three'?

-'The power of three' refers to a concept in the speaker's strategy where the opening price of a specific period (like 6 a.m.) plays a crucial role in determining potential price movements. This can signal either a buy or sell model depending on the market action.

How does the speaker use standard deviation in their analysis?

-The speaker uses standard deviation to identify price levels where the market could be expected to move, helping to determine areas where price manipulation might occur. The speaker tracks the relationship between standard deviations on different time frames to project potential price action.

Why is backtesting important for building confidence in a trading strategy?

-Backtesting is important because it allows traders to validate their strategy based on historical data, proving that the strategy has statistical support. It provides confidence in taking setups, even after experiencing losses, as it shows the likelihood of success over time.

What role does 'manipulation' play in the speaker's strategy?

-Manipulation refers to instances where price moves through certain levels (such as highs or lows) to create false signals. The speaker monitors these manipulations, especially around key levels like the CPI high, to forecast potential reversals or continuation of trends.

How does the speaker handle multiple losses in a row?

-The speaker explains that multiple losses are part of the process, and confidence comes from the ability to keep taking setups, even after losses, because the strategy is statistically proven to work over time. Backtesting helps in managing expectations and understanding that losses are temporary.

What is the significance of the 10:00 a.m. time frame in the speaker's strategy?

-The 10:00 a.m. time frame is critical because the speaker expects certain price behaviors to play out by this time, often seeing manipulations or reversals around this point. It’s a key marker for determining whether the market will continue in a specific direction or reverse.

What does the speaker mean by 'SMT' in their analysis?

-SMT stands for Standard Market Timing, a concept where the speaker monitors specific market events or price levels in relation to a certain time or other assets. For example, the CPI high is a significant level that could indicate potential market manipulations and price action.

How does the speaker approach trading when there is no clear SMT signal?

-When there is no clear SMT signal, the speaker looks at the alignment of other indicators, such as the distribution leg, standard deviation levels, and the manipulation around key open prices to make informed decisions about price direction.

What should traders focus on during forward testing versus backtesting?

-The speaker stresses that traders should focus on backtesting to build confidence and statistical evidence of their strategy. Forward testing alone isn’t enough because the process lacks the historical context needed to refine and trust a strategy. Backtesting gives traders a clearer picture of what to expect over time.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)