Brahmashtra Strategy to find Swimg Trading Stocks || Corporate Candles

Summary

TLDRThis video walks through the process of creating a stock screener for swing trading, using the tool screener.in. The speaker explains how to filter stocks based on key conditions such as market cap, PE ratio, return on capital employed, debt-to-equity ratio, volume, moving averages, and RSI to identify the best stocks for short-term trades. The video emphasizes using modern tools like AI for stock selection and stresses the importance of market conditions in decision-making. Additionally, it introduces the concept of automating stock screenings and receiving trade alerts for efficient trading.

Takeaways

- 😀 Swing trading success relies on a proper setup and efficient stock screening.

- 😀 In 2025, tools like GPT and AI are making stock selection easier for everyone, even small-town traders.

- 😀 Screener.in is a useful tool for filtering stocks based on custom conditions like market cap, PE ratio, and volume.

- 😀 Key screening criteria include a market cap above ₹1000 crore, stock price below ₹50, PE ratio less than 40, and return on capital employed greater than 10.

- 😀 Companies with low debt-to-equity ratios (less than 1) are more favorable for swing trading.

- 😀 Volume above 500 is a good indicator of stock movement for swing trading.

- 😀 Stocks that are above their 50-day moving average are in an uptrend, signaling potential for swing trading.

- 😀 An RSI (Relative Strength Index) above 50 indicates strong stock momentum, which is beneficial for swing trading.

- 😀 Filtering stocks based on the aforementioned conditions helps identify companies with better profit potential and reduced risk.

- 😀 Market conditions (e.g., overall market trends, geopolitical factors) play a crucial role in determining whether a stock will succeed in swing trading.

Q & A

Why do 90% of people fail in swing trading?

-The failure in swing trading is often due to traders not fully understanding the market dynamics. They tend to pick stocks based on superficial criteria like price movement, rather than using advanced tools or strategies to identify high-potential trades.

How does the speaker suggest using AI for swing trading?

-The speaker suggests that AI tools like ChatGPT and other machine learning technologies are now widely available and can be used to identify stocks for swing trading more effectively. They mention leveraging AI for research and creating more advanced setups.

What is the primary tool mentioned in the video for swing trading?

-The primary tool mentioned in the video is screener.in, a free tool that allows users to create custom stock screeners based on different criteria, helping to filter and identify stocks for swing trading.

What are some of the key conditions used for screening stocks in swing trading?

-Some of the key conditions include market cap greater than Rs 1000 crore, stock price less than 50, a price-to-earning ratio (PE) less than 40, return on capital employed (ROCE) greater than 10, debt-to-equity ratio less than 1, and good trading volume (greater than 500).

What does the PE ratio indicate in swing trading?

-The PE ratio indicates how much investors are willing to pay for a company's earnings. A lower PE ratio (under 40) suggests the stock may be undervalued relative to its earnings, making it a potential candidate for swing trading.

Why is the return on capital employed (ROCE) important for swing trading?

-ROCE measures how efficiently a company is using its capital to generate profits. A higher ROCE (above 10) indicates that the company is managing its resources effectively, making it a more stable choice for swing trading.

What is the significance of the debt-to-equity ratio in swing trading?

-The debt-to-equity ratio shows how much debt a company has in relation to its equity. A ratio below 1 suggests that the company is not overly reliant on debt, which reduces risk, especially in swing trading where stability is important.

How does the speaker view the role of technical indicators like RSI and moving averages?

-The speaker acknowledges that technical indicators like the RSI (relative strength index) and moving averages are useful for confirming trends. For instance, an RSI above 50 suggests strength in a stock, and a price above its 50-day moving average signals an upward trend.

What is the role of volume in swing trading?

-Volume plays a crucial role in swing trading as it indicates the level of activity and interest in a stock. The speaker suggests a minimum volume of 500 to ensure sufficient market participation and liquidity for short-term price movements.

What is the impact of market conditions on swing trading?

-Market conditions are critical for swing trading. Even if a company is strong, overall market factors like economic downturns, political instability, or global events (e.g., war) can affect the stock price. The speaker emphasizes that no matter how good a stock is, broader market conditions can impact its performance.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Find & Trade Memecoins on Your iPhone [FULL GUIDE]

How to Make 2X Gains Daily Using THIS Fibonacci Retracement Strategy

DEXscreener Обзор (2024) Полная Инструкция По Поиску Новых Монет на Сотни Иксов

PROFIT $100/HARI SCALPING PAKAI FIBONACCI (MASTER FIBONACCI)

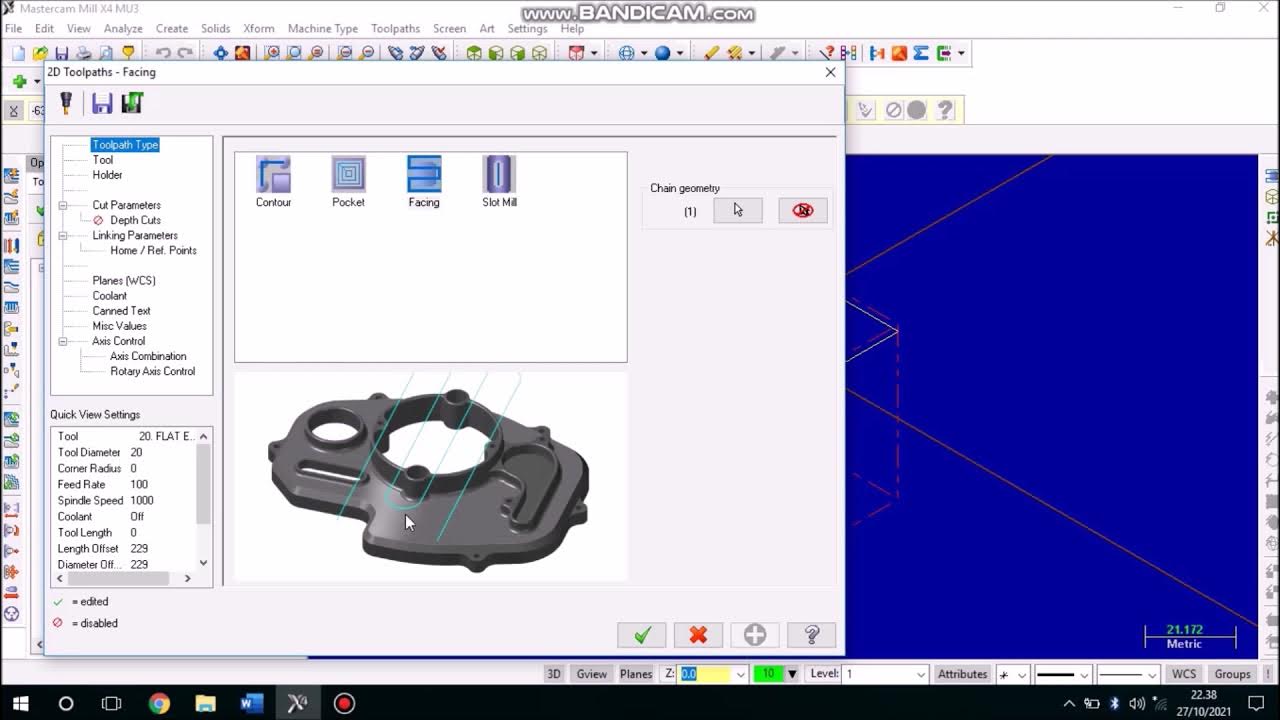

Job Facing Master CAM Mill

HOW TO FIND HIGH PREMIUM OPTIONS WHEN SELLING CALLS & SELLING PUTS!

5.0 / 5 (0 votes)