Mengapa Konsistensi Profit Lebih Berharga Daripada Entry Sempurna

Summary

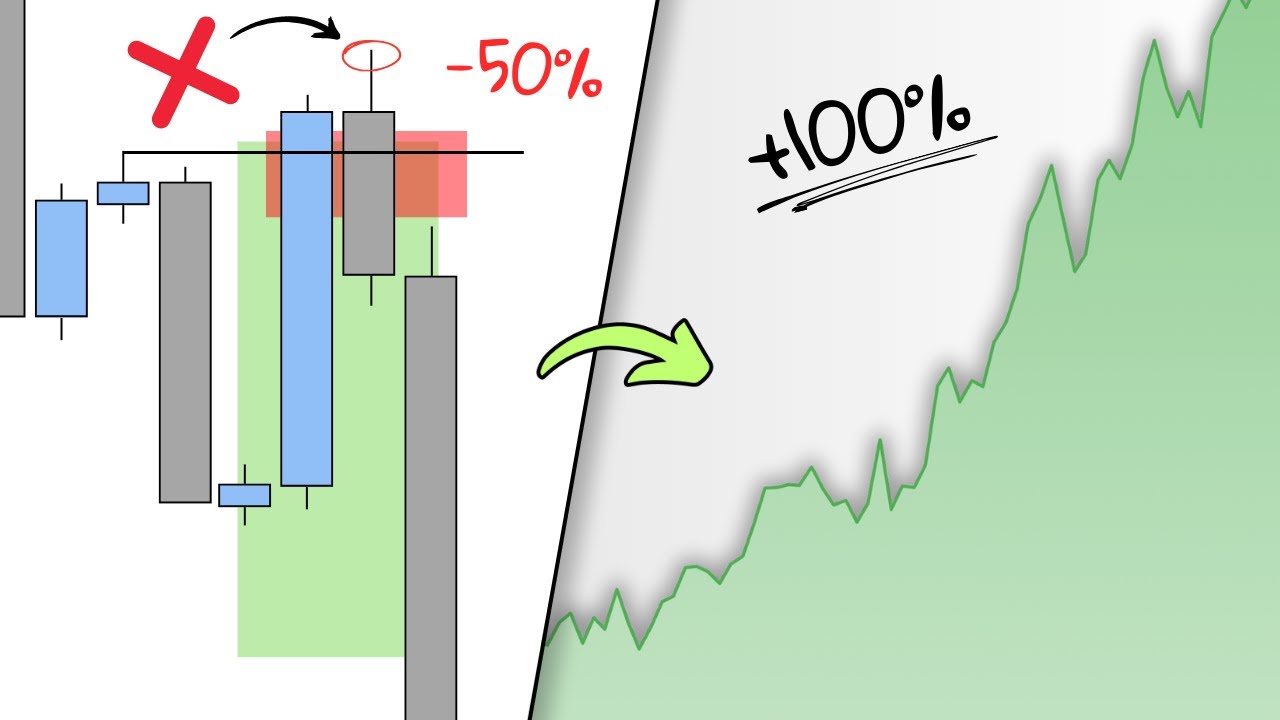

TLDRIn this video, the NFC Forex mentor emphasizes the importance of managing expectations in trading, highlighting that consistent, realistic profit goals are more valuable than chasing rare, high-reward trades. Traders should focus on sound risk-reward strategies and long-term consistency rather than seeking 'trade of the year' opportunities. The mentor shares insights on using exponential moving averages (EMA) for trend analysis and introduces the 'Exponential Scalper' tool to assist with trade management. Overall, the video stresses the significance of patience, consistency, and finding a trading style that matches one’s risk profile and goals.

Takeaways

- 😀 Emphasizing risk-reward and money management is crucial in trading, with a focus on trading psychology above technical aspects.

- 😀 Avoid chasing 'trade of the year' opportunities. Such trades are rare and may lead you to miss consistent, profitable setups.

- 😀 Managing your expectations is vital. Don't aim for unrealistic profits, like turning $100 into $10,000 overnight.

- 😀 Risk-reward ratios like 1:10 or 1:20 are rare, and while they can be profitable, they require numerous trades to succeed in the long run.

- 😀 Focus on consistent, realistic returns such as 1:2 or 1:3 risk-reward ratios, which can provide healthy account growth over time.

- 😀 The 'trade of the year' is rare, only happening once a year, and it's hard to predict when it will appear.

- 😀 Many traders focus too much on finding rare, high-reward trades and miss out on solid, repeatable setups with realistic profit potential.

- 😀 Use trading tools like the exponential scalper to automate and assist in decision-making, but ensure you understand how to trade manually first.

- 😀 Consistency is more important than aiming for big profits in each individual trade. A balanced approach is key to being a successful trader.

- 😀 Be clear about your trading style—whether you're a scalper or a swing trader—because the tools and methods you use should match your style and risk tolerance.

- 😀 Always have clear goals and objectives in your trading, and align your expectations with your risk profile for long-term success.

Q & A

What is the main message the speaker is conveying in the video?

-The speaker is emphasizing the importance of managing expectations and focusing on consistent, sustainable profits in forex trading, rather than chasing rare, high-risk, high-reward trades. They also highlight the significance of a disciplined trading strategy and the proper use of tools like the exponential scalper.

Why does the speaker warn against focusing on the 'trade of the year'?

-The speaker warns against focusing on the 'trade of the year' because such opportunities are rare, difficult to predict, and often lead traders to miss out on more frequent, profitable trades that offer realistic returns with lower risk.

What does the speaker mean by 'managing expectations' in forex trading?

-Managing expectations means understanding that trading is about consistent, smaller profits over time, rather than seeking large, one-off gains. Traders should not expect to turn small amounts of capital into large sums quickly, but instead focus on steady growth through disciplined trading.

How does the speaker suggest traders balance their desire for big profits with the need for consistency?

-The speaker suggests that traders should aim for a balance by setting clear goals, staying consistent with their trading methods, and focusing on smaller, more frequent trades rather than gambling on big, rare profits. This approach will lead to long-term success.

What role does risk-reward (RR) play in the speaker's trading philosophy?

-Risk-reward (RR) is essential in the speaker's philosophy, but they stress that traders should not only chase extreme RR ratios like 1:10 or 1:20. Instead, they advocate for consistent risk management with more achievable and frequent RR ratios, such as 1:2 or 1:3, which help build a healthy, growing account.

What is the exponential scalper tool mentioned in the video?

-The exponential scalper tool is a semi-automatic trading assistant that helps monitor trades, manage stop-losses, and set take-profit levels based on specific indicators like moving averages. It automates parts of the trading process while still allowing traders to follow their strategy.

Why does the speaker use the exponential scalper tool, and what is its advantage over manual trading?

-The speaker uses the exponential scalper tool because it helps them follow trends, automatically manage stop-losses, and set take-profit levels without constant monitoring. It also reduces the risk of emotional decision-making and ensures more consistent results over time.

What advice does the speaker give to traders who are considering purchasing tools like the exponential scalper?

-The speaker advises that tools like the exponential scalper can be useful, but they are not essential for success. Traders can still be profitable by learning the principles of trading and using free methods. However, if they have extra money, they can consider purchasing tools to help automate certain aspects of trading.

How does the speaker suggest traders define their trading style?

-The speaker suggests that traders should assess their own risk tolerance and trading preferences, such as whether they prefer scalping or swing trading. This helps them choose the right tools and strategies that align with their style, whether automated or manual.

What does the speaker say about traders who look for constant transactions every day?

-The speaker mentions that some traders may feel pressured to have constant transactions every day. However, they emphasize that not every trader needs to be active all the time. Consistent, less frequent trades with realistic expectations can be more profitable in the long run, and tools like the exponential scalper can assist those who want to maintain a steady trading pace.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)