What Can I Do For You? - At the BANK | Real English Conversation

Summary

TLDRThis video script provides a detailed guide on various banking services, including how to open a bank card, withdraw money, recover a password, borrow money, and deposit funds. The dialogue-based scenarios illustrate real-life interactions with bank customers, showcasing the different services offered by the bank. Topics like debit and credit cards, international payments, loan applications, passbook deposits, and customer support for password recovery are covered. Each scenario highlights key banking processes and customer service tips, offering viewers a practical understanding of bank operations in a friendly and approachable manner.

Takeaways

- 😀 The video explains how to open a bank card, with a focus on different types of cards like debit, credit, and visa cards.

- 😀 A debit card is the most popular and allows payments for goods and services directly from the user's bank account, with a monthly maintenance fee of $2.

- 😀 A credit card allows users to borrow money from the bank to make payments, but it requires proof of monthly income for approval.

- 😀 The visa card is recommended for those who frequently make international purchases.

- 😀 The bank ensures a simple process for opening a new card, with the option to receive it by mail after filling out necessary forms.

- 😀 When withdrawing money, the bank needs personal details like full name and identity number to locate the account.

- 😀 The withdrawal process includes verifying account balance, which may be lower than the requested amount, as seen in a scenario where the balance was $2,000 but the request was for $3,000.

- 😀 To recover a forgotten password, customers can visit the bank, provide their personal details, and reset the password for free.

- 😀 In the case of a loan, the customer needs to provide collateral and fill out a loan form. After verification, the bank disburses the money.

- 😀 For depositing money, customers can open a passbook account and earn interest on their deposits, with an annual interest rate of 12%.

- 😀 The video highlights a friendly, helpful atmosphere at the bank, with employees assisting customers in a polite and professional manner throughout all procedures.

Q & A

What types of bank cards are offered by the bank?

-The bank offers debit cards, credit cards, and visa cards. Debit cards allow you to pay for goods and services with money in your account, while credit cards let you borrow money to make payments. Visa cards are especially useful for international purchases.

Is there any fee for opening a debit card?

-No, opening a debit card is free of charge. However, there is a $2 monthly maintenance fee, and your account balance needs to be more than $5.

What is required to open a credit card?

-To open a credit card, you need to prove your main account and monthly income. The bank offers various incentives for those using a credit card.

What are the benefits of using a visa card?

-A visa card is beneficial for making purchases in foreign countries, especially for international payments.

How can I withdraw money from my bank account?

-To withdraw money, you need to provide your full name, identity number, and your request amount. After checking your account balance, the bank will process the withdrawal for you.

What should I do if I forget my bank account password?

-If you forget your password, you can reset it at the bank. You will need to provide your identity card and confirm your account details. The bank will give you a new password, which you can change at any time.

Is there any fee to recover my bank account password?

-No, recovering your password is free of charge.

What documents are required to borrow money from the bank?

-To borrow money, you need to provide your identity card, collateral information, and fill out a loan application form. The bank will assess your assets and the loan amount before processing the request.

How much interest does the bank offer on a passbook deposit?

-The bank offers a 12% annual interest rate on passbook deposits.

Can I deposit money in cash in the bank?

-Yes, you can deposit cash in the bank. The bank will verify the amount, and once confirmed, they will proceed with creating a passbook for you.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

At the bank English conversation | Daily English conversation | Bank vocabulary

Produk Bank | Video Belajar 10 IPS Ekonomi

English conversation, At The Bank|Opening a Bank Account|Listening and Speaking Skills|Daily Life|

Banking Application Project | Java | MySQL | JSP | Eclipse

How to Withdraw from Binance to Bank Account

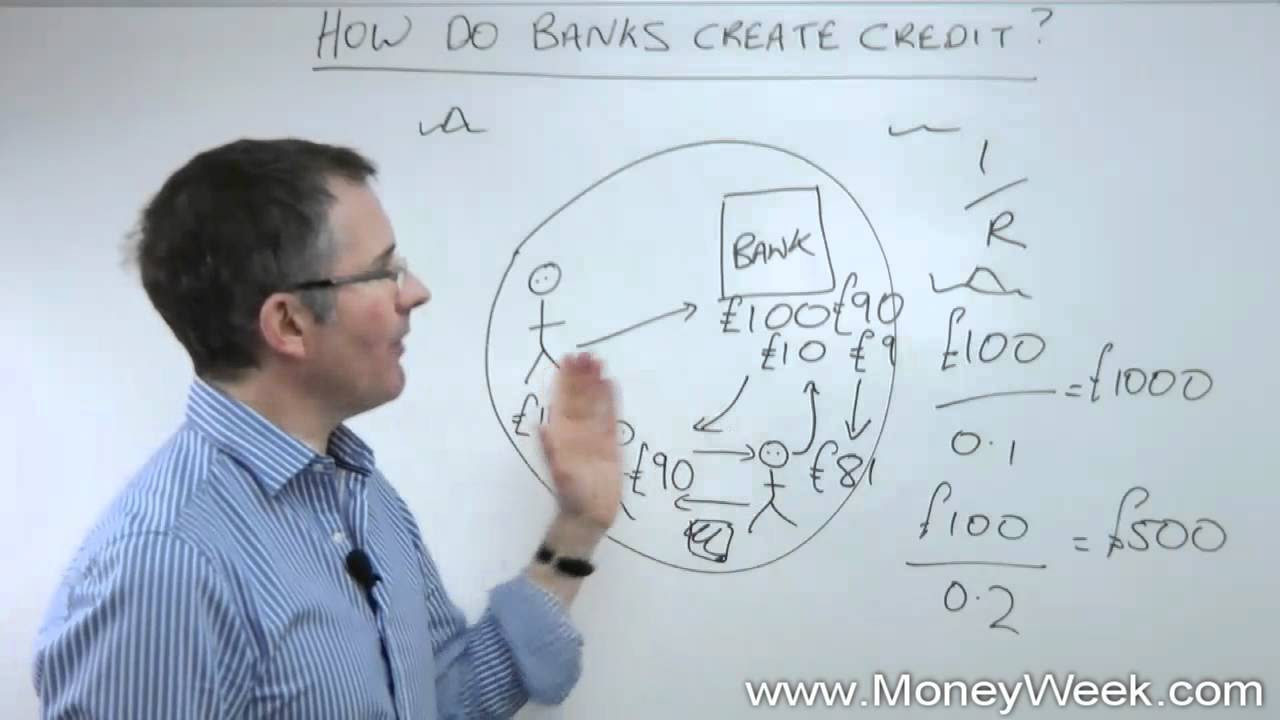

How banks create credit - MoneyWeek Investment Tutorials

5.0 / 5 (0 votes)