Ball & Brown 1968 - Group 1

Summary

TLDROn Black Monday (February 24, 2003), a major scandal shook the Dutch Stock Exchange when Royal Ahold, a parent company of several international brands, was found to have overstated earnings by $880 million. This led to the resignation of its CEO and CFO, facing accusations of fraud. The incident demonstrated the importance of stock prices reflecting known information quickly. Research by Colin Brown highlighted the timeliness of accounting income numbers, showing that most information is already priced in by the time annual reports are released. The Ahold case proved that manipulating earnings can have severe consequences, as stock prices were corrected after the truth emerged.

Takeaways

- 😀 Black Monday (24th February 2003) marked a major accounting scandal involving Royal Ahold, a prominent Dutch company.

- 😀 Royal Ahold overstated earnings by 880 million dollars, leading to severe consequences for stockholders and executives.

- 😀 Stockholders reacted with a sharp decline in share prices and market value in just a few days after the revelation of fraud.

- 😀 The CEO and CFO of Royal Ahold were forced to resign and faced accusations of fraud, potentially leading to jail time and large penalties.

- 😀 The scandal demonstrated the efficiency of stock prices in reflecting all known information, as the stock price quickly adjusted after the fraud was uncovered.

- 😀 Colin Brown's research showed that accounting income numbers (like net income and earnings per share) hold significant value in assessing a firm's performance.

- 😀 Accounting income numbers represent 50% of the information about a firm that becomes available during the year, according to Brown's study.

- 😀 Annual income reports are not efficient in terms of timeliness, as 80-90% of the information is already reflected in stock prices before the report is released.

- 😀 The study emphasized that income numbers are informative, but most of the information they provide is already known to stockholders.

- 😀 Brown's research also demonstrated that stock prices deviate from the market average when a firm provides information not already reflected in the market, with larger-than-expected earnings leading to stock price increases.

Q & A

What event is referred to as 'Black Monday' in the script?

-Black Monday refers to February 24th, 2003, when a major scandal involving accounting malpractice was revealed at Royal Ahold, a Dutch company, leading to a dramatic drop in stock price and market value.

What was the nature of the accounting fraud at Royal Ahold?

-Royal Ahold, the parent company of several supermarkets, overstated the earnings of U.S. Food Services by $880 million and withheld crucial information from their accountants, leading to a significant financial scandal.

What was the immediate consequence for the CEO and CFO of Royal Ahold?

-The CEO and CFO were forced to resign and faced accusations of fraud, with potential jail time and large penalties.

What positive insight did the Royal Ahold scandal provide for the stock market?

-The scandal demonstrated that stock prices efficiently reflect all known information, as the stock price corrected almost immediately after the news about the manipulated earnings was made public.

What research does Colin Brown's paper focus on?

-Colin Brown's paper investigates whether accounting income numbers like net income or earnings per share are useful, by examining the timeliness and information content these numbers provide to stakeholders.

How did earlier economists like John Cannon view accounting numbers?

-John Cannon and other economists believed that analytical accounting numbers were simply results of accounting procedures and had little value in understanding a company's actual performance.

What did Colin Brown's research reveal about the role of accounting income numbers?

-Colin Brown found that accounting income numbers reflect 50% of all information available about a firm during the year and that while these numbers are informative, a large portion of the information is already reflected in the stock price before the annual report is released.

How does the stock price reflect company information according to the script?

-Stock prices are said to incorporate all market information, including firm-specific components that reflect information unique to the company. As soon as real net income information is made public, stock prices adjust accordingly.

What were the consequences when the real earnings of Royal Ahold were revealed?

-Once the true earnings were revealed, the stock price corrected, causing a loss of over $6 billion in market value, highlighting the importance of truthful financial reporting.

What does the script suggest about the relationship between stockholders and company owners during financial misreporting?

-The script suggests that stockholders are often misled by company owners, who can deceive them with false information. However, the truth eventually comes out, and financial markets correct themselves when the real information is disclosed.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Fast Fashion Exposed - The Effects of the Growing Industry

PwC China Suspended, Fined Record $62M for Evergrande Audit Failures

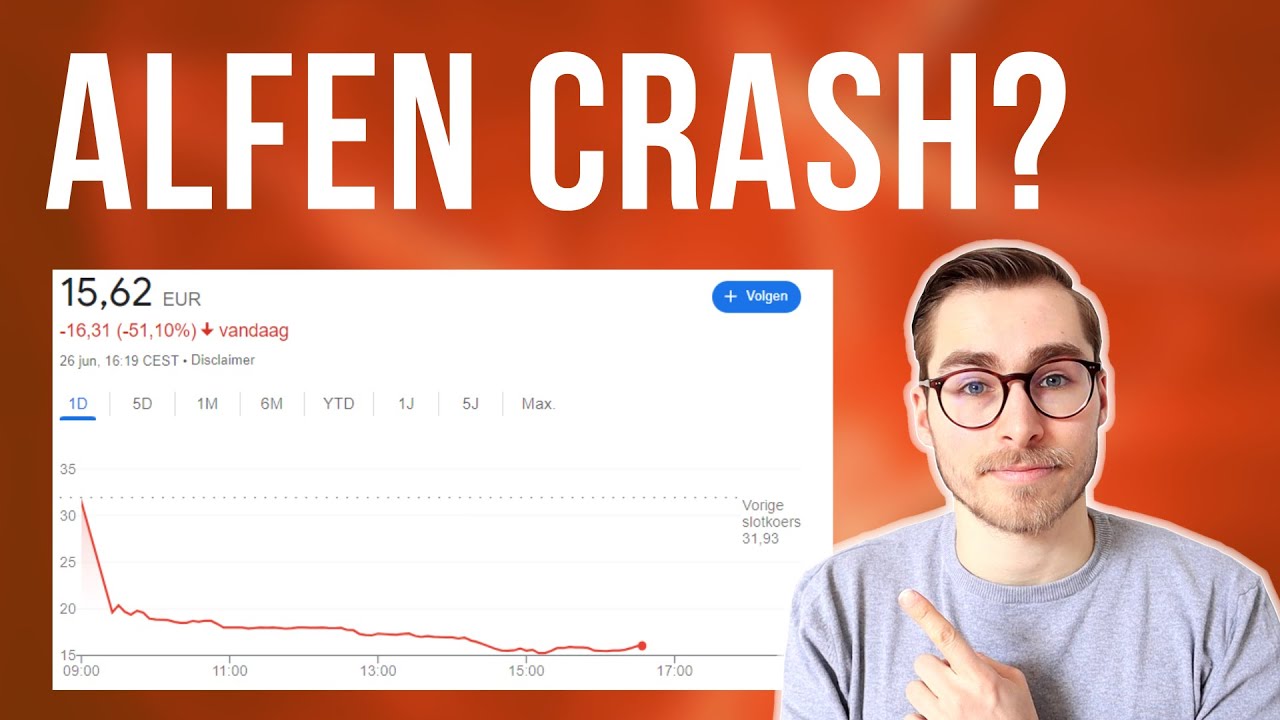

Wat is er aan de hand met ALFEN?

MCH: Cổ phiếu đã tăng 150% - Có nên tiếp tục nắm giữ? | Phân tích cổ phiếu

The Biggest Accounting Scandal in Italian History: The Fall of Parmalat

Skandal Akuntansi ini Gila, tapi Banyak Orang Ga Tahu!

5.0 / 5 (0 votes)