The First Presented FVG Explained

Summary

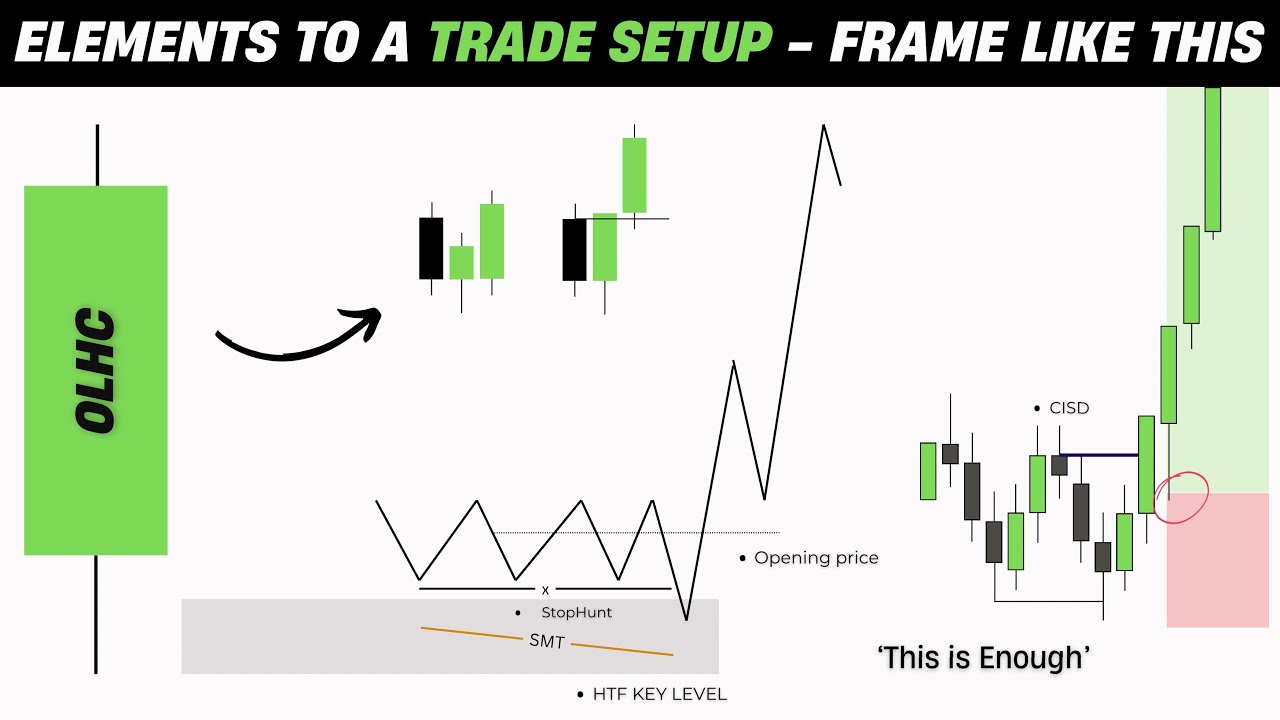

TLDRThis video provides an in-depth guide on the concept of the 'First Presented Fair Value Gap' (FVG), which forms after the market opens at 9:30 AM. The speaker explains how to identify these gaps, their significance, and how to use them in trading strategies. By exploring real trading examples across different days of the week, including using them for entry and exit points, the video emphasizes combining these gaps with other models like the 2022 model. The concept also touches on post-news FVGs and when gaps might be invalid, helping traders understand how to refine their setups for better decision-making.

Takeaways

- 😀 The 'First Presented Fair Value Gap' (FVG) forms after 9:30 AM and is the first gap following the 9:30 candle, excluding the 9:29 candle.

- 😀 The 'Post-News Fair Value Gap' forms after an 8:30 AM news release and is significant when the price moves away from a balanced range.

- 😀 A valid FVG is one that doesn't include a balanced price range, meaning it shouldn’t be preceded by an up-and-down candle in a tight price range.

- 😀 The first presented FVG of a new week (like Monday’s) can be extended throughout the entire week, and price often gravitates toward it.

- 😀 Traders can use these FVGs for reactions during specific times, such as macros or looking for entries when the FVG is hit.

- 😀 Combining the first presented FVG with other models like the 2022 model enhances confidence in trade setups.

- 😀 FVGs should be extended throughout the day and week, as price often bounces off these areas during the trading session.

- 😀 On certain days, such as Wednesday, an FVG can be used both for shorting if it’s bearish or for long setups if it’s a bullish inversion play.

- 😀 Post-news FVGs, especially those formed after a news release, can provide useful insights when marked on charts and used as a directional indicator.

- 😀 Backtesting is encouraged to validate the strategy. Even if a trade doesn’t work out perfectly, sticking to the rules is key to successful trading in the long run.

Q & A

What is the first presented fair value gap?

-The first presented fair value gap is the first fair value gap that forms after the 9:30 opening bell of the market, excluding the 9:29 candle. The first candle it includes is the 9:30 candle.

What is a key difference between a valid and invalid first presented fair value gap?

-A first presented fair value gap is considered invalid if it includes the 9:29 candle. For example, if a fair value gap includes the 9:29 candle along with the 9:30 candle, it is not considered the first presented fair value gap.

How can the first presented fair value gap be used in trading?

-The first presented fair value gap can be used to identify potential trade setups. Traders can extend the gap across the day or even the week, looking for price reactions at these levels, which may indicate a potential entry point for a trade.

What is a typical reaction to the first presented fair value gap after it is formed?

-Once the first presented fair value gap is formed, price tends to gravitate toward it, often bouncing off the gap. Traders can use this bounce as a potential entry signal, especially during specific time periods like the 10:00 a.m. to 11:00 a.m. window.

How does the first presented fair value gap relate to the 2022 model?

-The first presented fair value gap can complement the 2022 model by adding extra confidence to a trade setup. If a trade meets the criteria for the 2022 model and also aligns with the first presented fair value gap, the confidence in the setup increases.

What does the use of the first presented fair value gap in conjunction with daily volume imbalances indicate?

-When price reacts to the first presented fair value gap and moves toward or away from a daily volume imbalance, it indicates that there is a significant price level to watch. For example, if price runs into a daily volume imbalance, it could signal a continuation or reversal based on the gap.

What should traders look for when the price fails to respect the first presented fair value gap?

-If price fails to respect the first presented fair value gap (e.g., the gap is not hit or is violated without a proper retest), it might be a sign to wait for the next gap or to consider other indicators to reassess the market conditions.

What is a post-news fair value gap, and how is it different from the first presented fair value gap?

-A post-news fair value gap forms after an 8:30 news release, whereas the first presented fair value gap forms after the market opens at 9:30. The post-news gap is used to identify significant market reactions post-news, and is often used to trade short-term price movements following a news event.

How do balanced price ranges affect the validity of a fair value gap?

-A balanced price range, where price moves up and then down within the same candle, is considered less significant when forming a fair value gap. If the gap occurs within such a balanced range, it is not considered a valid fair value gap for trading purposes.

What does it mean when the first presented fair value gap isn't tagged during a day?

-If the first presented fair value gap isn't tagged during a particular day and just runs away, traders may look to use that gap the following day, especially if the price is still in close proximity. This suggests that the gap may still hold significance for future price action.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)