Day Trading NQ Market Maker Model Review - ICT Concepts

Summary

TLDRIn this video, the trader walks viewers through a recent execution on the NASDAQ and ES, emphasizing the slow price action due to a bank holiday and minimal news drivers. The trader details their reasoning for being bullish, highlighting key price levels, liquidity imbalances, and SMT formations. They explain their decision-making process for entering and exiting trades, including using fair value gaps and order flow analysis. The trade ended with a modest profit, with a focus on caution due to the lack of major news. The video also touches on other markets like oil, gold, and silver, providing insights into various opportunities.

Takeaways

- 😀 The speaker discusses a recent trade executed on the NASDAQ and ES markets.

- 😀 The market conditions were slow due to a bank holiday and lack of major news events.

- 😀 The speaker had a bullish outlook on NASDAQ and ES based on a low being taken on ES and an internal liquidity imbalance.

- 😀 The speaker observed price action on the NASDAQ and identified key lows and imbalances to inform their trading decisions.

- 😀 A consolidation pattern was formed, which led the speaker to believe that the lower move could be a manipulation setup.

- 😀 The speaker noted the presence of an SMT (Smart Money Technique) pattern, which helped to inform their decision to enter a trade.

- 😀 A key aspect of the trade was waiting for displacement above certain highs before entering the market.

- 😀 The trade had a modest risk-reward ratio (1:1.19), and the speaker closed it early after noticing a price rejection.

- 😀 The speaker emphasizes the importance of not being overly aggressive with trades during low-volatility periods.

- 😀 Other markets like oil, gold, and silver saw significant moves, but the speaker didn't capitalize on them, focusing only on the NQ trade.

- 😀 The overall trade resulted in a small profit, with the speaker noting a 'tiny green' from a 25-point move, and they plan to continue trading the next day.

Q & A

What is the main reason the speaker was bullish on NASDAQ and ES?

-The speaker was bullish on NASDAQ and ES because ES had taken out a recent low and visited an imbalance. This suggested the potential for price to move up and target higher levels, driven by internal to external liquidity flows.

What is SMT and why did the speaker mention it?

-SMT stands for 'Smart Money Technique.' It refers to a pattern where price action forms relative lows or highs that can be manipulated. The speaker mentioned it because they observed SMT formations as key indicators for trade setups, specifically for potential reversals after lows were swept.

What was the reasoning behind waiting for a displacement above a certain high before entering a long trade?

-The speaker wanted to see a displacement above a certain high to confirm that the market was ready to move higher. This helped ensure that the trade had a higher probability of success, as it validated the breakout from a consolidation zone.

Why did the speaker avoid taking the long position in the 1-hour fair value gap initially?

-The speaker avoided taking the long position in the 1-hour fair value gap because they hadn’t yet seen enough price action to confirm the validity of the move. The speaker preferred waiting for further confirmation before entering the trade.

What was the risk-to-reward ratio (RR) of the trade taken by the speaker?

-The risk-to-reward ratio of the trade was 1:1.19, which the speaker considered low. Despite the low RR, they took the trade because of the technical setup and the higher probability of success after the price displaced above the high.

Why did the speaker exit the trade quickly after entering?

-The speaker exited the trade quickly because they observed a rejection of price movement. Although the trade setup was good, the market lacked significant news drivers, and the speaker chose to take the small profit rather than hold out for larger moves.

What external factors influenced the speaker's decision to take a cautious approach in this trade?

-The speaker was cautious because there were no major news drivers for the week. The lack of impactful news like NFP or FOMC meant that the market was likely to be slow and the risk of large moves was lower.

What was the primary trade taken by the speaker, and what asset was it focused on?

-The primary trade taken by the speaker was a long trade on NASDAQ (NQ) after observing a displacement above a certain high and confirming the presence of a fair value gap. The speaker focused on this asset for its technical setup.

How did the speaker handle their trade execution in terms of account management?

-The speaker executed the trade on multiple accounts, including TOP Step accounts and a deviate account. They aimed for conservative risk management, taking the trade with a low-risk setup and deciding to exit early due to market conditions.

What was the speaker's outlook on other markets like oil, gold, and silver?

-The speaker mentioned that oil had a huge move higher and that they should have taken a long position in it. They noted that gold was trending higher as well. For silver, they observed that it was likely targeting equal highs, and they considered it for a potential trade, but the setup didn’t materialize.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Weekly Forecast - January 4th, 2026

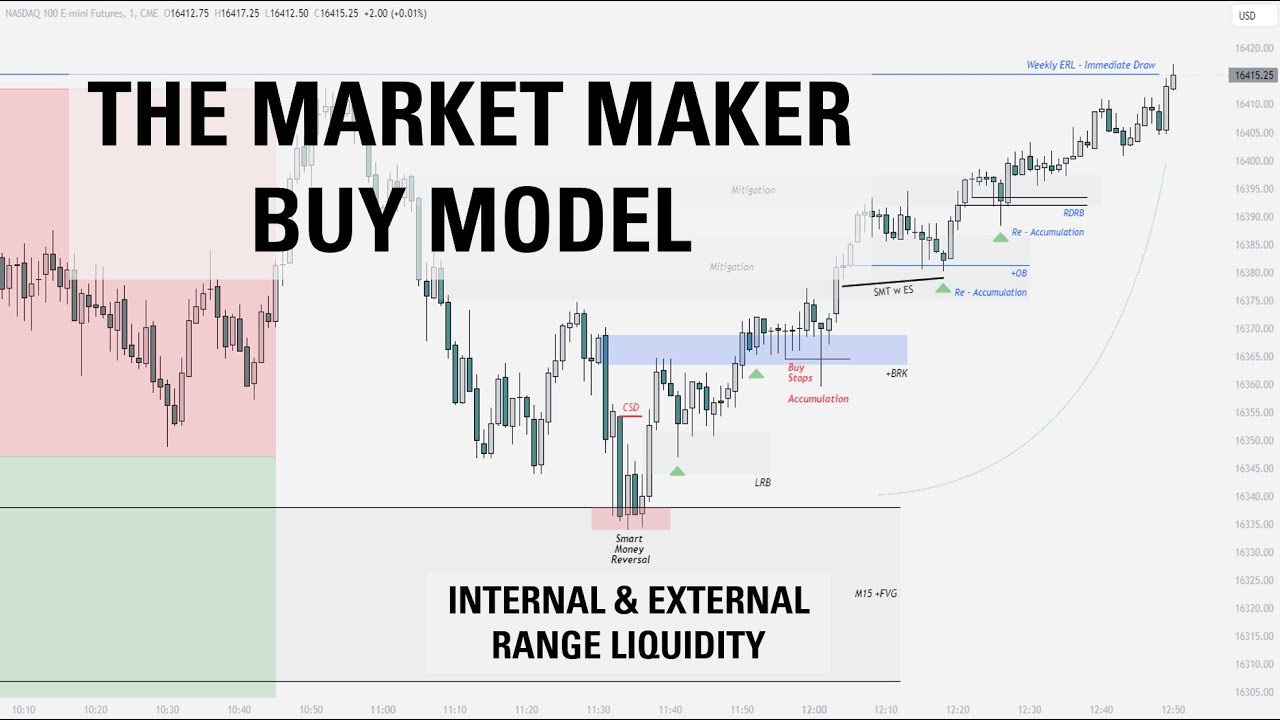

The Market Maker Buy Model | Full Trade Breakdown $NQ

ICT 9:30am Judas Swing Model - Explained In-depth

The Only SMT Divergence Video You Need

My Top 3 Trades from the World Cup

HOW TO TRADE THE MARKET MAKER X MODEL without BIAS! trade RECAP pt.9 (detailed explanation)

5.0 / 5 (0 votes)