AS/A Level Accounting - Part exchange of assets and Depreciation entries

Summary

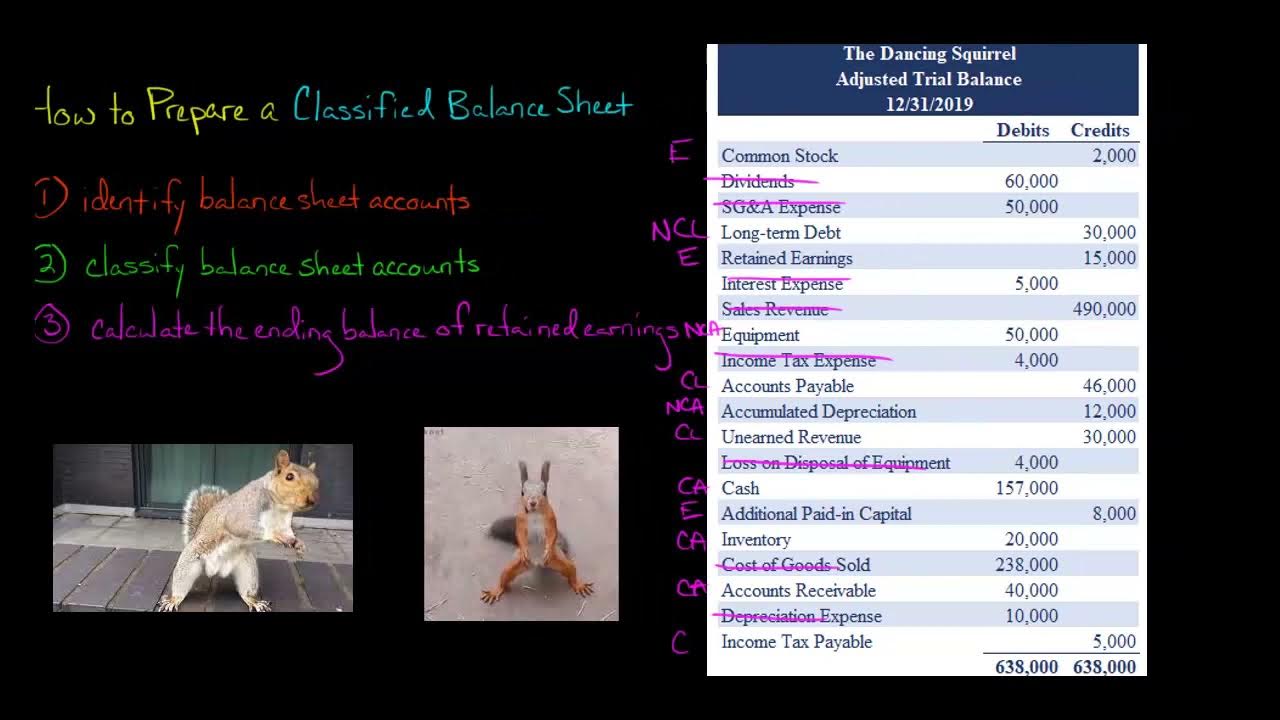

TLDRIn this video, the process of accounting for the part exchange of non-current assets is explained. The video begins with a revision of disposal entries, including how to transfer the cost and accumulated depreciation of an asset. It then covers how the entries for part exchange differ from normal asset disposals, where a new asset is received and the old asset's value is credited to the disposal account. A practical example involving motor vehicles is used to illustrate the journal entries and calculations, helping viewers understand the concept in detail.

Takeaways

- 😀 The video covers the entries to be passed when there is a part exchange of a non-current asset.

- 😀 It's assumed that viewers are familiar with basic depreciation concepts before watching this video.

- 😀 A quick revision of disposal entries is presented, including the transfer of cost and accumulated depreciation to the asset disposal account.

- 😀 The sale value of the asset is recorded through cash or bank debits, with the asset disposal account being credited.

- 😀 The difference between the sale value and the net book value helps calculate the profit or loss on disposal.

- 😀 The part exchange of assets involves the same entries as disposal, except the third entry, which is replaced by the receipt of a new asset.

- 😀 In a part exchange, instead of receiving cash or a check for the old asset, the new non-current asset is debited, and the disposal account is credited.

- 😀 The final entry in a part exchange transaction reflects the cash or cheque paid for the difference in the value of the new asset and the old one.

- 😀 In a part exchange, the old asset’s value is credited to the disposal account and deducted from the price of the new asset.

- 😀 The video uses an example to clarify the process, demonstrating how to record the purchase and disposal of a motor vehicle in the ledger accounts.

Q & A

What is the first entry to be passed when disposing of an asset?

-The first entry is to transfer the cost of the asset from the asset account to the asset disposal account. This is done by debiting the asset disposal account and crediting the asset account with the original cost of the asset.

How do you handle accumulated depreciation when disposing of an asset?

-The accumulated depreciation on the asset being disposed of is transferred to the asset disposal account. This is done by debiting the provision for depreciation account and crediting the asset disposal account with the accumulated depreciation amount.

What entry is made when an asset is sold or disposed of for cash or cheque?

-When the asset is sold or disposed of for cash or cheque, the entry made is to debit the cash or bank account and credit the asset disposal account with the sale value of the asset.

How do you calculate the profit or loss on asset disposal?

-The profit or loss on asset disposal is calculated by deducting the net book value (original cost minus accumulated depreciation) from the sale value of the asset. If the sale value exceeds the net book value, a profit is recorded. If the sale value is lower than the net book value, a loss is recorded.

What changes in the journal entries during a part exchange of non-current assets?

-In a part exchange, instead of receiving cash or cheque for the old asset, a new non-current asset is received. The journal entry involves debiting the new asset account with the cost of the new asset and crediting the disposal account with the value of the old asset. The difference is paid in cash or cheque, and this amount is recorded as a credit in the cash or bank account.

What is the primary difference between a regular disposal and a part exchange of assets?

-The primary difference is that in a part exchange, the old asset is not sold for cash but is traded for a new asset. The value of the old asset is credited to the disposal account, and the new asset is debited. The difference between the cost of the new asset and the old asset's value is settled by cash or cheque.

How is the sale of the old asset treated in a part exchange transaction?

-In a part exchange, the sale of the old asset is treated by crediting the disposal account with the value agreed by the supplier. The value of the old asset reduces the price of the new asset. There is no cash or cheque received for the old asset.

What is the correct way to handle the motor vehicle account in a part exchange transaction?

-In a part exchange transaction for a motor vehicle, the old vehicle's cost is credited to the motor vehicle account, and the new vehicle's cost is debited. The value of the old vehicle, provided by the supplier, is credited to the disposal account, and the balance is paid in cash or cheque.

How is depreciation calculated for a motor vehicle being exchanged?

-Depreciation for the motor vehicle is calculated based on the time the asset was held by the business. For example, if the vehicle was used for three months before exchange, depreciation for those three months is provided using the reducing balance method. In the example, depreciation for three months on the vehicle was calculated to be $630.

What happens to the provision for depreciation account during a part exchange transaction?

-During a part exchange transaction, the entire accumulated depreciation of the old asset is transferred from the provision for depreciation account to the asset disposal account. This clears out the accumulated depreciation of the old asset before the exchange.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)