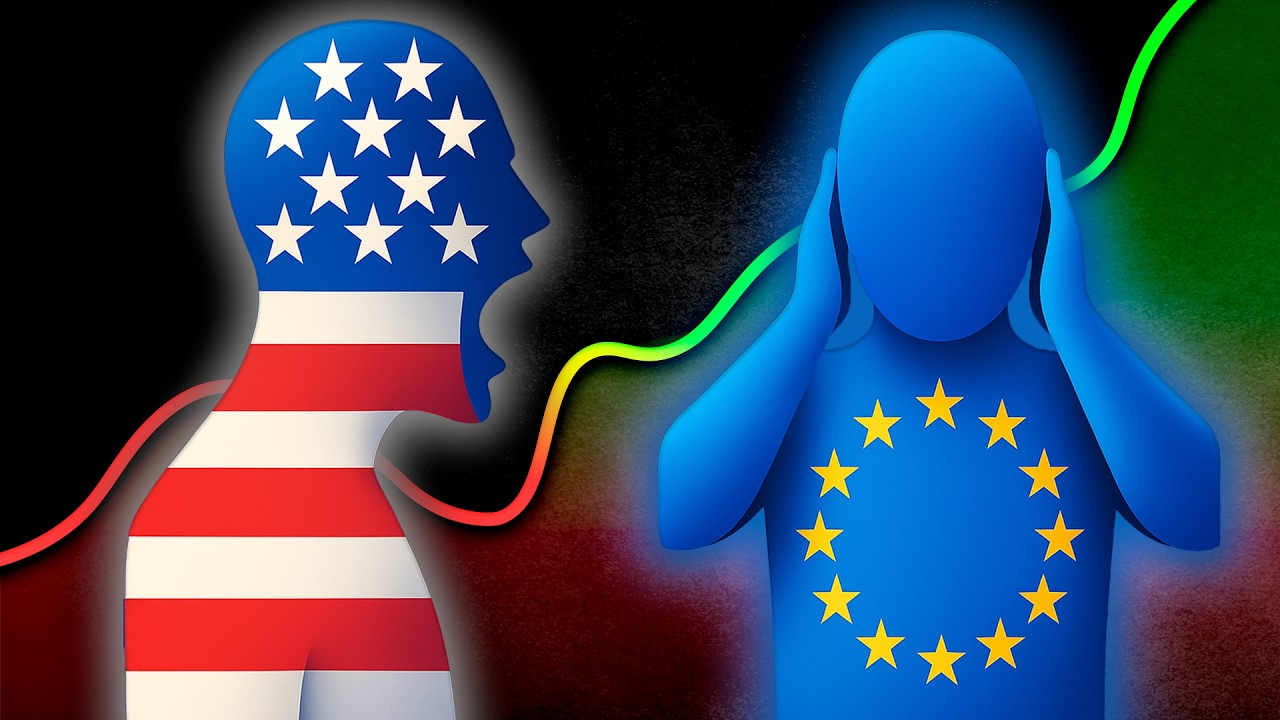

ETFs Irlandeses: REDUZINDO Drasticamente seus IMPOSTOS ao investir no exterior!

Summary

TLDRThis video explains the benefits of Irish ETFs for international investors, especially in terms of tax advantages. By focusing on ETFs registered in Ireland, investors can potentially reduce taxes on dividends and inheritance, particularly when compared to U.S.-based ETFs. The script details how Irish ETFs, such as the VWRA and CSPX, offer strategies like dividend reinvestment that can outperform other global ETFs. The video also highlights how Irish ETFs provide easier tax reporting, reduced withholding taxes, and even inheritance tax benefits, making them a powerful tool for long-term investors seeking to optimize their portfolios.

Takeaways

- 😀 Irish ETFs provide tax advantages, such as reduced dividend taxes and avoidance of U.S. inheritance tax, making them an attractive option for international investors.

- 😀 Irish ETFs typically invest in global assets, including U.S. companies, and not just Irish companies, despite the name 'Irish'.

- 😀 The tax rate on dividends from Irish ETFs can be as low as 15%, depending on the type of ETF (cumulative vs. distributive).

- 😀 Cumulative ETFs reinvest dividends, leading to higher long-term returns due to compounding, while distributive ETFs pay out dividends but may be subject to higher tax rates.

- 😀 Irish ETFs help simplify tax returns by eliminating the need to declare dividends in Brazil's Carnê Leão tax system for cumulative ETFs.

- 😀 Investors can access Irish ETFs through brokers like XTB, which offers low-cost trading and support for Brazilian accounts, and allows trading on European and global exchanges.

- 😀 The Irish government incentivizes investment in Irish ETFs by offering tax benefits, making it a tax haven for international investors.

- 😀 When comparing ETFs, Irish ETFs with cumulative strategies tend to outperform U.S. ETFs, such as the VT ETF, due to reinvested dividends.

- 😀 The inheritance tax on U.S. assets can be as high as 40%, but Irish ETFs help bypass this issue, as they fall under Irish jurisdiction, which does not have such a tax for non-residents.

- 😀 Not all U.S. ETFs have an equivalent Irish ETF, limiting diversification options for investors seeking to replicate every U.S. ETF strategy.

- 😀 While Irish ETFs may have higher administrative fees than U.S. ETFs, these costs are often outweighed by the long-term tax advantages and better overall returns.

Q & A

What are Irish ETFs and how do they benefit investors?

-Irish ETFs are exchange-traded funds that are managed and held in Ireland. They offer significant tax advantages, particularly for non-residents, such as reduced tax rates on dividends and potential inheritance tax benefits, making them an attractive investment option for international investors.

How do Irish ETFs differ from US ETFs?

-Irish ETFs typically invest in companies worldwide, including American companies, but they are custodians in Ireland. US ETFs, however, are primarily focused on American stocks and are subject to higher withholding taxes on dividends. Irish ETFs can offer a more favorable tax treatment for non-resident investors, especially concerning dividends and inheritance tax.

What is the tax advantage for investors using Irish ETFs?

-Irish ETFs offer lower withholding tax rates on dividends. For cumulative ETFs, the tax rate on dividends can be reduced significantly, while distributive ETFs in Ireland are taxed at a rate of 15%. This tax treatment is more favorable compared to US ETFs, which generally have a 30% withholding tax on dividends.

What is the difference between cumulative and distributive Irish ETFs?

-Cumulative Irish ETFs reinvest dividends back into the fund, which can enhance the compound growth of investments. Distributive Irish ETFs, on the other hand, pay out dividends to shareholders, and the tax treatment of these dividends can vary. Cumulative ETFs are generally preferred by long-term investors looking for tax efficiency and reinvestment of earnings.

How do Irish ETFs make tax filing easier for Brazilian investors?

-Brazilian investors in cumulative Irish ETFs do not need to declare dividends in their income tax return through the 'Carnê Leão' system, as dividends are reinvested. This simplifies the tax filing process, especially for long-term investors, by reducing the number of declarations required.

Can Brazilian investors invest in Irish ETFs through brokers like XTB?

-Yes, Brazilian investors can access Irish ETFs through brokers such as XTB, which offers zero brokerage fees, Portuguese language support, and access to European and American markets. XTB also allows trading on various European exchanges, such as the London Stock Exchange, where Irish ETFs are often listed.

Are there any disadvantages to investing in Irish ETFs?

-One of the main disadvantages is the higher administration fees of Irish ETFs compared to US ETFs. Additionally, Irish ETFs may have a slightly higher spread due to lower liquidity, and not all US ETFs are replicated by Irish ETFs, limiting some diversification opportunities.

What is the inheritance tax benefit of investing in Irish ETFs for non-resident investors?

-Investors with substantial assets in the United States may be subject to inheritance tax, which ranges from 18% to 40%. Irish ETFs do not incur this inheritance tax, offering a significant advantage to international investors, especially those planning for long-term wealth accumulation.

Can an investor with tax residence in Ireland benefit from the tax advantages of Irish ETFs?

-No, investors with tax residence in Ireland do not benefit from the tax advantages that non-residents enjoy. The tax benefits are designed to attract foreign capital and are not applicable to Irish residents who are subject to local tax laws.

How do Irish ETFs compare to investing in BDRs (Brazilian Depositary Receipts)?

-Investing in BDRs may involve higher fees and additional complexities compared to directly investing in Irish ETFs. Brokers like XTB offer easier access to international markets with lower costs and greater tax benefits, making Irish ETFs a more attractive option for Brazilian investors.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Temettü Ödeyen Fonlar

Regimi fiscali: Gestito VS Amministrato VS Dichiarativo | Il Documento di Trade Republic

Top ETFs for young investors to build that Million Dollar Portfolio - Best Growth ETFs!

Save your Investment Portfolio: Is this the right to invest in Groww Gold ETF Investment ? #goldetf

Как ИЗБЕЖАТЬ НАЛОГОВ в Украине?

Don't Take American Investment Advice If You Live in Europe

5.0 / 5 (0 votes)