Cara Lapor SPT Tahunan PPh Orang Pribadi Pengusaha dengan Tarif Umum | Tutorial Lengkap

Summary

TLDRThis video provides a step-by-step guide on reporting an annual PPh SPT for individual entrepreneurs using the Kortex application. It explains the process of logging in, selecting the correct tax return, and completing the necessary sections, such as financial reports, profit and loss details, and balance sheets. The video also covers tax adjustments, asset reporting, and finalizing the submission with electronic signatures. It emphasizes the importance of accurate data and provides an overview of submitting and confirming the SPT for tax compliance.

Takeaways

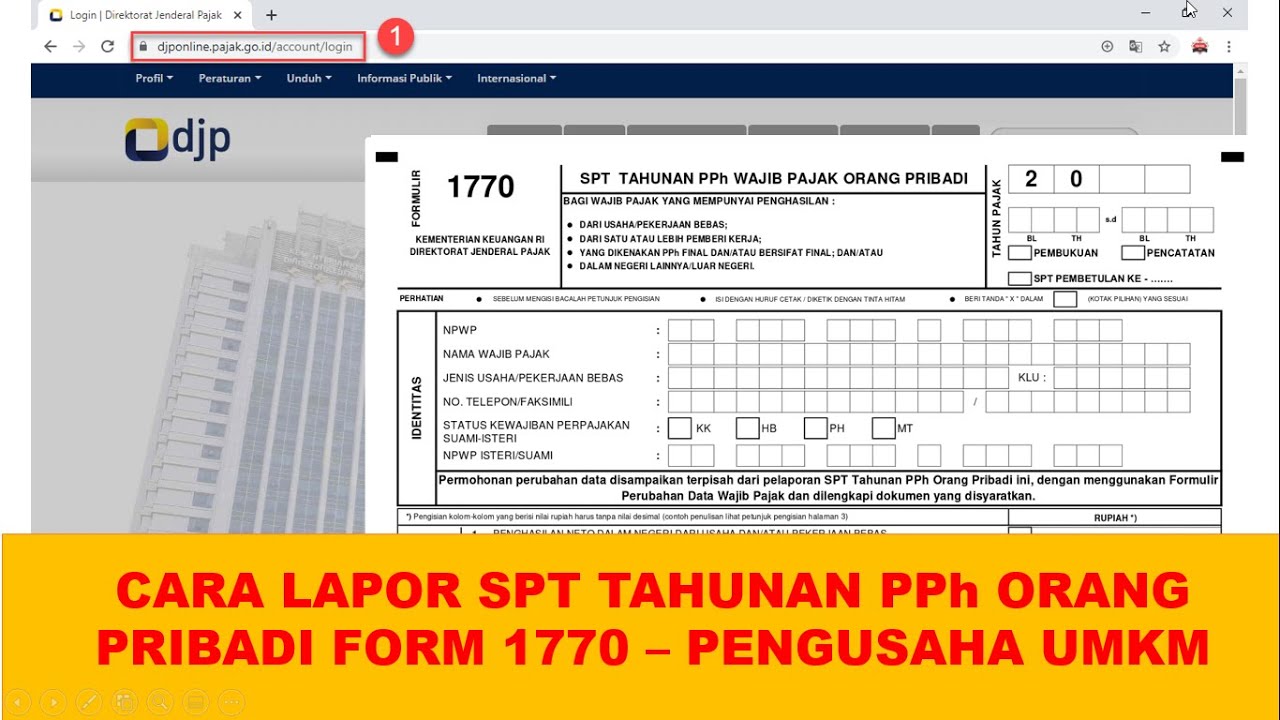

- 😀 Login to the Kortex application by entering your NPWP, password, and captcha.

- 😀 Choose the 'Text Return' menu and select the 'Create Text Return' option to begin filing the annual PPH SPT.

- 😀 Select the appropriate tax year and SPT correction status before proceeding to create the SPT.

- 😀 For business owners, answer 'Yes' in Section B1b1, and choose the correct PPH calculation method in Section B2 and B3.

- 😀 Fill in the type of business you conduct in Section B4, as required for the SPT submission.

- 😀 Attach the necessary financial report (e.g., profit and loss statement) and fill in profit and loss components, including fiscal corrections.

- 😀 Complete the Statement of Financial Position (Balance Sheet) in Section A2 and provide details about auditing if applicable.

- 😀 In Section C, fill in PTKP and other income reductions, and provide proof of income and foreign tax credits if applicable in Section D.

- 😀 Specify PPH payable in Section E, and fill in Sections F, G, and H if the SPT status involves corrections, overpayment, or installments of PPH Article 25.

- 😀 Add asset details in Attachment 1 and provide information about any debts or obligations at the end of the tax year in Section I.

- 😀 Complete Section K by verifying information and electronically signing the SPT. Submit the SPT after reviewing all data.

- 😀 After submission, download the electronic proof of receipt and print the finalized SPT document for your records.

Q & A

What is the purpose of the Kortex application in the context of this video?

-The Kortex application is used for reporting the Annual PPH SPT (Income Tax Return) for individual taxpayers, specifically entrepreneurs who use the general PPH rate.

What are the steps to log in to the Kortex application?

-To log in, enter your 16-digit NPWP, password, complete the CAPTCHA, and click the 'Login' button.

What should you do after logging into the Kortex application?

-After logging in, go to the 'Text Return' menu, select 'Create Text Return', and choose the appropriate tax year and SPT correction status.

What does section 1B4 in the SPT form require from the user?

-Section 1B4 requires the user to specify the type of business they are operating.

How does the Profit and Loss statement integrate with the Kortex application?

-The Profit and Loss statement is filled in under attachment 3a2, where users must include all variables, including fiscal corrections. After saving, the profit before tax value is auto-filled into the parent SPT (section B1B5).

What information is needed to complete the Statement of Financial Position in section A2?

-The user needs to fill in the balance sheet details, including whether the financial report is audited, and if so, provide the public accountant's details.

What do you need to fill out in Section C of the SPT form?

-Section C requires the user to provide details of the PTKP (Personal Income Tax Exemption) and any other income reduction components.

What should be done in Section D of the SPT form if there is no proof of income or foreign tax credit?

-In Section D, select 'No' for points 10A and 10D if there is no proof of income or foreign tax credit.

What does Section E in the SPT form display?

-Section E displays the amount of PPH payable that still needs to be paid, which is calculated after completing the previous sections.

How do you declare assets in the Kortex application for the Annual PPH SPT?

-In Attachment 1 (Section A), users must declare a list of assets owned at the end of the tax year by clicking 'Add' to input asset details, specifying type and classification.

What should be done after completing all sections of the SPT form?

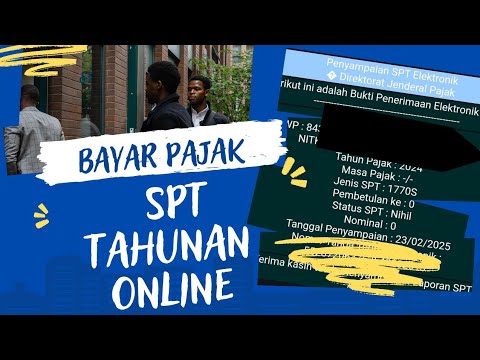

-After completing all sections, check the statement in Section K, sign the SPT, and click 'Pay and Submit'. If there is an underpayment, select whether to use the deposit balance or create a billing code.

What happens after submitting the SPT in the Kortex application?

-Once the SPT is submitted, users can download the electronic proof of receipt and print the submitted SPT for their records.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Cara Lapor SPT Tahunan PPh Orang Pribadi Pengusaha UMKM | Tutorial Lengkap

Cara Lapor eBupot Unifikasi Full Lengkap

PPh Orang Pribadi (Update 2023) - 13. Panduan Pengisian SPT 1770 (Status KK)

Badan Tidak Ada Kegiatan Usaha, Bagaimana Cara Lapor SPT Tahunannya?

Cara lapor SPT Tahunan PPh Orang Pribadi pengusaha umkm menggunakan eform 1770

Cara Lapor Spt Online Tahun 2025

5.0 / 5 (0 votes)