Memilih Produk ETF

Summary

TLDRIn this detailed discussion, Matius Deni and Mas Marco explore the dynamic world of investment in Indonesia's capital markets. They delve into the differences between passive and active investment strategies, with a focus on products like IPS and mutual funds. The conversation touches on market indexes, their relevance to investors, and strategies for diversifying portfolios. Additionally, they provide valuable tips for investors, highlighting the importance of financial planning, disciplined investing, and choosing appropriate products based on individual goals. The session also emphasizes Indonesia's growth in the investment space, especially in comparison to other ASEAN countries.

Takeaways

- 😀 The number of investment products listed on Indonesia's stock market has increased significantly, with 47 IPOs recorded in 2020.

- 😀 Indonesia has the highest number of initial public offerings (IPOs) in Southeast Asia as of 2020, overtaking Singapore after several years.

- 😀 Passive investment products, like index-based mutual funds, are popular in Indonesia, offering low-cost, diversified investment opportunities.

- 😀 Active mutual funds, though promising higher returns, often fail to outperform passive strategies, with around 90% underperforming the market in a study from 2013-2019.

- 😀 The key to successful investment is determining one's investment goals and risk profile, which can guide decisions on product types and allocation.

- 😀 There are two main markets for mutual funds in Indonesia: the primary market (where units of participation are purchased directly) and the secondary market (where investors can trade existing units).

- 😀 In the primary market, mutual funds are bought through brokers, with investments contributing to the fund’s overall performance.

- 😀 The secondary market offers more liquidity for mutual fund investors, allowing them to buy or sell units at any time with greater flexibility.

- 😀 Mutual funds in Indonesia can be classified based on various indices, such as the IDX30 and LQ45, which track the performance of different market sectors and strategies.

- 😀 Smart Beta strategies, like dividend-focused investments or low valuation strategies, are gaining popularity in Indonesia as a way to potentially outperform traditional market indices.

- 😀 Investors in Indonesia can start investing with as little as IDR 10,000, making it accessible and affordable for most individuals to enter the market.

Q & A

What is the primary focus of the discussion in the transcript?

-The primary focus of the discussion is about capital market products in Indonesia, particularly the development of investment products like IPS (Indeks Pasar Saham) and the comparison between passive and active investments.

How does the number of listed companies in Indonesia compare to other ASEAN countries?

-As of 2020, Indonesia has the highest number of listed companies in ASEAN, surpassing Singapore, which had held the top position for many years.

What is the difference between passive and active investment products?

-Passive investments typically track an index, like the IDX30, and aim to replicate market performance. Active investments involve selecting individual stocks to outperform the market, but the success rate of active investments is generally lower, with about 90% underperforming compared to passive options.

What is the role of an investment manager in the context of IPS?

-The investment manager in an IPS (Indeks Pasar Saham) typically curates a list of stocks and manages the overall investment portfolio, aiming to follow a specific market index or investment strategy.

What are the two main markets in capital investments discussed in the transcript?

-The two main markets discussed are the primary market, where investors purchase products like mutual funds directly from the fund manager, and the secondary market, where investors buy and sell products from other investors.

How does the tax system differ between the primary and secondary markets in Indonesia?

-In the primary market, tax implications are minimal, as purchases are directly exchanged for units of participation. In the secondary market, taxes are applicable on transactions, adding to the overall cost of buying and selling investments.

What is the advantage of the primary market in terms of cost efficiency?

-The primary market offers greater cost efficiency because transactions are handled directly between the investor and the issuer, avoiding additional fees like buying and selling costs typically incurred in the secondary market.

How are IPS products priced, and how accessible are they to individual investors?

-IPS products are typically priced starting at a low amount, often around IDR 10,000 to 20,000 per unit, making them accessible to a wide range of individual investors.

What is the role of a 'liquidity provider' in the secondary market?

-A liquidity provider in the secondary market helps ensure smooth trading by being ready to buy or sell products, maintaining the market's liquidity and enabling easier transactions between buyers and sellers.

How can investors determine the right investment strategy in the Indonesian capital market?

-Investors should determine their investment strategy based on their financial goals, risk tolerance, and desired outcomes. For example, if they want to replicate the performance of the market, they can invest in passive products like those tracking the IDX30, or they can choose thematic or sector-specific investments depending on their interests.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Janji Manis Investasi IKN Mengundang Keraguan Investor?

Hype Business

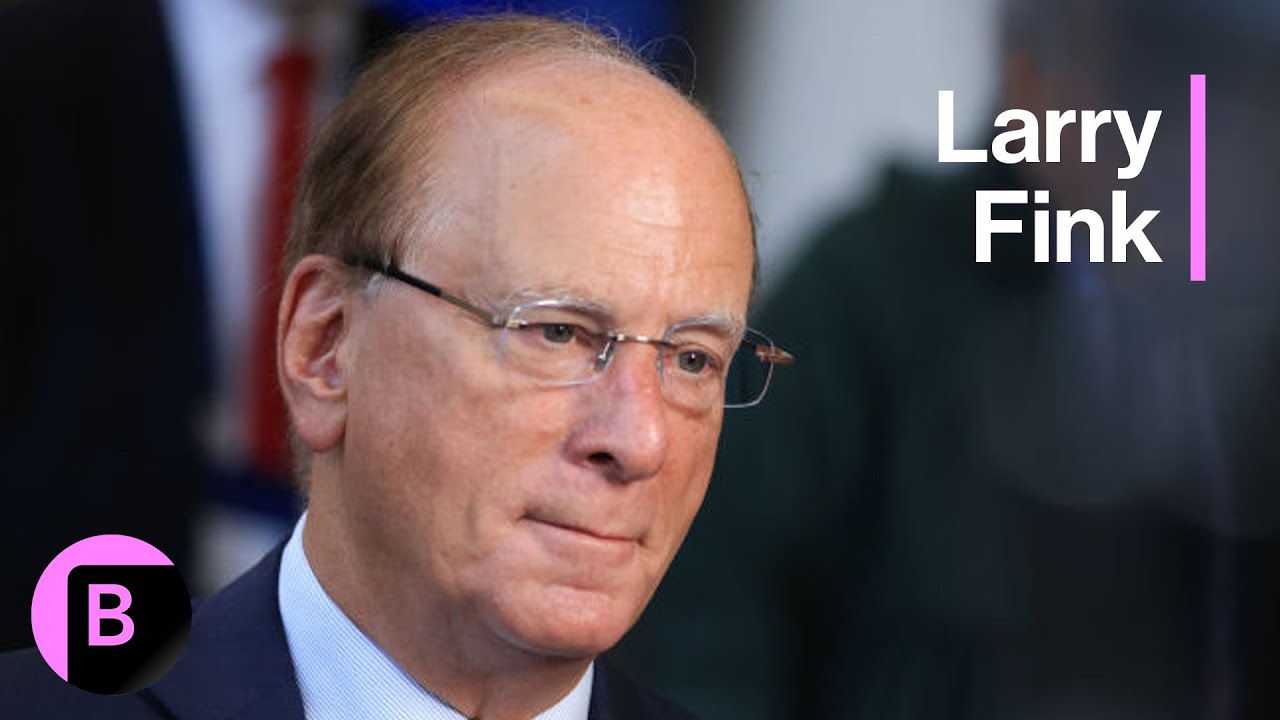

BlackRock CEO Larry Fink on US Economy, Trump Vs. Harris, Geopolitical Risks (Full Interview)

The Portfolio Manager | Portfolio Construct Of PPFAS Flexicap Fund | NDTV Profit

Dampak Ekonomi Perang India-Pakistan Bagi Indonesia

Caution | Trump Tariff India Impact |ट्रंप के एलानों से भारतीय बाजार में कितना बढ़ा खतरा?|Ajay Sharma

5.0 / 5 (0 votes)